ICYMI: Dose of DeFi is on the lookout for extra paid writers and researchers. Click on right here for extra info and to use.

DeFi yields have continued to surge larger. Till very not too long ago, the lending panorama consisted of stalwarts like Maker* and Aave printing cash with larger charges whereas being challenged by a brand new crop of lending protocols. These newbies, the likes of Morpho and Ajna, entered with extra market-based threat administration – as we mentioned in our January examination of the lending panorama.

That was kind of the state of play till an emergency proposal was submitted to MakerDAO on March 8th to hike rates of interest to insulate in opposition to the danger of peg instability. The proposal, which was handed and carried out inside three days, tripled borrowing charges in a single day and raised the Dai Financial savings Charge (DSR) to fifteen% (up from 5.5%).

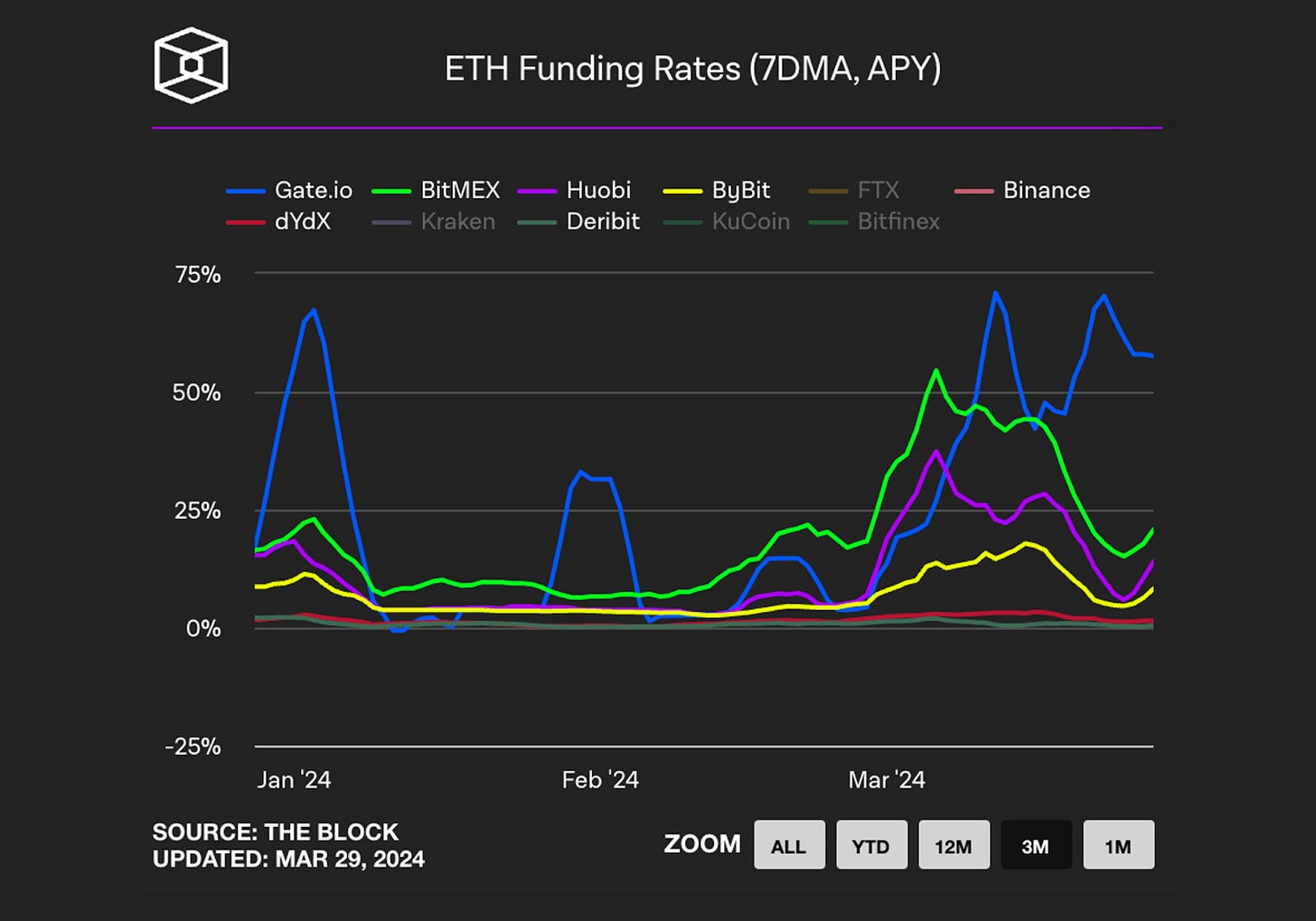

The drastic measures have been in response to the sudden success of Ethena’s sUSDe stablecoin. USDe is at present providing 35%+ yield (previous seven-day return annualized), generated by tapping into the premise commerce on centralized exchanges. Such yield alternative solely exists as a result of buyers are so bullish proper now, keen to pay excessive funding charges to remain levered lengthy.

Whereas there was some preliminary hesitation, long-time DeFi trade leaders have rapidly embraced sUSDe and are in a mad sprint to combine it into their lending protocols. Queue the purpose the place we spotlight the obtrusive reality: issues might additionally go south and result in a painful unwinding if market sentiment (and the funding price) change rapidly. Lenders are at present working to make sure that such threat is mitigated, however this doesn’t negate the apparent: The Yield Wars have begun.

DeFi has all the time been about yield. After TradFi charges shot up in 2022, DeFi lastly has aggressive yield that justifies the very actual threat, and extra importantly, will likely be far more sustainable than the governance tokens handed out in liquidity mining campaigns in 2021. Ethena is tapping right into a novel supply of yield, tokenizing it and providing it to DeFi degens. It is a playbook that will likely be repeated sooner or later because the black gap of DeFi sucks in any obtainable yield.

These days, all monetary innovation in crypto is labeled ‘DeFi’, however the time period solely began being extensively utilized in 2019. Bitcoin was the OG and what the cool youngsters name a “paradigm shift”, enabling the digital switch of worth in a censorship-resistant method. Stablecoins have been an additional breakthrough in pre-DeFi days. The opposite massive monetary innovation in pre-DeFi crypto was the perpetual swap, first developed by Bitmex in 2016.

Perpetual swaps (or perpetual contracts) are much like a futures contract however do not need a hard and fast expiry or settlement date. They merely roll over – watch for it – perpetually. They’re additionally a favourite as a result of they supply straightforward leverage (Bitmex was infamous for providing 100x leverage). Perpetual swaps are by far the popular technique for going lengthy an asset and utilizing leverage.

These swaps can present this publicity by sustaining a steadiness between buyers going lengthy and brief. This works by way of a funding price that incentivizes positions that the system wants to remain balanced. Most perpetual swaps set new funding charges each eight hours. At that time, the system determines the variety of longs and shorts and makes a calculated fee to all accounts holding the place it must incentivize, and deducts a small quantity from these with positions the system has an excessive amount of of.

As our readers could also be conscious, crypto buyers are typically hyper bullish, journey in packs, and love leverage (maybe, ‘gaggle’ is the suitable collective noun). When the bulls begin operating, degens purchase crypto perpetual swaps to maximise their publicity. Paying curiosity on this crowded commerce is a small value to pay for being a bull. This market dynamic creates arbitrage alternatives for classy merchants.

The commerce is easy: you maintain BTC or ETH and brief BTC or ETH. Or higher but, you discover the alternate providing the juiciest yield for shorting and one of the best yield for longing. That is referred to as a delta-neutral technique as a result of there’s no publicity to the value of the underlying asset. Since each positions are held concurrently, the worth of your place doesn’t change if the value of the underlying asset goes up or down.

Holding spot and shorting futures (or perpetuals), aka the premise commerce, can be a common technique in TradFi, the place hedge funds will reap the benefits of the market discrepancy created from pension and long-term buyers preferring to carry Treasury Futures relatively than spot.

Ethena launched as a strategy to faucet into yield from the funding price on centralized exchanges and provide it onchain. Ethena’s CEO Man Younger says he was impressed by Bitmex founder Arthur Hayes’ ‘Mud on Crust’ publish a few scalable crypto stablecoin utilizing perpetual swaps. Ethena’s core product is USDe, a token that’s pegged to the greenback and collateralized by a delta-neutral place, one lengthy ETH and one brief ETH. USDe holders can stake their tokens and obtain sUSDe in return, which comes with the yield that Ethena generates with the collateral backing the token.

The yield handed onto sUSDe holders comes from two sources. First, the lengthy ETH place is within the type of a liquid staking token (LST) which generates 3-4% yield from protocol rewards and MEV. Second, the brief ETH place pays handsomely on all main CEXs (upwards of 20-40% annualized yield).

The 20%+ yield on a steady asset with out reliance on governance tokens has caught the eye of the market, with many having flashbacks to Luna and perpetual movement machines. Ethena is completely different. All yield is paid by one other investor (or ETH protocol rewards). USDe has seen explosive progress, reaching a $1.4 billion circulating provide simply 4 months after launch.

In complete, there’s $9.94 billion in open curiosity on ETH derivatives throughout CEXs & DEXs, so Etherna is sort of 15% of that.

Along with tapping right into a novel supply of yield, the opposite innovation is that USDe can scale counting on crypto collateral with the capital effectivity of USDC/Tether, “ For the reason that staked ETH collateral might be completely hedged with a brief place of equal notional, the artificial greenback solely requires 1:1 ‘collateralization.’” Its ceiling is the scale of ETH open curiosity, however after all it might additionally faucet into BTC funding, an excellent bigger market.

Launching a brand new stablecoin is a reasonably frequent prevalence in DeFi. As some of the profitable launches, Ethena introduces new aggressive dynamics within the stablecoin market. These will play out within the coming months, however the recognition of its product and the investor rush to entry it has had repercussions throughout the DeFi lending house. Insatiable investor urge for food for sUSDe led to essentially the most drastic rate of interest adjustments at Maker since Black Thursday in March 2020.

Let’s look at why.

Dai has two various kinds of collateral backing it, with separate suggestions loops that contribute to peg stability, rates of interest on crypto-collateralized loans, and real-world property (together with the stablecoin USDC), which does a lot of the heavy lifting for peg administration. Maker launched the Peg Stability Module (PSM), which permits for a 1:1 conversion of Dai to USDC, shortly after Black Thursday. This has ensured a good peg for the final 4 years, but in addition opened Maker as much as criticisms as USDC approached 50% of all collateral-backing Dai. Maker drastically decreased this proportion by taking a portion of the USDC within the PSM and investing it in T-bills by Blocktower and Monetalis, and by way of a related association with Coinbase Custody.

These strikes gave MakerDAO entry to the 4%+ yields in TradFi, growing Maker’s income by greater than $100 million and paving the way in which for an improve within the DSR to five.5%.

The one draw back was that this left much less USDC within the PSM. Going from T-bills to USDC is doable in concept, however not on DeFi time. So whereas real-world property are nice for Maker income technology, they make Dai barely much less liquid onchain and improve the possibility of peg stability points.

Okay, so again to Ethena and the recognition of sUSDe. Its excessive yield comes from the excessive rates of interest crypto degens have been keen to pay to extend their crypto publicity additional. But it surely’s not itself minted from leverage. So, say you will have a stack of ETH and also you see this 20% yielding stablecoin. You don’t need to promote your ETH, so you employ it as a collateral and borrow in opposition to it (at an rate of interest a lot decrease than sUSDe yield), then purchase USDe after which stake it. Ah, the carry commerce. What a basic.

Maker has lengthy been the most cost effective supply of leverage on crypto collateral in DeFi. In contrast to Aave, Compound, or different cash market-based lending markets, Maker doesn’t require stablecoin deposits to make stablecoin loans. Importantly, many now entry this low cost borrowing by Spark, relatively than instantly by Maker core, though it is the identical final result.

In order a diligent crypto degen, your typical circulation is borrow Dai in opposition to crypto and both: 1. promote Dai and purchase extra crypto or 2. promote Dai and purchase USDe and stake it to get sUSDe and 25%+.

The important thing to Maker is everyone seems to be minting Dai (good) however promoting Dai (dangerous). This has launched downward strain on the peg and with the PSM as a simple exhaust valve, the Dai provide has declined during the last two months, bucking the traditional knowledge that Dai circulating provide expands in bull markets as a result of buyers take out extra crypto-backed loans.

MakerDAO governance and extra particularly Block Analytica was attuned to those dynamics. The expansion of sUSDe decreased demand for holding Dai within the DSR, which was solely providing 5.5%. Whereas there wasn’t a threat of MakerDAO being bancrupt (its collateral is nice!), there have been vital dangers to peg stability with the depletion of USDC within the PSM. And with the weekend approaching (and TradFi markets closed, delaying means to maneuver extra RWAs into USDC), MakerDAO governance acted swiftly to boost rates of interest on all crypto-backed loans to 16%+ and set the DSR at 15.5%.

The proposal went up on Friday morning (US time) on March 7th, was handed 24 hours later, after which executed on Monday, March 10th after the 48-hour time lock. The sudden strikes and overwhelming present of power are harking back to the aggressive actions central banks take to calm markets.

MakerDAO’s actions achieved their main goal: growing demand to carry Dai, which additionally led to a replenishment of the PSM with USDC (at present $636 million of Dai’s $4.5 billion provide). And with the DSR at 15%, extra Dai was staked to get sDai.

Some protested with the pace of the hikes – wouldn’t signaling aggressive strikes be sufficient? However general the market has calmed. Charges are anticipated to come back down barely however – as loopy because it sounds – 15% appears to easily be the ‘risk-free price’ in DeFi today.

Crypto lending has come a great distance over the previous yr. The introduction of RWA property at scale built-in a bottomless supply of yield (T-bills) onchain. Getting 5% onchain was nice within the bear market, however pales compared to the 25%+ yields degens are getting on centralized exchanges. Like RWAs, Ethena created a hyperlink between a supply of yield and DeFi. There’s a large design house for the way that yield will get translated onchain however ultimately, there’s all the time going to be a token and an APY.

The present lending incumbents nonetheless can profit from these new sources of yield as a result of they keep deep liquid markets. Simply at present, MakerDAO (by Morpho and Spark) allowed as much as $100m of Dai to be borrowed in opposition to sUSDe after a fast however thorough threat evaluation (Aave is contemplating as nicely and Ajna already has an sUSDe pool since its permissionless). This may very well be a brand new supply of borrowing demand and likewise tighten the hyperlink between the funding price on perpetual swaps and DeFi credit score markets. Sooner or later, lending protocols would be the distribution channels for brand spanking new sources of yield.

After all, including extra collateral will introduce extra leverage to the system. With sUSDe as collateral on Morpho, all (rational) sUSDe holders will deposit their sUSDe into Morpho, borrow Dai at 16%+ after which purchase USDe, stake it and repeat it. This yield optimization technique is how borrowing charges from CeFi can translate to DeFi.

With excessive charges and leverage, we must be aware of the way it might all go south. In contrast to Luna, a shock to the arrogance of the system can’t destroy the underlying worth of USDe. There are typical custodial and fraud considerations, and USDe might face its personal peg disaster, significantly if there are liquidity points for an LST, which occurred final yr with Lido. However the greater fear is what occurs when the supply of yield collapses? USDe would nonetheless have worth, however sUSDe yields would drop to the only digits. Then the unwinding would happen, and whereas the whole lot seems solvent, main market strikes might expose the gaps (assume USDC through the SVB disaster) and exploit the weakest hyperlink.

So maintain calm and keep on, however safe your flank. The Yield Wars are right here.

* Most of my working time is spent contributing to Powerhouse, which is an Ecosystem Actor for MakerDAO. MKR is a part of my compensation package deal, so I’ve a monetary curiosity in its success.

-

1kx raises new $75m fund Hyperlink

-

Vaults.fyi, which tracks prime yields throughout DeFi, releases documentation Hyperlink

-

Calldata.pics tracks blobs utilization after Ethereum’s Dencun improve Hyperlink

-

Information to develop dapps on Flashbots’ SUAVE Hyperlink

-

IDEX releases imaginative and prescient for IDEX token 2.0 Hyperlink

-

Base surpasses $500m in day by day DEX quantity for 4 straight days Hyperlink

-

Cow-backed MEV Blocker considers including price Hyperlink

-

BlackRock launches onchain fund with Securitize Hyperlink

That’s it! Suggestions appreciated. Simply hit reply. Written in Nashville, the place I really like, love, love spring time.

Dose of DeFi is written by Chris Powers, with assist from Denis Suslov and Monetary Content material Lab. I spend most of my time contributing to Powerhouse, an ecosystem actor for MakerDAO. All content material is for informational functions and isn’t supposed as funding recommendation.