🎉New- take heed to the audio🎙️ model of this text🎉

Whereas the climate is beginning to cool, the dialogue round Ethereum’s future has heated up. Solana’s breakout yr and issues over extractive L2s have shaken confidence in Ethereum. Whereas costs and the market stay stagnated, progress has come on the analysis facet. Under, Zhev seems to be on the MEV area from the attitude of order-flow auctions (OFAs), and evaluates what may nicely be the ultimate MEV boss: operating credible auctions on censorship-resistant blockchains.

Collectively, we’ve progressed quickly in the direction of the MEV-mitigating targets set out by Flashbots and co-opted by Ethereum. The truth is, the success of Flashbots – virtually the face of MEV on Ethereum – implies that the illumination of the darkish forest objective has nearly been met. The opposite two – democratization of conscious extraction, and the distribution of advantages – are additionally seeing extra daylight. Nonetheless, there stays extra work to be achieved earlier than Ethereum reaches the MEV utopia, the place leakage is minimized at each stack of the protocol.

The simplest gotcha for MEV on Ethereum is that almost all auctions are solely offchain and centralized. Because of this the protocol can’t give any ensures concerning execution to any participant in such auctions. Fairly, ensures are bestowed by a second agent who’s extra privileged within the mechanism.

That is most clearly illustrated with Order Move Auctions (OFAs). Such auctions had been speculated to be an answer to the issue of worth distribution, a method for customers to recapture the worth they’re chargeable for creating by operating an public sale antiparallel to MEV-Increase, or any such related PBS auctions. And whereas OFAs have enhanced person welfare, there are different points. OFAs depend on trusted intermediaries who’re finally on the behest of the oligopolistic builder market, which has confirmed prepared to censor transactions as they please. As such, efforts have to be made to make sure that block producers aren’t in a position to affect purposes’ transactions and alter them in their very own favor.

This finally signifies that new OFA designs which are decentralized are wanted. And extra importantly, so is credible infrastructure with censorship resistance to run these OFAs, be it SUAVE and FOCIL or the newly launched BRAID – which might introduce a number of proposers to the Ethereum protocol. Though SUAVE and a Flashbots/Ethereum-aligned future appeared just like the inevitable MEV endgame, the route that brings a number of proposers to Ethereum seems to be just like the surprising favourite.

In a earlier article, we evaluated among the emergent OFA platforms on the time, which function trusted intermediaries between extractors (searchers and builders) and customers beneath the PBS framework.

Earlier than we transfer on, it’s vital to notice that almost all performant OFAs so far – reminiscent of UniswapX, CoWswap, and the like – are application-specific (on this case, they provide OFAs for commerce/swap execution). This implies they don’t seem to be generalizable MEV infrastructure however particularly designed to forestall frontrunning retail merchants, so whereas priceless, it’s not a long-term constructing block that gives the programmability of say a sensible contract. This additionally doesn’t even think about different ache factors reminiscent of the price of bootstrapping a solver community that truly prioritizes person welfare (promise you received’t entrance run anybody, bro), and the disadvantages that include a siloed solver community.

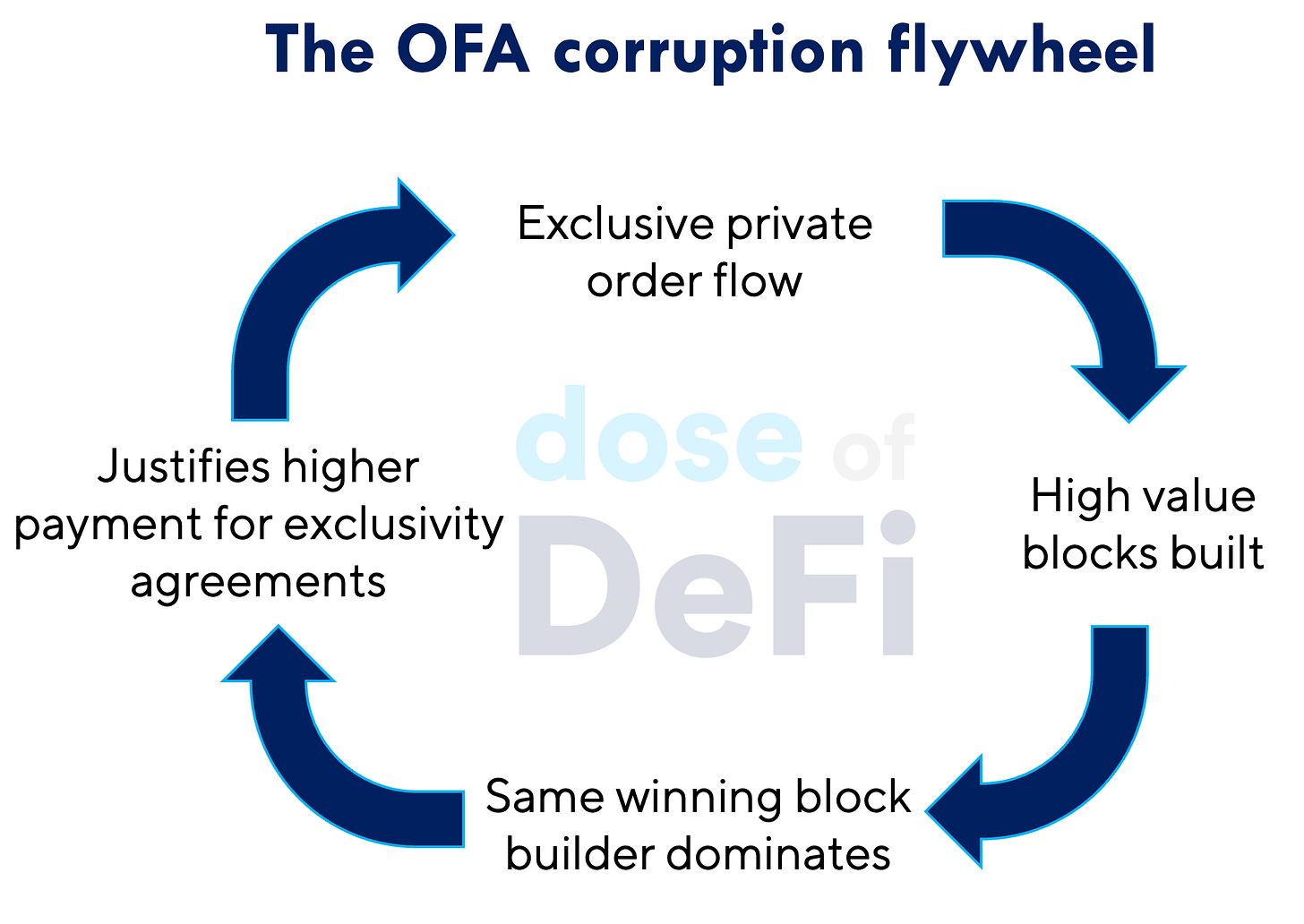

There’s additionally the issue that almost all OFA platforms thrive on a cost for order move (PFOF) or unique order move (EOF) mannequin. Right here, user-facing purposes reminiscent of RPCs, pockets suppliers, and decentralized purposes obtain funds from extractors for unique entry to the customers’ orders, a form of vertical integration.

So then, now we have two key issues:

-

the proliferation of backroom offers and a PFOF mannequin that is not optimum for person welfare.

-

block producers (builders and proposers) can censor transactions which pay them solely a minimal portion of the transaction’s extractable worth. In different phrases, the bottom protocol’s low value of censorship.

To beat the primary drawback, application-agnostic/generalized OFAs are being designed with the objective of being carried out as a portion of the protocol’s execution logic (identical to MEV auctions), in order that purposes can simply implement OFAs with decrease overheads. This might finally redefine how person welfare overlaps with inclusion/execution ensures.

The overarching drawback of conducting offchain auctions is that the disincentive for predatory habits is not native to the system, however relatively enforced via loss to fame and/or mounted penalties utilized by a (centralized) authority.

Additionally, in addition to different components (reminiscent of participation prices) which invariably result in an undesirable oligopolistic extractor regime in MEV markets, the PFOF mannequin is unavoidably oligopolistic, as demonstrated by the growing oligopoly of market making in TradFi by HFT companies.

This oligopoly is not achieved via truthful competitors amongst extractors, the place they optimise for options and person welfare. Fairly, through backroom offers which the person would not essentially profit from, and may not even concentrate on. The truth is, 80% of block builder income comes from personal order move – so why take away the punch?

With a purpose to cease this suggestions loop, work have to be achieved to introduce extra competitors and decentralization in each the OFA market and within the block builder market.

An important factor to repair is the centralized builder market, which prevents MEV auctions from being run onchain. We’ll focus on that in additional element under, however needed to spotlight two promising OFA designs, MEV-Share and Atlas, which make enhancements on two key areas: privateness and software sovereignty.

The first design distinction between MEV-Share and Atlas lies in the place the public sale’s inclusion ensures move from. The previous depends on ensures from block builders to be credible, so decentralization and competitiveness of the builder set is essential, which Flashbots says is why they’re constructing SUAVE.

In the meantime, Atlas chooses to make use of an Entrypoint contract, akin to ERC 4337, to get direct entry to an alternate mempool (referred to as ‘ops relay’) hosted by an celebration. This distinction within the supply of the inclusion assure permits Atlas to be rather more versatile, because it would not want a PBS-supportive protocol to be performant. Nonetheless, this comes at the price of its gasoline effectivity since there’s loads of verification to be achieved onchain.

These designs enhance person welfare, however finally, they may solely work if there’s credibly impartial infrastructure to run these auctions.

In “credible, optimum auctions through blockchains” Tarun et al. look at the results of blockchains and cryptography on credible auctions. The notion of credibility on this context is predicated on Akbapour’s work the place a reputable public sale is outlined as one through which the auctioneer’s (vendor’s) income is best off after they observe the described mechanism. The outcomes from Tarun et al. present that censorship-resistant blockchains gas credibility.

The query is can a blockchain run a good, high-value public sale whereas sustaining censorship resistance? Within the present setup, Titan, rsync and beaverbuild (the three largest block builders on Ethereum) have a privileged place for any onchain public sale and can merely censor any transaction from an public sale that tries to redistribute MEV they’ve dutifully earned. It is a enormous impediment to efforts to cut back LVR and the CEX-DEX arbitrage. Thus, any credible OFA would solely turn out to be absolutely performant when there are ensures of truthful inclusion and censorship resistance towards all odds from the blockchain.

The prevalent questions, then, are (a) how can Ethereum (or one other blockchain) present these ensures? and (b) in what methods can the ability of a block producer be restricted to make sure there isn’t any potential to censor?

There are two paths rising for the place the market will go. The primary is a continuation of the MEV mitigation and redistribution technique of the final 4 years, which has been led by Flashbots. And the second path tries to repair the supply of MEV privilege by eradicating the proposer monopoly solely.

Flashbots launched with a cost to “frontrun the MEV disaster”. This was a tacit acknowledgement that they weren’t going to repair the disaster, however relatively construct extractive instruments after which work out how one can make them truthful.

SUAVE (or the Single Unifying Public sale for Worth Expression) is the endgame for this imaginative and prescient, a blockchain that may be a decentralized block builder for any EVM chain.

SUAVE extends MEV-Share’s programmable privateness to execution environments which might use it as a decentralized block builder, or perhaps a shared sequencer. It makes use of “TEE-kettles”as confidential compute enclaves, and runs as “SUAVE chain” powered by Clique’s proof-of-authority consensus protocol. SUAVE intends to be the credible infrastructure for MEV auctions, basically turning into the house of all MEV extraction, however with the upside that it’s being run on a decentralized blockchain, relatively than the opaque MEV provide chain of immediately.

This method offloads the issue of censorship resistance to a unique setting than the L1, which suggests Ethereum’s censorship-resistance can be depending on one other chain.

To shore up its censorship-resistance, Ethereum researchers have proposed inclusion lists. Whereas the specs differ between designs, the essential premise of inclusion lists is to permit the proposer to forcefully embody some transactions of their slot (or a future one!), doubtlessly towards the desires of a censoring builder.

FOCIL takes this a step additional to maneuver the manufacturing of an inclusion listing from the slot’s proposer, to a leaderless committee of validators chosen randomly. For each slot, a random set of validators produce a native inclusion listing from transactions within the mempool, which have to be included within the subsequent block.

This design is extra of a patch over one of many many leaks of PBS on Ethereum, and the factor with patches is that they largely do not final. The workforce at init4 tech additionally not too long ago confirmed that pressured inclusion doesn’t forestall censorship of most DeFi transactions. FOCIL could also be helpful but it surely is not going to handle the builder monopoly.

So path one is the place Ethereum implements one thing like FOCIL on the protocol degree after which depends on SUAVE to decentralize its block constructing market.

Flashbots and the Ethereum Basis have each agreed to work to externalize MEV auctions exterior of Ethereum, however that standard knowledge is starting to fray with the emergence of multiple-concurrent proposer (MCP) designs and BRAID.

With a number of proposers, relatively than having a single proposer append blocks for each slot, the protocol implements a leaderless scheme through which not less than two proposers are chargeable for producing the payload to be executed for the slot. This removes the monopoly a single entity has on inclusion and permits the protocol to show a costlier value of censorship at each slot, greater than it could have in a leader-based scheme. That is because of the remark {that a} single slot with Ok proposers achieves the identical value of censorship that may require Ok slots on a single proposer chain.

The work of Max Resnick on BRAID has once more sparked curiosity within the subject as a viable means for growing the censorship resistance/value of censorship of a protocol. Whereas the specs are nonetheless being fleshed out in actual time, BRAID and its multiple-proposer structure is a wrecking ball to the present Ethereum roadmap and its PBS structure (it’s seen as a direct various to FOCIL). After being offered final month, BRAID shortly gained help from Dan Robinson of Paradigm, which is notable given their funding in Flashbots, and SUAVE by extension. Not everybody from Paradigm is on board nevertheless, and it seems to be like SUAVE will compete with BRAID for what is going to finally be the long-term resolution for MEV mitigation. Max was even on Bankless twice in six weeks attempting to shift the Ethereum mindshare (and it seems to be working – not less than on the “Are L2s extracting?” dialogue).

There’s additionally been different criticism of BRAID, which is geared toward its thought of a leaderless scheme for consensus. In such a system, there needs to be some allowance for latency, in order that proposers can obtain some extent of simultaneous launch. A brief period would result in missed slots and potential liveness failures. However longer ones would expose the last-look drawback, the place brokers can delay in an effort to view the blocks launched by different proposers and doubtlessly grief them.

If carried out, BRAID would upend the MEV provide chain. There would nonetheless be leakage however not a transparent actor within the system who may exploit it. This might imply extra redistribution primarily based on aggressive dynamics relatively than goodwill.

MEV has confirmed such a vexing (and attention-grabbing!) drawback to resolve, we frequently overlook why it’s so damaging to person welfare within the first place. Customers now worry transacting onchain due to the predatory habits of MEV. Certainly, if you need to belief somebody, why not go for CEXes? They’re extra pleasant than the creatures of the darkish forest. That sentiment is not going to change in a single day, however the work being achieved now offers software builders the instruments and infrastructure to make MEV invisible with out new centralization dangers.

This might be an enormous step ahead, however would it not finally repair the issue of personal order move?

In all probability not. However it should repair unique order move the place entrenched builders buy move and additional cement their builder monopoly. As an alternative, with out a centralized builder market, the issue of personal order move turns into a query of finest execution for software builders.

With credible infrastructure to run auctions that can’t be censored by block builders, purposes and different transaction originators will probably be extra answerable for their MEV provide chain. This implies they’ll should turn out to be more proficient at bundling transactions or outsourcing to 3rd celebration builders who do. The function of tightly packing blocks will nonetheless be wanted however achieved by distinct actors at completely different elements of the availability chain.

-

USDS and SKY launch on Ethereum, finishing MakerDAO rebrand Hyperlink

-

Centrifuge launches new institutional RWA Morpho market on Base Hyperlink

-

Visa releases new dashboard on stablecoin utilization Hyperlink

-

Home lawmakers conflict at DeFi’s first congressional listening to Hyperlink

-

Coinbase’s cbBTC reaches $120m one week after launch Hyperlink

-

SAFE proposes native swap charge Hyperlink

-

Doppler, a liquidity-bootstrapping hook design on high of Uniswap v4 Hyperlink

-

Atlas, a high-performant DeFi Ethereum L2 primarily based on SVM, launches testnet Hyperlink

-

ZKsync pronounces onchain governance system Hyperlink

That’s it! Suggestions appreciated. Simply hit reply. Nice to be again after a restful summer season!

Dose of DeFi is written by Chris Powers, with assist from Denis Suslov, Zhev and Monetary Content material Lab.