In a world the place digital property are shortly turning into a cornerstone of worldwide finance, america stands at a crossroads. The Trump administration has repeatedly emphasised its dedication to creating on a regular basis People extra affluent. From pledging to revive financial power on the marketing campaign path to appointing forward-thinking advisors, the White Home appears poised to usher in a brand new period of monetary freedom. But when President Trump really desires to supercharge wealth creation for common residents—and set up the U.S. because the world’s main “Bitcoin Superpower”—his administration should embrace a daring, transformative coverage: remove capital beneficial properties taxes on Bitcoin.

The Winds of Change: Classes from Overseas

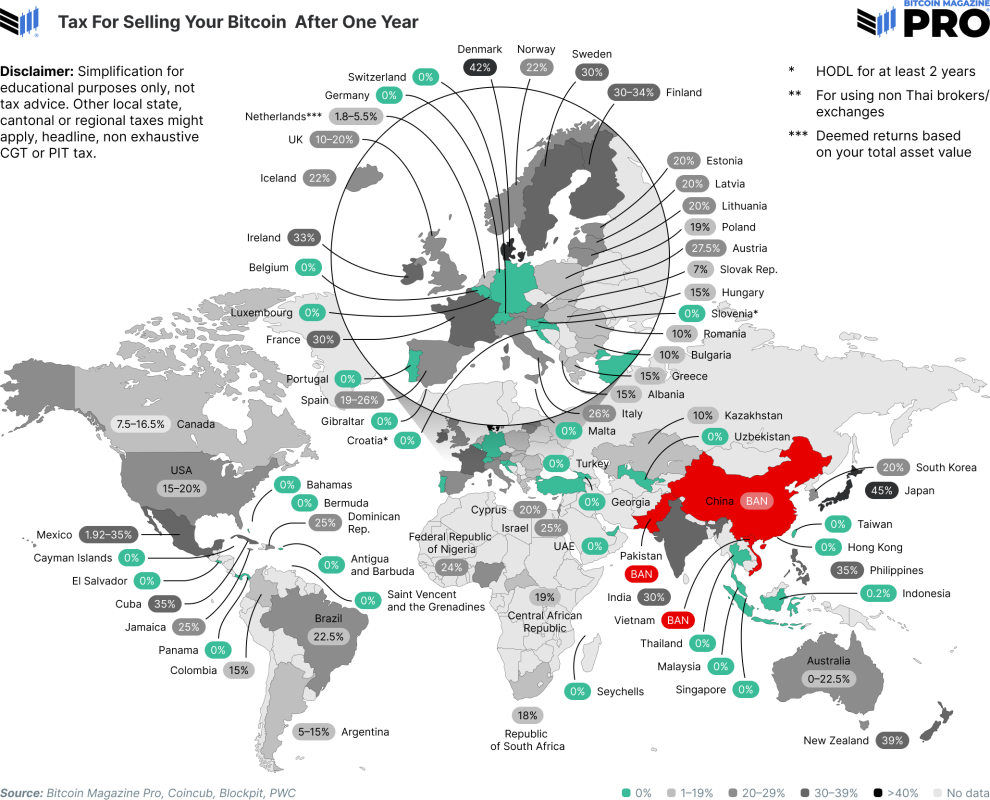

The Czech Republic not too long ago made headlines when its Parliament overwhelmingly voted to exempt capital beneficial properties from Bitcoin and different crypto-asset gross sales from private revenue tax—offered they’re held for greater than three years and meet sure revenue thresholds. This isn’t an remoted occasion. International locations like Switzerland, Singapore, the United Arab Emirates, El Salvador, Hong Kong, and elements of the Caribbean have lengthy acknowledged that zero or minimal capital beneficial properties taxation on Bitcoin will help spur adoption, monetary innovation, and client confidence.

As John F. Kennedy famously mentioned, “A rising tide lifts all boats.” If we apply that logic to financial progress by Bitcoin, the tide is world—and it’s rising quick. In a sea awash with world liquidity and debt, America’s financial ship should navigate these digital currents. These nations’ coverage selections—and their residents’ rising prosperity—ship a strong sign: The U.S. can and will leverage Bitcoin as a device for progress, not burden it with outdated taxation fashions.

Trump’s Personal Phrases: A Path to Prosperity

President Trump himself has indicated a willingness to rethink Bitcoin taxation. “They’ve them paying tax on crypto, and I don’t assume that’s proper,” he mentioned in a latest interview, echoing the frustrations of tens of millions of People who discover it absurd to pay capital beneficial properties taxes after utilizing Bitcoin to buy one thing as small as a cup of espresso. “Bitcoin is cash, and it’s important to pay capital beneficial properties tax for those who use it to purchase a espresso?” he requested rhetorically, highlighting how present legal guidelines discourage on a regular basis transactions. He added, “Perhaps we do away with taxes on crypto and substitute it with tariffs.”

This sentiment isn’t simply rhetorical flourish. Trump, who spoke on the Bitcoin 2024 Convention in Nashville, proclaimed his imaginative and prescient for America to turn into the world’s “Bitcoin Superpower.” He’s additionally pledged to “Make Bitcoin in America,” turning the U.S. into a number one hub of Bitcoin innovation. Furthermore, he appointed former PayPal Chief Working Officer David Sacks as his ‘White Home A.I. & Crypto Czar’ on December 5—a transfer extensively seen as a step towards implementing forward-looking crypto insurance policies.

The BITCOIN Act of 2024: A Strategic Reserve for the Individuals

The U.S. has already taken monumental steps on this path. The BITCOIN Act of 2024 mandates that every one Bitcoin held by any federal company be transferred to the Treasury to be held in a strategic Bitcoin reserve. Over 5 years, the Treasury should buy a million Bitcoins, holding them in belief for america. This government-level accumulation exhibits a long-term imaginative and prescient for incorporating Bitcoin into nationwide monetary technique. However why cease there? Eliminating capital beneficial properties tax on Bitcoin would create a optimistic suggestions loop between nationwide coverage and private prosperity. Because the federal authorities invests and holds Bitcoin, non-public residents might do the identical with out dealing with punitive tax obligations.

Serving the On a regular basis American

For on a regular basis People, the price of residing and the sting of inflation had been focal factors of President Trump’s reelection marketing campaign. Conventional methods—rate of interest manipulations, quantitative easing—typically quantity to rearranging deck chairs on a sinking ship when confronted with really systemic financial challenges. Bitcoin presents a life raft—dare we are saying, a digital Noah’s Ark—for People attempting to protect and develop their wealth in opposition to the erosive forces of inflation. Eradicating capital beneficial properties taxes on Bitcoin would enable residents to transact, make investments, and save in a secure, finite asset with out the drain of federal taxes on each incremental acquire.

The ripple impact right here is evident: Extra individuals adopting Bitcoin as a retailer of worth and medium of alternate means stronger demand, which might additional buttress the U.S. Treasury’s strategic holdings. It’s a virtuous cycle, a optimistic suggestions loop. As Bitcoin’s worth grows, so does the nation’s wealth base—serving to pay down nationwide debt, bolstering the greenback’s hegemony in world commerce, and genuinely making People richer and safer.

Why America Wants Bitcoin

Bitcoin is now not a distinct segment experiment reserved for a small band of fanatics. It has developed right into a mainstream, pressing precedence for on a regular basis People—particularly the rising era that may form our nation’s future financial system. This isn’t some ideological plea; it’s a sensible, data-backed actuality. In accordance with the Stand With Crypto Alliance, a non-profit devoted to clear blockchain insurance policies, greater than 52 million People now personal some type of cryptocurrency. Almost 9 in ten People imagine the monetary system wants updating, and 45% say they’d not help candidates who stand in the best way of crypto innovation. These numbers symbolize a sweeping, cross-partisan groundswell: Stand With Crypto’s analysis exhibits that 18% of Republicans, 22% of Democrats, and 22% of Independents maintain crypto. This cuts by the same old tribal politics and factors to a basic fact—Bitcoin is now a nationwide coverage speaking level, not a aspect notice on a fringe agenda.

The demand for America to steer is evident. 53% of People need crypto firms to be U.S.-based, making certain that technological innovation and the wealth it generates stay on residence soil. Amongst Fortune 500 executives, 73% favor U.S.-based companions for his or her crypto and Web3 initiatives, signaling a company want to maintain America on the forefront of worldwide monetary progress.

Failing to behave now dangers a replay of previous errors. America as soon as led the world in superior manufacturing, but at this time 92% of probably the most refined semiconductor manufacturing sits in Taiwan and South Korea. We can’t afford to cede the longer term monetary panorama to different areas. Bitcoin isn’t simply one other funding class; it’s the digital spine of a quickly evolving financial system. If the U.S. desires to protect its financial hegemony, keep innovation management, and guarantee on a regular basis People have entry to a secure, growth-oriented monetary future, it should embrace Bitcoin wholeheartedly. In doing so, the nation can safe its place as the worldwide Bitcoin superpower—uplifting our residents, strengthening our financial base, and safeguarding our strategic pursuits within the Twenty first-century digital financial system.

America, Charting the Course

By aligning with world finest practices and enacting forward-thinking insurance policies, the U.S. can place itself as a beacon of monetary liberty and technical innovation. Eliminating capital beneficial properties tax on Bitcoin would sign to traders, entrepreneurs, and on a regular basis residents that America is critical about main within the Twenty first century’s digital financial system. It’s not nearly being “Bitcoin-friendly”; it’s about making certain that common People have the instruments they should navigate turbulent financial waters.

The complexity and inefficiency of taxing each digital transaction is an pointless burden on innovation and on a regular basis life. People deserve higher—they deserve the liberty to transact in a digital world with out punitive oversight.

In essence, that is America’s probability to do what it has at all times performed finest: innovate, adapt, and lead. Eradicating capital beneficial properties taxes on Bitcoin wouldn’t simply fulfill a marketing campaign promise; it will set the stage for long-term prosperity, empower residents to safe their monetary futures, and cement america because the world’s foremost Bitcoin champion. A rising tide, certainly, lifts all boats—and what higher vessel to embark upon than a Bitcoin Ark, captained by a visionary administration decided to actually Make America Nice Once more?

This text is a Take. Opinions expressed are fully the creator’s and don’t essentially replicate these of BTC Inc or Bitcoin Journal.