- Crypto analyst JD recommended a historic precedent for XRP’s 10x rally as a possible benchmark, which may propel its value from $2.64 to round $26.4.

- Whereas XRP has beforehand defied comparable patterns, he suggested merchants to stay vigilant and take into account correction alternatives as DCA factors.

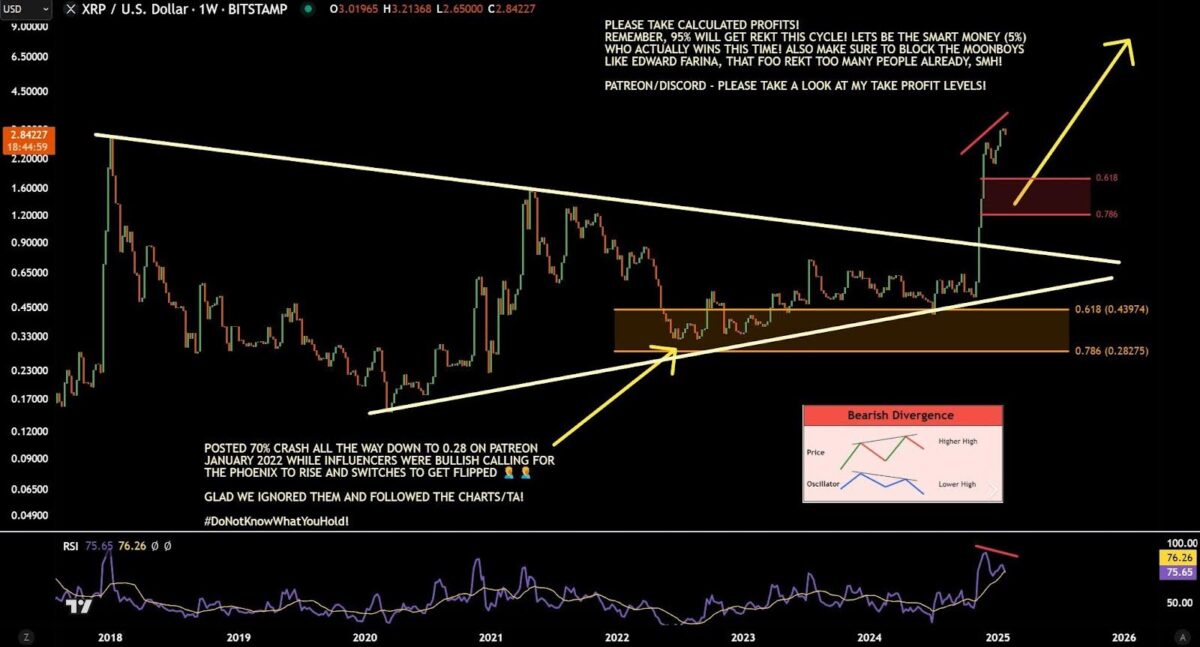

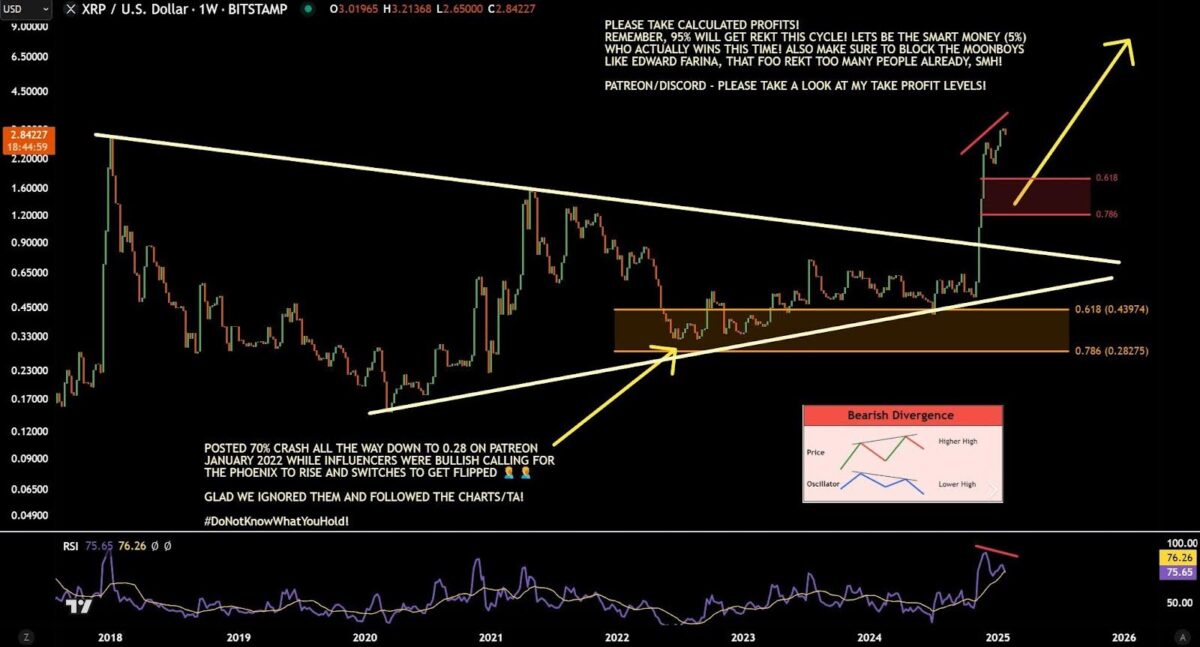

Crypto analyst JD lately shared a technical breakdown of Ripple’s XRP value, stating a big breakout and essential market indicators. He underlined the truth that strategic profit-taking is critical whereas cautioning towards extreme market enthusiasm.

Crypto Analyst Spotlights XRP Value Technicals

JD talked about his earlier appropriate predictions and the way XRP’s value skyrocketed tenfold from its $0.28 low in earlier years. He described this stage as the muse for a powerful rally, stating that those that adopted his evaluation had seen vital returns.

As indicated by JD, the XRP value has left a long-term symmetrical triangle sample and seems to be effectively right into a bullish development. In his chart, he has famous Fibonacci retracement ranges with 0.618 positioned at about $0.44 and the 0.786 stage round $0.28. He signifies that each ranges have beforehand supported pushing XRP larger.

JD recognized a resistance zone, marking it as a possible level the place merchants may take into account taking earnings. His evaluation additionally highlighted a bearish divergence, a state of affairs the place XRP’s value types the next excessive, however the Relative Energy Index (RSI) creates a decrease excessive.

Nonetheless, regardless of XRP’s historical past of ignoring comparable bearish divergence in 2024, JD thought of this a fairly normal formation warning of potential weak point in value. He requested: “Can we negate bearish divergence? IF NOT, purple field could hit for an additional DCA alternative!” Because of this if the bearish divergence happens, XRP may drop by correction, so one other DCA alternative could materialize.

Nevertheless, amid the broader crypto market selloff at present, XRP is down greater than 16% and is at present buying and selling at $2.30 with a market cap of $136 billion. Additionally, the Coinglass knowledge exhibits that XRP futures open curiosity has tanked 35% to $3.7 billion whereas 24-hour liquidations have soared to $119 million.

Is $27 Goal On Playing cards For Ripple Token?

JD avoided specifying an actual goal however referenced XRP’s historic 10x surge as a doable benchmark. With XRP at present buying and selling at $2.64, an analogous rally would push the worth towards $26.4, aligning with projections from different market analysts who’ve set targets round $27. As beforehand talked about in our report, the XRP TVL has additionally surged previous $80 million and the rising ETF demand may function an additional catalyst.

He reminded everybody of the necessity for strategic exits by cautioning merchants about dangers on the markets: “95% will get rekt this cycle! Let’s be the sensible cash (5%) who truly wins this time!” JD has all the time discouraged reckless market habits and as an alternative promoted structured buying and selling methodologies like DCA, or Greenback Value Averaging.

His newest technical outlook sheds gentle on an important features of XRP’s value motion with regard to monitoring the help ranges and resistance zones and the way bearish divergence would have an effect on the buying and selling. In line with JD, if the Ripple token can reverse this divergence, it will likely be “the cycle high” on the present rally.

Advisable for you: