Solana’s rise has expanded the DeFi subject. We’ve adopted from afar, however by no means had a recent take to supply. Nonetheless, the previous couple of months of frenzied exercise on Solana has offered a brand new alternative to have a look at its place out there, and the way it would possibly evolve. Zhev has beforehand written technical explainers of AMMs and different DeFi primitives on his personal substack. This month, we’ve teamed up with him for an in-depth have a look at Solana’s price markets. MEV has come to dominate the price market dialog on Ethereum, and as Zhev explores under, it’ll quickly come to dominate on Solana’s as properly.

Transaction charges are essential to help even probably the most fundamental actions on a blockchain, as they allow customers’ transactions to be granted validity and included in a block. The first objective of those charges is to disincentivize spamming; it’s additionally a part of the subsidy paid to validators to construct/validate blocks. In a way, these community charges are analogous to lease; customers are paying to entry a commodity which is finite per unit of time. The commodity on this context is ‘blockspace’, and is strictly what it implies – area on a block.

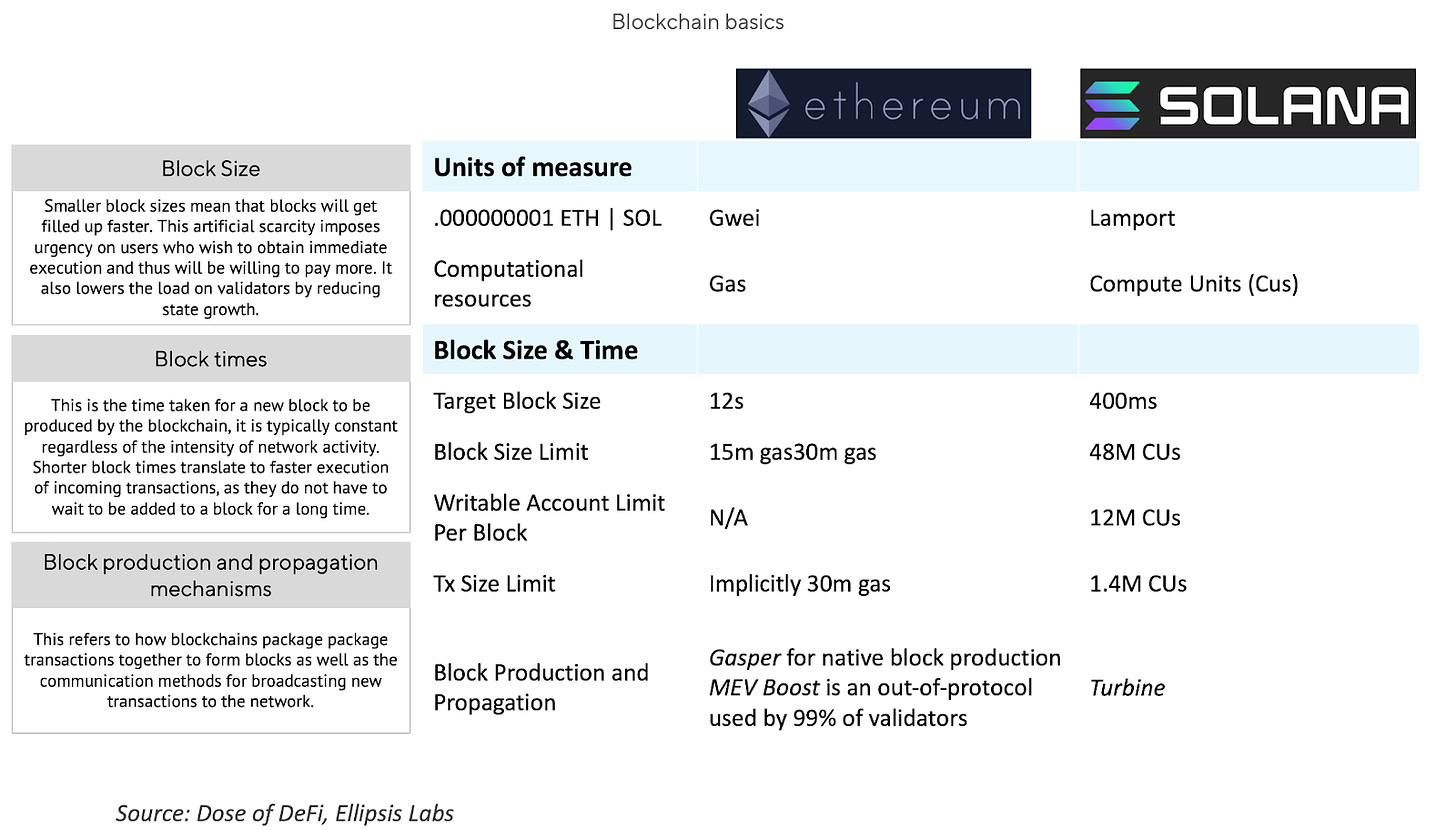

Right here, we assess blockspace on the 2 greatest smart-contract blockchains, Ethereum and Solana. And as we glance deeper, we study that price markets – designed each throughout the protocol and organically from the bottom-up – allow validators to leverage their entry to blockspace.

Solana’s price market was optimized for prime efficiency and designed to keep away from the problems which have arisen from Ethereum’s method. But whereas Solana’s market could finally be extra performant than Ethereum’s, it nonetheless must undergo an analogous MEV revolution to its peer’s (the place validators start to make the most of their privileged place). Solana doesn’t must go the identical proposal-builder-separation (PBS) route that Ethereum selected, nevertheless it might want to decide on a holistic method to stabilize its price market long run.

Earlier than we dive in, let’s attempt to perceive how blockspace worth is roughly decided.

There’s each a technical side and a social layer (basically, the entities whose collective belief within the blockchain affords it worth). On the technical aspect, blockchains can modify the block dimension, block time, and block-production and propagation mechanism. See the under chart for a extra detailed description and comparability in method by Ethereum and Solana.

The social side is the coordination of blockchain stakeholders to realize the chain’s technical and financial targets. It may be considered because the chain’s social standing, which is subjective however however an necessary measure. Social stress works, as does setting a specific tradition for resolving points – one thing Solana and Ethereum have each established. Current examples of discussions across the social layer are the continuing arguments over whether or not to extend Ethereum’s fuel restrict and issuance per epoch, and the current closure of Jito’s mempool on Solana.

Now, let’s transfer on to a extra detailed evaluate and distinction of the price markets on each Ethereum and Solana.

Ethereum’s reputation is usually as a consequence of its execution surroundings: the Ethereum Digital Machine (EVM), which allows sensible contracts. One other issue is that the permissionless nature of Ethereum has yielded numerous revolutionary functions throughout a number of cycles: the ICO craze of ‘17-’18, DeFi summer time 2020, and ‘21-’22s NFT mania. The persevering with presence of those functions creates worth that’s transferred to validators, who present the blockspace for these actions.

Quickly after financial exercise proliferated on Ethereum, miners (this was a number of years earlier than the swap to PoS) started exploring methods to make use of their place as block proposers to insert their very own transactions when arbitrage alternatives arose.

Phil Daian was the primary to doc this exercise – which we now confer with as MEV – in his seminal paper, Flash Boys 2.0 in 2019. On the time, the Ethereum price market solely allowed larger fuel costs as a approach to incentivize transaction inclusion. These precedence fuel auctions (PGAs) clogged up the Ethereum community and raised fuel costs till Flashbots (co-founded by Daian), launched. This then created a marketplace for miners to receives a commission for transaction inclusion by searchers, who’re on-chain arbitrage merchants. Ethereum researchers subsequently realized that MEV extraction may very well be a extra highly effective motivator than in-protocol charges.

Maybe the largest change to Ethereum’s price market was EIP-1559, which created a base price (dynamically deterministic per epoch, disincentivises spamming, burned), and a precedence price (used to indicate urgency or specify preferences, and paid to the block proposer for transaction inclusion). An necessary level to notice is that ‘precedence charges’ are functionally completely different from ‘ideas’. The previous ensures inclusion and is mediated by the underlying chain, whereas the latter ensures ordering alongside inclusion and is mediated through a price market.

Ethereum’s method has continued to evolve; try our two half deep dive on MEV from final fall. This has occurred by way of a mixture of the social layer that’s making an attempt to decentralize a centralizing MEV trade, and the technical layer the place MEV is now a key a part of the technical roadmap (Vitalik calls this a part of the roadmap, ‘The Scourge’).

Solana was constructed with an acutely completely different method to blockchain structure, particularly concerning scalability.

A few of Solana’s notable improvements embrace:

-

The absence of a basic mempool: In Solana, transactions are straight forwarded from the originating shopper to the present chief in control of producing a block, eliminating the necessity for a mempool. This theoretically reduces the latency for transaction affirmation, however isn’t all the time the case in observe as a consequence of ‘jitter’, which is the variation in processing instances that completely different validators expertise when dealing with transactions or blocks.

-

State isolation: An extension of its lack of a mempool, enabling transactions on its dAPPs to be extra unbiased of one another. This method is analogous to the ‘including extra lanes to ease site visitors’ precept; several types of transactions on Solana have a selected ‘path’ they must observe from the person to the chief so as to be added to a block. This text gives extra element.

These two elements, alongside Solana’s state isolation, allow transaction ‘multithreading’. That is the place the present epoch chief schedules a number of packets of transactions to be confirmed at roughly the identical time (on the situation that transactions in the identical threads don’t alter the identical state) in the identical means and on the identical time.

Community charges on Solana are sometimes very low (though they’ve risen with current demand). In distinction to Ethereum, Solana has a static base price per signature measured in lamports. Its precedence price is then measured in microlamports per compute unit requested.

Which means whereas charges algorithmically scale with complexity and demand on the EVM, the SVM scales solely its precedence charges through easy demand. The technical points arising from this non-dynamism are detailed right here, however the gist is that pricing a commodity whose demand fluctuates wildly whereas its provide is deterministic in a static method is not optimum.

The social consensus on Solana is that its low charges are its distinctive benefit over different blockchains. This method invitations spam, so some have referred to as for larger charges or a dynamic base price for instances of excessive exercise (akin to EIP-1559).

Solana’s method up to now has been to implement localized price markets in response to heightened demand. Since states are remoted, it’s trivial for the community to find out ‘hotspots’ or states which are experiencing a surge in demand. This hotspot-approach allows a blockchain to algorithmically value focused transaction charges above the common for transactions in comparison with different much less in-demand states. This method – just like the block-builder position on Ethereum – is completed by a scheduler, which helps to position transactions in steady blocks based mostly on precedence charges.

As a part of the implementation of native price markets, Solana constructed an in-protocol scheduler, which natively schedules transactions to be executed based mostly on a first-in-first-out algorithm. Transactions are repeatedly streamed to the slot chief who then types the transactions based mostly on the ideas they provide.

The algorithm additionally requires that the slot chief shares the shreds they’re constructing with a number of the nodes they’re linked to, based mostly on the latter’s stakes. Nonetheless, as famous earlier, this course of is disrupted by jitter. Particularly, scheduler jitter (arising from Solana’s random project of incoming transactions to execution threads) and community jitter (from delays in P2P relay of incoming transactions and shreds).

These ‘jitters’ contribute to non-deterministic transaction ordering on Solana, which makes blockspace auctions economically viable. So, in different phrases, each time there may be jitter, validators have an financial incentive to insert or reorder transactions. For customers, this implies MEV leakage and for validators, MEV earnings.

A fast MEV-Ethereum recap: on Ethereum pre-Flashbots, MEV exercise crowded out common blockchain exercise, pushing up fuel costs for all customers by way of PGAs. On Solana, charges don’t spike as a result of it doesn’t have a shared state and a worldwide minimal value like Ethereum, nevertheless it’s extremely troublesome for normal customers on Solana to land a transaction throughout heightened exercise. Flashbots launched MEV-GETH to take care of PGAs, making a separate lane for MEV worth to be auctioned off outdoors of the in-protocol price mechanism. Within the case of Solana, Jito launched an analogous product for validators that gave them entry to a psuedo-mempool and a custom-made scheduler that may order transactions in probably the most worthwhile means. Jito’s mempool was engaging to customers, providing them assured inclusion for the fitting to be front-run (aka, have their MEV extracted).

Whereas a well-liked product, Jito’s mempool got here underneath social stress and was shuttered final month. That is possible for the same motive as to why greater than 20% of Ethereum transactions run by way of personal mempools: customers are bored with being sandwiched. Spamming is now again on the desk as the only mechanism for (probabilistically) assured execution of time-sensitive transactions on Solana. And the absence of a mechanism for environment friendly blockspace bidding results in uncertainty throughout excessive demand.

Since transactions on Solana are actually streamed on to the slot chief and the prioritization mannequin has been damaged, topology (and latency by extension) is an important element customers will take into account for time-sensitive transactions.

A person’s topology within the community could also be understood as how ‘far’ they’re from the chief, and depends on the burden of their stake and/or the stake of the nodes they’re linked to. Thus, rational brokers will search to be linked to nodes which already management excessive quantities of stake, resulting in centralisation.

As a short-term consequence of spamming, Solana is now so congested that it’s virtually unusable for less-savant customers due to transaction failures. And addressing the long-term penalties (co-location and centralization of community stake) has grow to be much more necessary.

Solana’s preliminary design philosophy was centered round eliminating person friction and permitting the validator community to fulfill demand in no matter means it may. What Solana missed was that markets do greatest after they have some underlying certainty about how they operate. Price markets present a approach to democratize inclusion by requiring customers to pay extra, transferring the issue from a topological perspective, to an incentive-based one.

Whereas this modifications the person expertise, embracing price markets – significantly as they relate to MEV – is the very best path ahead for Solana and its customers. Arguably,offering a cost-intensive avenue to inclusion, whereas sustaining a series’s integrity, is much better than no avenue in any respect.

Certainly, onchain actions are nearly all the time time delicate, particularly when an agent seeks to extract worth with little-to-no financial value. Overpriced deterministic execution is best than low cost probabilistic execution.

The specialization of price markets allows the bargaining and auctions for blockspace to happen at larger ranges away from consensus and execution. Validators can thus perform their duties with out having to fret about optimizing for greatest outcomes to accrued blockspace worth.

Solana is within the midst of a chain-wide dialog on how its price markets ought to restructure (one thing Ethereum has been pondering for years, but nonetheless not discovered).

Solana has but to undergo the mandatory MEV transition. And whereas the current improve in exercise on the chain has attracted MEV gamers like Jito and Ellipsis to start constructing MEV infrastructure, main validators have but to cross the rubicon and begin working their very own Solana MEV methods. That is in distinction to all main staking suppliers on Ethereum that run MEV increase. The Solana validator group is just not as adversarial as Ethereum’s, so the handshake settlement to not extract MEV so as to prioritize the end-user expertise has been held (to date).

This won’t final; the social layer can’t police conduct endlessly. Blockchains should operate in an adversarial surroundings with self-interested actors. Solana would possibly fare higher than Ethereum as a result of it might clear up some MEV issues with out the heavy decentralization shackles that Ethereum wears. But it should reply thorny questions like, ought to all staked SOL get entry to MEV rewards like Ethereum has achieved by way of MEV increase?

Some minimization mechanisms are already being explored with the purpose to resolve Solana’s congestion downside. These embrace a dynamic price construction, upcoming modifications to the native scheduler specs, stake-based limitations, and different optimizations on the utility stage. Issues are transferring rapidly. Jito’s CEO just lately acknowledged {that a} “small cluster of operators/searchers [are] sandwiching [and] working personal mempools”.

MEV is a marker for financial progress and as such is unavoidable. The truth is, even Bitcoin – whose simplicity is often hailed as its biggest characteristic – is starting to expertise a reinvention following the rise of Ordinals and financial exercise. Selecting to disregard options as a consequence of detrimental externalities (akin to in Jito’s case) doesn’t remove stated externality, it merely results in an uncoordinated market.

The social layer is an efficient software for stopping predatory conduct, however just for a short while. Ethereum is experiencing the shortcomings of the social layer with the rise of timing video games, a method the place block proposers deliberately delay the publication of their block for so long as potential to maximise MEV seize. This weakens the safety of the chain however makes financial sense from a validator perspective. Disgrace works for a short time, however protocol analysis is the one long-term repair.

It’s too early to say what Solana’s MEV provide chain will appear like in a couple of years’ time. However one factor we might be certain of for now’s that almost all worth shall be captured by massive validators.

-

Bitcoin halving dashboard Hyperlink

-

Frax Finance expands to Cosmos through Noble Hyperlink

-

Paradigm open sources Reth AlphaNet, an OP Stack-compatible rollup Hyperlink

-

Synthetix V3 goes reside on Base Hyperlink

-

Extremely anticipated restaking protocol, Eigenlayer launches on ETH mainnet Hyperlink

-

Different Layer-1 Monad raises $225m earlier than launching its testnet Hyperlink

-

Senators Lummis and Gillibrand introduce new stablecoin invoice Hyperlink

-

MakerDAO raises sUSDe & USDe debt ceiling to $1bn Hyperlink

That’s it! Suggestions appreciated. Simply hit reply. Nice to lastly get a deep dive on Solana on Dose of DeFi. I’ll be in Berlin subsequent month at Dappcon & ETH Berlin

Dose of DeFi is written by Chris Powers, with assist from Denis Suslov and Monetary Content material Lab. I spend most of my time contributing to Powerhouse, an ecosystem actor for MakerDAO. All content material is for informational functions and isn’t meant as funding recommendation.