With many of the crypto neighborhood targeted on the US election and rising costs, Denis offers us a reprieve with a deep-dive on a subject we’re at all times eager to study extra about: zero-knowledge proofs. – Chris

The adoption of zero-knowledge (ZK) rollups – as soon as hailed as the subsequent large factor in blockchain scalability – has been surprisingly gradual. Regardless of their technological promise and up to date main leaps in privateness and scalability, implementation into on a regular basis blockchain use has been gradual. Under, we focus on causes behind the slower uptake of ZK rollups in comparison with optimistic rollups, and ponder how the expertise will combine into DeFi and blockchains sooner or later.

Zero-knowledge proofs permit somebody to show a declare with out revealing the underlying info. Whereas ZK includes a number of the most superior math in crypto, we will grasp the fundamentals by way of analogies and high-school ideas.

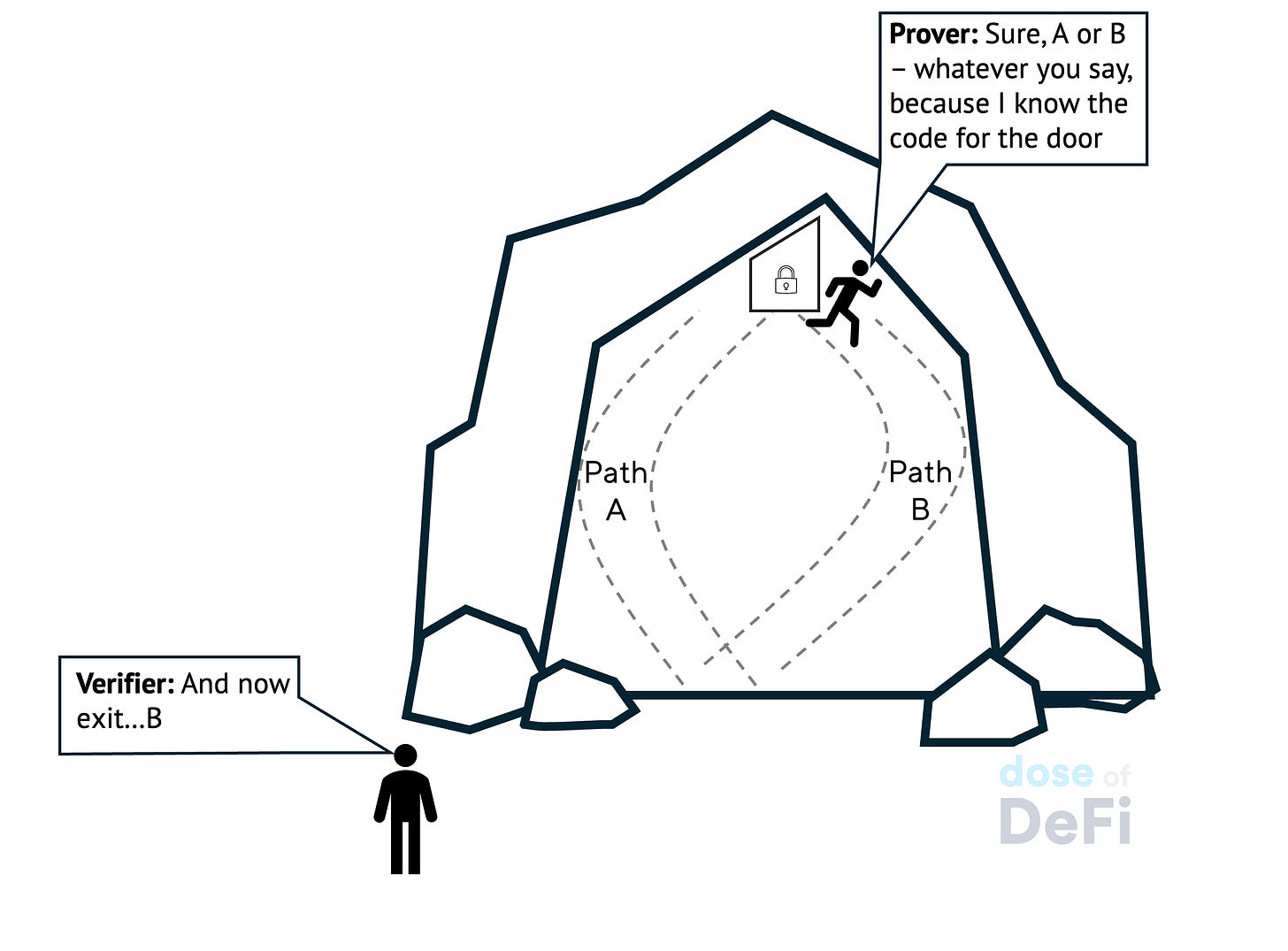

Think about a cave with two paths – path A and path B – that ultimately meet at a locked door inside. The door can solely be unlocked with a secret code. You declare to know this code.

The method:

-

You and the verifier stand outdoors the cave. You enter the cave, selecting both path A or B. The verifier stands outdoors and doesn’t see which path you’re taking.

-

Problem: When you’re inside, the verifier shouts which path they need you to come back out from.

-

Response: In the event you take path A and the verifier asks you to come back out from path A, you merely exit from path A. In the event you take path A and the verifier asks you to come back out from path B, you will need to use the key code to unlock the door, stroll by way of it, after which exit from path B.

This course of is repeated a number of instances. In the event you persistently exit by way of the proper path, the verifier positive factors confidence that the code. Importantly, the verifier by no means learns the code itself – therefore, ‘zero-knowledge’.

The way in which the cave is constructed on this instance (a door with a secret code and the way it can affect the end result) is similar to how ZK techniques are constructed.

ZK proofs can additional be defined in easy phrases, counting on arithmetic, notably utilizing polynomials. These algebraic expressions – shaped by the sum of any variety of phrases of the shape cxokay – are key to how ZK techniques work. You might keep in mind these from highschool math:

x + 1

x2

X3+3x2+2x+1

345x335+221x334+115x333+…+65x+44

The vital factor to recollect as we attempt to perceive ZKs is that polynomials can include an unbounded variety of phrases. We will then perceive {that a} single equation involving a lot of polynomials can symbolize an infinite variety of equations (learn: relationships) between numbers. For instance, take into account the equation that features polynomials A, B, C, and variable x: A(x) + B(x) = C(x). If this equation is true, then it’s additionally true that:

A(0) + B(0) = C(0)

A(1) + B(1) = C(1)

A(2) + B(2) = C(2)

A(3) + B(3) = C(3)

…

If some equation involving some polynomials solves for a randomly chosen x, then it nearly definitely holds true for the polynomials as a complete. So, after we look again to the cave instance above, the particular person (verifier) can exit by way of the randomly required path a number of instances, which is similar as an equation involving polynomials fixing for a randomly required x a number of instances. This in a succinct manner proves that the prover holds the complete quantity of data, whether or not it’s a secret code as within the cave instance, or regarding all transactions in an L2 block. For extra of an in depth clarification, see this Vitalik’s article or Starknet founder Eli Ben-Sasson’s video.

These proofs are computationally costly to create, however quick to confirm. Right here, it’s vital to know that despite the fact that ZK is about zero leaked info, it’s its velocity property, and never privateness, that underpins rollups. Mathematicians and cryptographers are engaged on additional decreasing verification instances.

ZK rollups combination transactions offchain into batches, producing proofs (zk-SNARK or zk-STARK) which can be used to validate batches of transactions. The aggregated proof, together with a minimal quantity of knowledge required to reconstruct the state, is submitted to the primary chain (e.g., Ethereum). This proof is used to verify that the offchain transactions have been processed accurately. The principle chain solely must confirm this small proof quite than re-executing each transaction, which considerably reduces the computational load and enhances scalability.

ZK proofs be certain that rollup operators can’t cheat or commit fraud with out being detected. The proof ensures that the state transitions and computations are appropriate in keeping with the protocol. So long as the proof is legitimate, the outcomes are accepted as appropriate, sustaining the integrity and safety of the rollup.

As a result of ZK proofs are succinct and don’t require full transaction knowledge to be saved or processed onchain, ZK rollups can deal with a better throughput of transactions in comparison with processing them immediately on the primary chain. This scalability is achieved with out compromising the safety ensures supplied by the primary chain.

ZK expertise can’t be used to confirm any computational downside immediately. Reasonably, the issue needs to be transformed into the appropriate ‘type’. Regular program logic needs to be represented by a gaggle of polynomials.

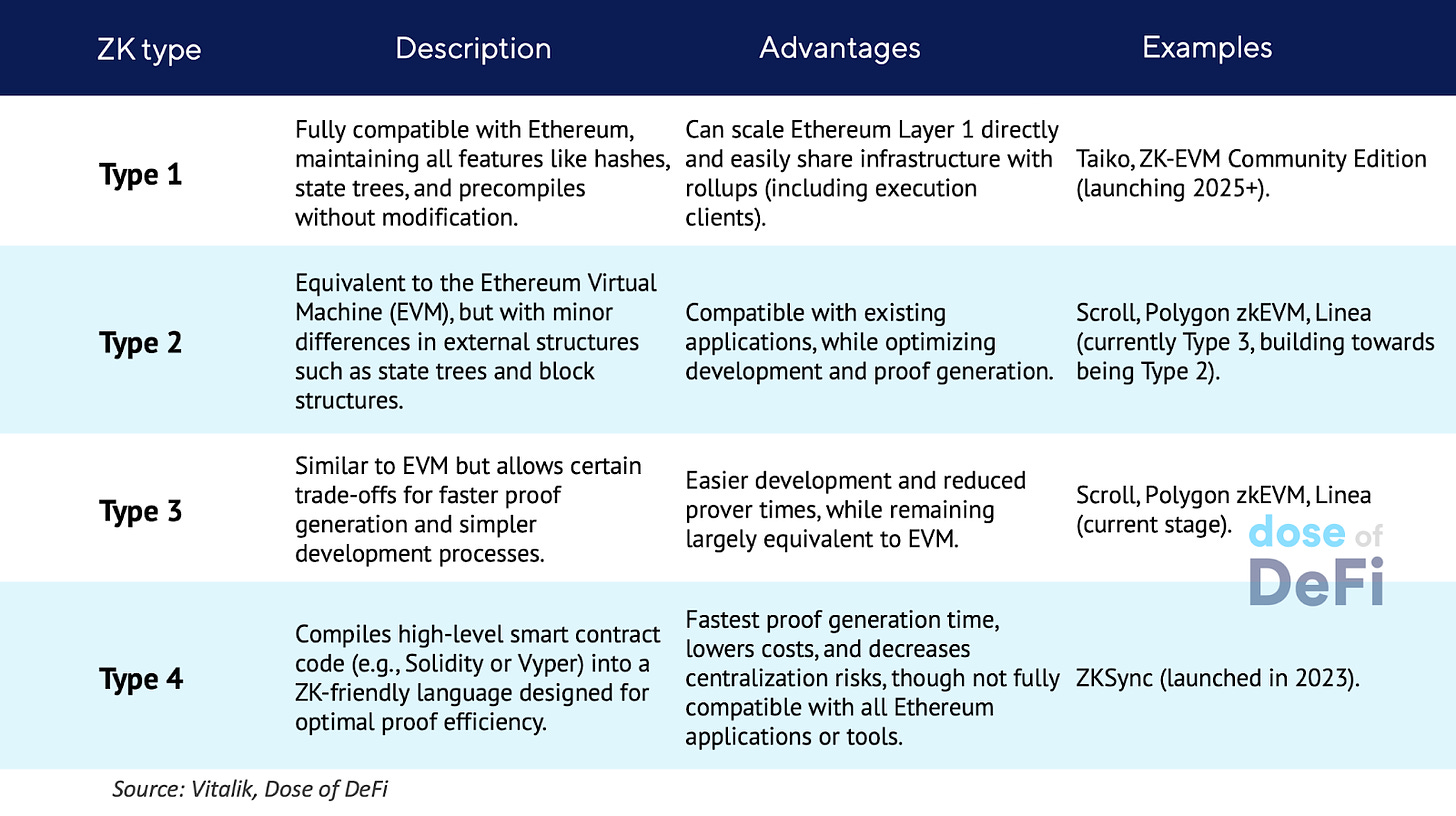

You’ll be able to think about how sophisticated that is, and rewriting EVM (or any digital machine) to have the ability to function through these polynomials is as advanced because it sounds. That’s why making a fully-EVM suitable zkEVM is difficult, and why there’s such a variety of zkEVM implementations taking place (from absolutely Ethereum-equivalent to high-level-language equal ones). This impacts applicability of trade infrastructure and the extent to which sensible contract code of current initiatives needs to be modified to run on the chain.

So, now that we perceive the fundamentals of ZK expertise, it’s time to deal with the conundrum of ZK rollups’ lackluster takeup.

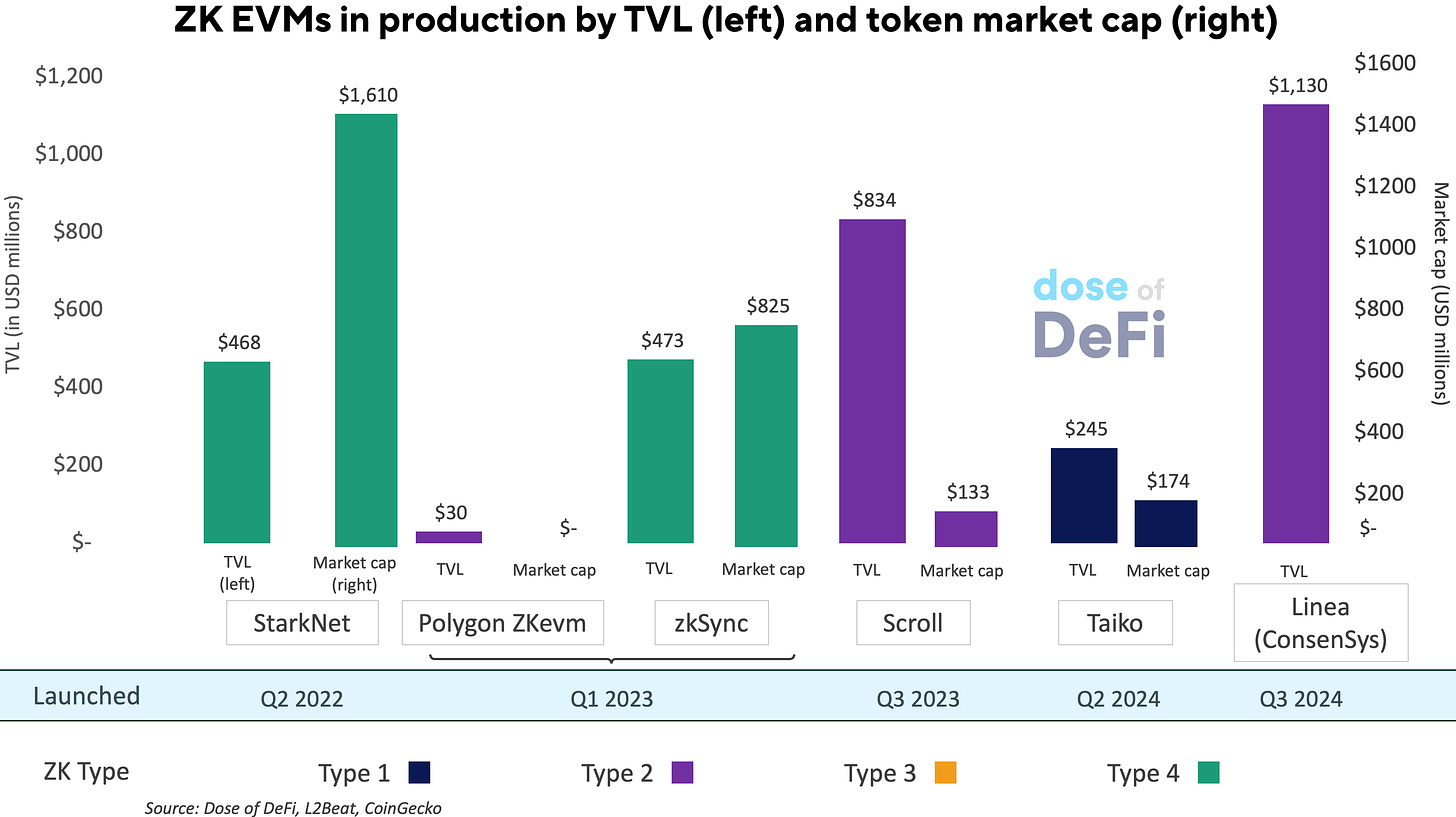

We’ve seen some profitable implementations: specifically, ZKsync, Scroll, Starknet. It marks a hit in itself that these perform at this level, with no vital hacks to this point (solely a couple of halts). Nevertheless, optimistic rollups are nonetheless dominating ZKs, the latter holding roughly 10% of the market solely by TVL and consumer exercise. L2beat.com’s proprietary statistic, scaling issue for ZK rollups, is 2.3 instances over the past 90 days. Which means that solely two instances extra transactions are settled by Ethereum thanks to those rollups. This determine is 9 instances for optimistic rollups, which implies optimistic rollups are being extra broadly used as the popular Ethereum scaling answer.

So what is de facto holding ZK rollups again? We see three doable explanations:

The tech behind ZKs merely hasn’t garnered as a lot belief as optimistic rollups. It appears tech-savvy whales are but to maneuver their capital to ZK rollups. Probably, they’re ready for ZK rollups to be battle examined and have all their bugs mounted. For instance, since verifiers (that aren’t but open-sourced) type such a significant a part of the stack, the trade can’t verify and confirm them.

This illustrates how making the zkEVM (or any zkVM) provable shouldn’t be an easy activity. Veridise, a safety audit agency specializing in ZK audits, claims that ZK safety is just more difficult. The agency’s ZK audits revealed a twice-increased likelihood of bugs in comparison with the remainder of their audits. That is comprehensible given the complexity and fast improvement of ZK expertise.

Plus, the sensible contracts for Sort 4s (Starknet & zkSync) are usually not simply forks of current Solidity contracts, so that they should be written from scratch, and buyers have much less belief in them. Battle-tested contracts are so wanted that Starknet, initially a Sort-4 ZK rollup, is including an EVM implementation Kakarot to grow to be a Sort-3 rollup (which can assist current Solidity contracts). Full EVM and Solidity assist appears to be essential for developer adoption.

Optimistic L2s have been launched three to 4 years forward of their ZK opponents. And as soon as customers moved to those options they stayed, with out seeing vital incentives to maneuver to new ZK chains. Charges on optimistic rollups have stayed on the similar degree as ZKs, despite the fact that the promised payment discount by ZKs is 10 instances that of optimistic rollups. ZK rollups nonetheless lack the mass adoption wanted to deliver tens of millions of customers and billions of transactions to actually exhibit their scaling benefit.

Additionally to be famous is that relative market capitalization of those chains is surprisingly low (zkSync, Taiko and Scroll are ranked 126, 342 and 344 on CoinMarketCap), largely defined by dangerous tokenomics. Low float with excessive FDV means tokens nonetheless should bear years of unlocks, deterring buyers from shopping for them. Token launch timing hasn’t been nice both; altcoins at the moment are performing notoriously worse than in earlier cycles, so ZK rollups have been launched to much less welcoming markets than optimistic rollups one cycle in the past. Certainly, since our piece on ZK rollups a 12 months and a half in the past, zkSync and Starknet have launched their tokens. Smaller market caps imply smaller treasuries to supply incentives to builders and customers, so there’s much less liquidity and exercise.

ZK expertise has the potential to scale blockchains by growing transaction throughput by a number of orders of magnitude, probably as much as 1000’s of transactions per second, relying on implementation.

The Ethereum Basis plans to make modifications to Ethereum to assist ZK rollups to additional enhance effectivity. In the long term, ZK will truly grow to be a main a part of the L1 itself. Ethereum node purchasers are anticipated to start experimenting with ZKs to confirm Ethereum block execution on L1. We anticipate a gradual shift from purchasers validating Ethereum L1 blocks by way of direct re-execution, to most purchasers counting on ZK proofs for verification.

To date, ZK implementations haven’t launched sufficient differentiation. The charges are nearly the identical, which doesn’t do sufficient to lure customers away from optimistic rollups. A brand new expertise can’t be simply marginally higher to persuade customers to modify: it have to be orders of magnitude higher. In the long run, as soon as there are 100 instances or 1,000 instances transactions onchain, ZK tech will really shine.

However the overarching query is whether or not this can happen by way of the present collective of ZK rollups, or whether or not ZK tech can be applied into current L2s or the bottom layer. The latter final result appears to be like more and more seemingly. With rising considerations about Ethereum’s positioning and the issue of L2 interoperability, ZK integrations look set to be the important thing enhancement to bettering the execution of the L1. Or, as the important thing customary that every one Ethereum L2s ought to comply with, as explored in Justin Drake’s ‘Beam Chain’ proposal to introduce ZK execution to the bottom layer, or Martin Koeppelman’s proposal for 128 Ethereum-approved ZK rollups that every one share the identical requirements.

ZKs will ultimately stay as much as the hype, however it doesn’t appear like the primary movers will profit.

-

Secure launches new L2, Safenet for cross-chain execution Hyperlink

-

Flashbots and Beaverbuild launch BuilderNet Hyperlink

-

Sky Ecosystem Threat & Analytics Dashboard Hyperlink

-

Decentralised.co launches SnetientMarketCap as dashboard for AI brokers Hyperlink

-

Implications of Twister Money’s victory in court docket Hyperlink

-

Hyperliquid airdrop praised for huge distribution and robust efficiency Hyperlink

-

DeFi TVL hits an all-time excessive over $200bn Hyperlink

-

Ethena continues USDe development with new partnership Hyperlink

That’s it! Suggestions appreciated. Simply hit reply. Brr! It’s chilly in Tennessee. Loved work and play in Asia and seeing readers at Devcon.

Dose of DeFi is written by Chris Powers, with assist from Denis Suslov and Monetary Content material Lab. *I spend most of my time contributing to Powerhouse, an ecosystem actor for MakerDAO/Sky. A few of my compensation comes from MKR, so I’m financially incentivized for its success. All content material is for informational functions and isn’t meant as funding recommendation.