On-chain information reveals the Bitcoin Hashrate has slumped again down just lately because the cryptocurrency’s worth has continued in a bearish trajectory.

Bitcoin Mining Hashrate Has Retraced Its August Restoration

The “Mining Hashrate” refers to a Bitcoin metric that retains monitor of the entire quantity of computing energy that the miners have at the moment related to the BTC community.

When the worth of this metric goes up, it means new miners are becoming a member of the blockchain and/or outdated ones are including to their amenities. Such a pattern implies that the community seems to be like a sexy enterprise to those chain validators.

However, the indicator registering a decline implies a few of the miners have determined to disconnect from the chain, doubtlessly as a result of BTC mining is not worthwhile for them.

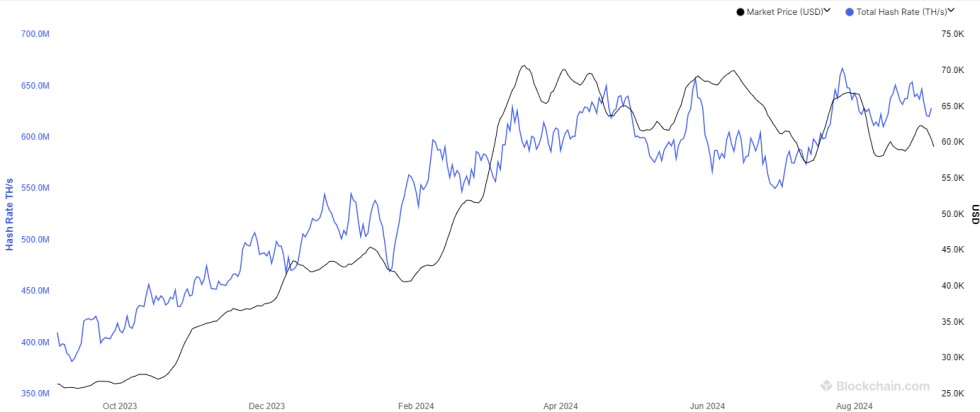

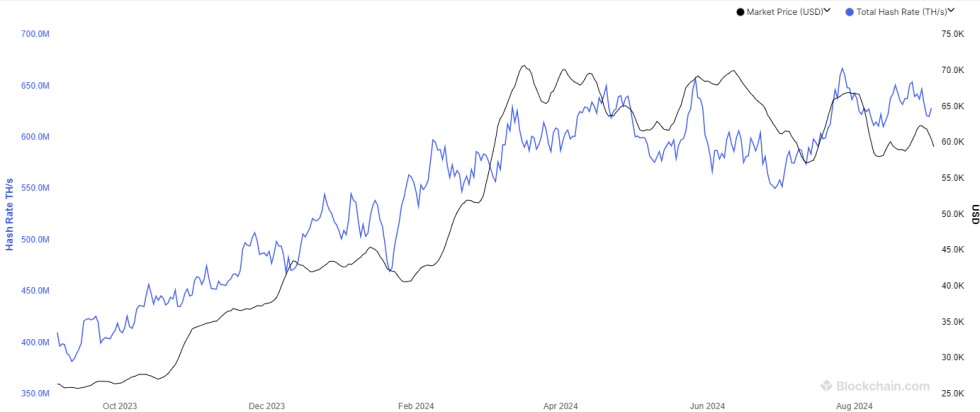

Now, here’s a chart from Blockchain.com that reveals how the 7-day common Bitcoin Mining Hashrate has modified over the previous yr:

Seems to be like the worth of the metric has gone down in current days | Supply: Blockchain.com

As is seen within the above graph, the 7-day common Bitcoin Mining Hashrate had proven an increase in the course of final month and had made restoration to ranges not removed from its all-time excessive (ATH) set again in July.

In the direction of the top of the month, nevertheless, the indicator had began taking place as a substitute and now, it has retreaded to virtually the identical lows as within the first-third of August.

The reason behind these developments might lie in the truth that the miners rely on the BTC spot worth for his or her revenue margin. It’s because the block subsidy, which they obtain as compensation for fixing blocks on the community, makes up for the first a part of their earnings.

These rewards are given out at a hard and fast BTC worth and at a hard and fast time interval, so the one variable associated to them is the USD worth of the cryptocurrency. With the value fighting bearish winds once more just lately, it is smart that miners have been downsizing their operations.

As has traditionally been the case, although, this current drop within the 7-day common Bitcoin Mining Hashrate might not stick for too lengthy, with any contemporary surges within the worth prone to renew uptrend within the metric.

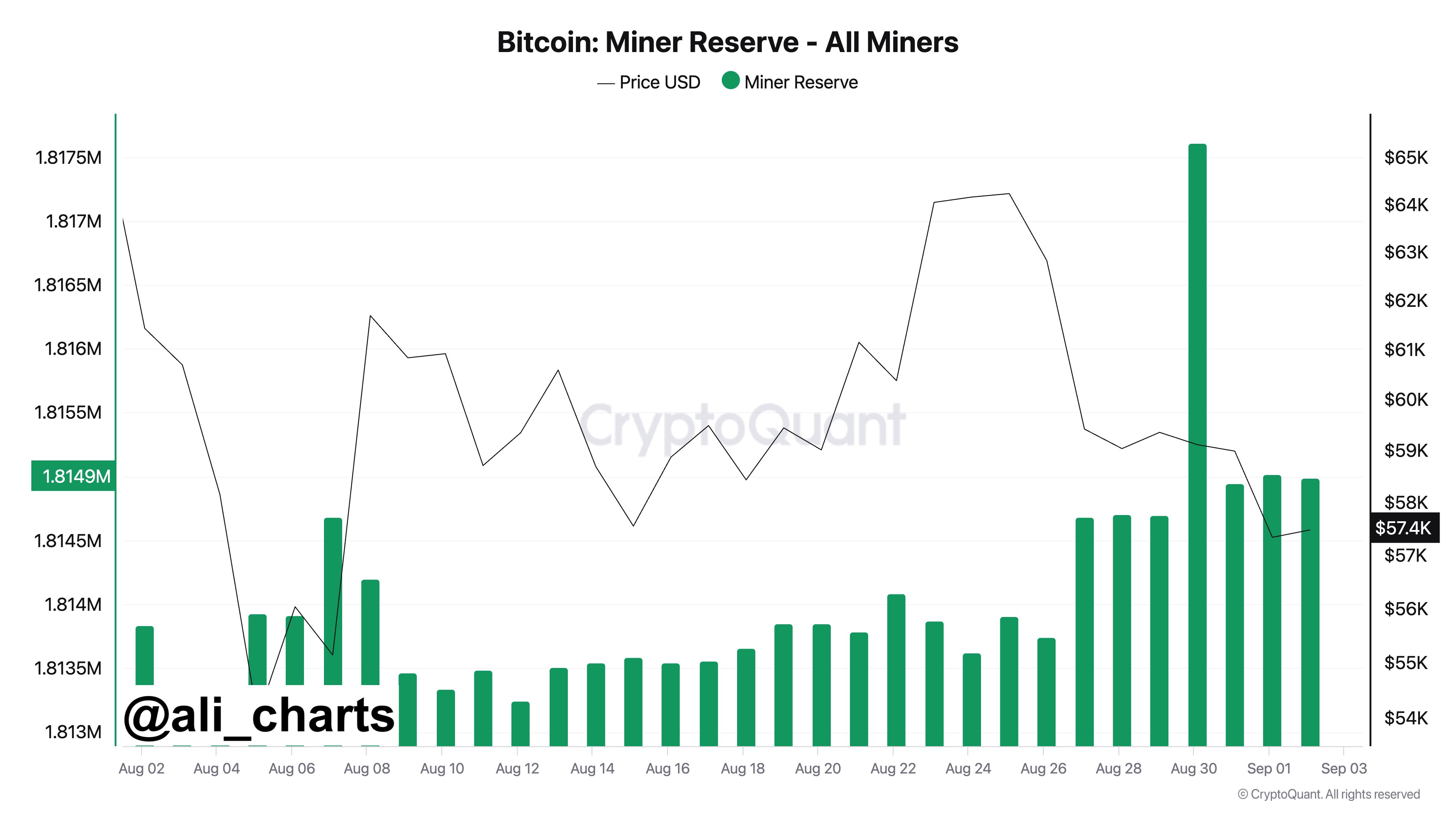

In addition to the Hashrate, one other indicator that might maybe showcase miner misery is the Miner Reserve, which measures the entire quantity of Bitcoin that’s at the moment sitting within the wallets associated to those chain validators.

As analyst Ali Martinez has identified in an X publish, miners participated in a notable quantity of promoting over the weekend.

The pattern within the BTC Miner Reserve over the previous month | Supply: @ali_charts on X

In complete, the Bitcoin miners eliminated 2,655 BTC from their wallets throughout this window, which is value greater than $156 million on the present alternate fee of the cryptocurrency.

BTC Value

On the time of writing, Bitcoin is floating round $59,000, down over 5% within the final seven days.

The value of the coin seems to have been transferring sideways over the previous few weeks | Supply: BTCUSD on TradingView

Featured picture from Dall-E, CryptoQuant.com, Blockchain.com, chart from TradingView.com

On-chain information reveals the Bitcoin Hashrate has slumped again down just lately because the cryptocurrency’s worth has continued in a bearish trajectory.

Bitcoin Mining Hashrate Has Retraced Its August Restoration

The “Mining Hashrate” refers to a Bitcoin metric that retains monitor of the entire quantity of computing energy that the miners have at the moment related to the BTC community.

When the worth of this metric goes up, it means new miners are becoming a member of the blockchain and/or outdated ones are including to their amenities. Such a pattern implies that the community seems to be like a sexy enterprise to those chain validators.

However, the indicator registering a decline implies a few of the miners have determined to disconnect from the chain, doubtlessly as a result of BTC mining is not worthwhile for them.

Now, here’s a chart from Blockchain.com that reveals how the 7-day common Bitcoin Mining Hashrate has modified over the previous yr:

Seems to be like the worth of the metric has gone down in current days | Supply: Blockchain.com

As is seen within the above graph, the 7-day common Bitcoin Mining Hashrate had proven an increase in the course of final month and had made restoration to ranges not removed from its all-time excessive (ATH) set again in July.

In the direction of the top of the month, nevertheless, the indicator had began taking place as a substitute and now, it has retreaded to virtually the identical lows as within the first-third of August.

The reason behind these developments might lie in the truth that the miners rely on the BTC spot worth for his or her revenue margin. It’s because the block subsidy, which they obtain as compensation for fixing blocks on the community, makes up for the first a part of their earnings.

These rewards are given out at a hard and fast BTC worth and at a hard and fast time interval, so the one variable associated to them is the USD worth of the cryptocurrency. With the value fighting bearish winds once more just lately, it is smart that miners have been downsizing their operations.

As has traditionally been the case, although, this current drop within the 7-day common Bitcoin Mining Hashrate might not stick for too lengthy, with any contemporary surges within the worth prone to renew uptrend within the metric.

In addition to the Hashrate, one other indicator that might maybe showcase miner misery is the Miner Reserve, which measures the entire quantity of Bitcoin that’s at the moment sitting within the wallets associated to those chain validators.

As analyst Ali Martinez has identified in an X publish, miners participated in a notable quantity of promoting over the weekend.

The pattern within the BTC Miner Reserve over the previous month | Supply: @ali_charts on X

In complete, the Bitcoin miners eliminated 2,655 BTC from their wallets throughout this window, which is value greater than $156 million on the present alternate fee of the cryptocurrency.

BTC Value

On the time of writing, Bitcoin is floating round $59,000, down over 5% within the final seven days.

The value of the coin seems to have been transferring sideways over the previous few weeks | Supply: BTCUSD on TradingView

Featured picture from Dall-E, CryptoQuant.com, Blockchain.com, chart from TradingView.com