- With XRP ETF approval possibilities at 98% in keeping with Polymarket, analysts anticipate a liquidity increase and broader adoption.

- The upcoming FOMC assembly on June 17–18 might affect XRP costs. Market hypothesis factors to a possible 25-basis-point price reduce.

Ripple’s native crypto XRP has underperformed the remainder of the altcoins market over the previous month, and is at present buying and selling across the $2.2 stage. Nonetheless, June may very well be a game-changer for XRP traders contemplating common returns of 8.5% this month, over the previous 11 years. Because of this, market optimism surrounding the Ripple crypto is rising as soon as once more, with analysts citing three developments that would result in an upside trajectory.

Approval of Spot XRP ETF

A big growth forward within the Ripple ecosystem for the month of June is the U.S. Securities and Alternate Fee’s (SEC) anticipated ruling on Franklin Templeton’s proposed Spot XRP ETF, anticipated by June 17. If accredited, the ETF would permit institutional and retail traders to put money into XRP via conventional monetary platforms instantly, eliminating the necessity for cryptocurrency wallets.

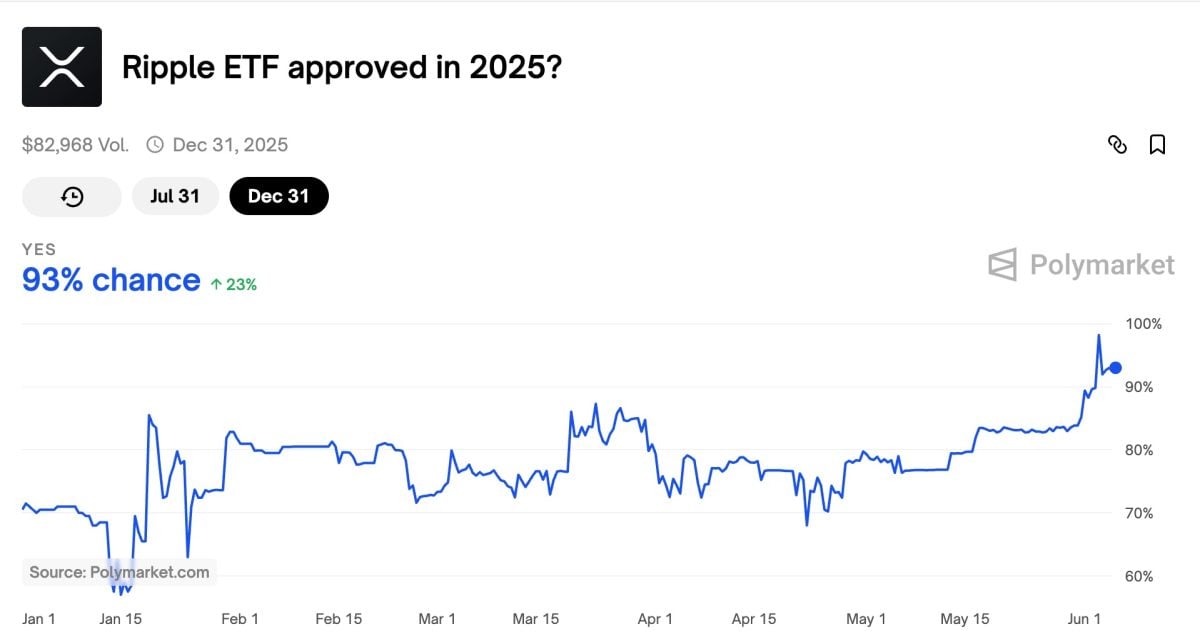

The likelihood of the U.S. Securities and Alternate Fee (SEC) approving an XRP exchange-traded fund (ETF) soared to 98% on June 3, in keeping with decentralized prediction platform Polymarket.

At present, Polymarket estimates a 93% probability of approval by December 31, 2025. This displays a notable 23% improve over the previous month, even amidst repeated delays by the securities regulator. Outstanding analyst Cekky Crypto predicts that this approval might have a transformative impact on XRP, akin to Bitcoin’s ETF launch in early 2024. This launch might actually present a significant liquidity increase to the Ripple cryptocurrency.

The Risk of Fed Charge Cuts to Affect Worth

All eyes are at present on the U.S. Federal Reserve’s Federal Open Market Committee (FOMC) assembly, set for June 17–18, as these macro indicators might play a vital position in figuring out the momentum of the Ripple cryptocurrency. Market hypothesis suggests the Fed might introduce a modest price reduce, doubtlessly round 25 foundation factors.

If carried out, this may very well be a significant pivot from months-long dovish coverage, doubtlessly reigniting investor curiosity in risk-on markets, together with altcoins like XRP. Traditionally, price cuts have pushed capital into expertise shares and cryptocurrencies. Analyst Cekky highlights that XRP might achieve from such an setting, noting that digital asset markets typically expertise broad rallies after such occasions.

XRP Whale Exercise On the Rise

A 3rd bullish sign is the buildup pattern noticed close to the $1.90 stage. On-chain knowledge reveals that enormous XRP holders, or “whales,” have been steadily growing their positions, seemingly in preparation for upcoming market catalysts. Moreover, corporations like VivoPower have introduced that it’ll begin constructing their XRP Treasury.

Crypto analyst Cekky views this as a crucial indicator, noting that whereas dangers stay, akin to potential ETF approval delays or a hawkish stance from the Federal Reserve, the “risk-reward is closely skewed in favor of bulls.” He describes the present section as “the final calm earlier than the XRP storm,” expressing optimism for a major value breakout.

Traditionally, June has been a difficult month for XRP holders, however the convergence of those components might sign a pivotal second, setting the stage for a possible rally

Really helpful for you: