Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ondo Finance is buying and selling at a pivotal second because the broader crypto market exhibits indicators of potential restoration. Whereas bullish sentiment is slowly constructing, macroeconomic uncertainty and escalating world commerce conflict fears proceed to inject volatility into monetary markets. For ONDO, nonetheless, analysts are carefully looking forward to a breakout that might sign the beginning of a brand new uptrend.

Associated Studying

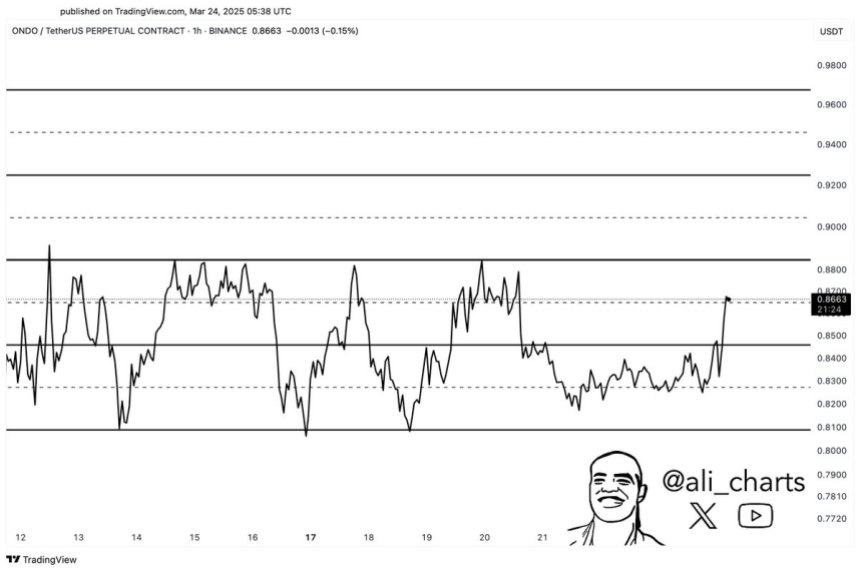

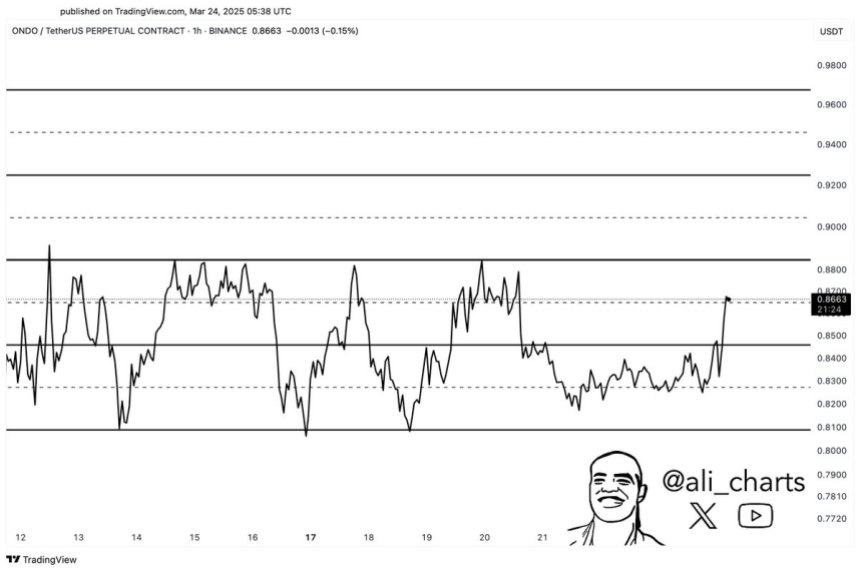

Prime crypto analyst Ali Martinez shared a technical outlook on X, highlighting that ONDO is at the moment buying and selling inside a slim parallel channel. In response to Martinez, a break above the higher boundary of this channel at $0.89 might set off bullish momentum, doubtlessly pushing ONDO into larger costs.

With ONDO already capturing consideration as a frontrunner within the real-world asset (RWA) sector, this technical setup might play a significant function in setting the tone for the asset’s short-term path. As traders carefully monitor world financial developments and market sentiment, a confirmed breakout above the $0.89 resistance might solidify ONDO’s place as one of many stronger performers within the coming weeks.

ONDO Prepares For Breakout As Market Eyes RWA

Ondo Finance has emerged as some of the distinguished real-world asset (RWA) tasks within the crypto area, securing strategic partnerships with main gamers like Ripple and World Liberty Monetary. These alliances have helped place ONDO on the forefront of tokenized finance, fueling optimism amongst traders who anticipated sturdy efficiency all through 2024.

Associated Studying

Nonetheless, ONDO’s worth motion has did not match the keenness. Since mid-December, ONDO has misplaced over 65% of its worth, tumbling from native highs and creating an setting of worry and uncertainty. Many long-term holders stay cautious, particularly with macroeconomic volatility and ongoing commerce conflict considerations dragging down market sentiment.

Regardless of the sharp correction, analysts are starting to identify indicators of a possible turnaround. Martinez’s technical evaluation reveals that ONDO is at the moment buying and selling inside a slim parallel channel—a sample that usually precedes vital worth actions. In response to Martinez, a breakout above the channel’s higher boundary at $0.89 might set off bullish momentum and result in a fast rally towards the $1 mark.

If ONDO can reclaim larger resistance ranges and maintain upward motion, it might reinforce its place as a frontrunner within the RWA narrative. The approaching days might be essential for ONDO as bulls try and flip the pattern and capitalize on the momentum constructing beneath the floor.

Value Holds Close to Resistance As Bulls Eye $1.08 Breakout

ONDO is at the moment buying and selling round $0.88 after a number of days of sideways consolidation just under the $0.90 resistance stage. This slim worth motion displays rising indecision available in the market as bulls try and regain momentum after weeks of heavy promoting stress. Whereas the general pattern stays cautious, ONDO’s proximity to key technical ranges has caught the eye of merchants looking forward to a breakout.

To verify a sustainable restoration, ONDO should break and maintain above $0.90 and push towards the 200-day shifting common (MA) and exponential shifting common (EMA), each sitting close to the $1.08 mark. Reclaiming these indicators would sign a shift in momentum and supply sturdy affirmation of an uptrend forming. A profitable transfer above $1.08 might open the door for a bigger rally as confidence within the RWA narrative strengthens.

Associated Studying

Nonetheless, if bulls fail to interrupt above $0.90 within the coming classes, ONDO dangers falling again into decrease assist zones. Continued rejection at this stage could set off a retest of earlier demand round $0.80 or decrease, doubtlessly extending the consolidation part. For now, ONDO stays on the sting of a breakout or deeper retrace, with the subsequent transfer seemingly defining short-term path.

Featured picture from Dall-E, chart from TradingView

Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ondo Finance is buying and selling at a pivotal second because the broader crypto market exhibits indicators of potential restoration. Whereas bullish sentiment is slowly constructing, macroeconomic uncertainty and escalating world commerce conflict fears proceed to inject volatility into monetary markets. For ONDO, nonetheless, analysts are carefully looking forward to a breakout that might sign the beginning of a brand new uptrend.

Associated Studying

Prime crypto analyst Ali Martinez shared a technical outlook on X, highlighting that ONDO is at the moment buying and selling inside a slim parallel channel. In response to Martinez, a break above the higher boundary of this channel at $0.89 might set off bullish momentum, doubtlessly pushing ONDO into larger costs.

With ONDO already capturing consideration as a frontrunner within the real-world asset (RWA) sector, this technical setup might play a significant function in setting the tone for the asset’s short-term path. As traders carefully monitor world financial developments and market sentiment, a confirmed breakout above the $0.89 resistance might solidify ONDO’s place as one of many stronger performers within the coming weeks.

ONDO Prepares For Breakout As Market Eyes RWA

Ondo Finance has emerged as some of the distinguished real-world asset (RWA) tasks within the crypto area, securing strategic partnerships with main gamers like Ripple and World Liberty Monetary. These alliances have helped place ONDO on the forefront of tokenized finance, fueling optimism amongst traders who anticipated sturdy efficiency all through 2024.

Associated Studying

Nonetheless, ONDO’s worth motion has did not match the keenness. Since mid-December, ONDO has misplaced over 65% of its worth, tumbling from native highs and creating an setting of worry and uncertainty. Many long-term holders stay cautious, particularly with macroeconomic volatility and ongoing commerce conflict considerations dragging down market sentiment.

Regardless of the sharp correction, analysts are starting to identify indicators of a possible turnaround. Martinez’s technical evaluation reveals that ONDO is at the moment buying and selling inside a slim parallel channel—a sample that usually precedes vital worth actions. In response to Martinez, a breakout above the channel’s higher boundary at $0.89 might set off bullish momentum and result in a fast rally towards the $1 mark.

If ONDO can reclaim larger resistance ranges and maintain upward motion, it might reinforce its place as a frontrunner within the RWA narrative. The approaching days might be essential for ONDO as bulls try and flip the pattern and capitalize on the momentum constructing beneath the floor.

Value Holds Close to Resistance As Bulls Eye $1.08 Breakout

ONDO is at the moment buying and selling round $0.88 after a number of days of sideways consolidation just under the $0.90 resistance stage. This slim worth motion displays rising indecision available in the market as bulls try and regain momentum after weeks of heavy promoting stress. Whereas the general pattern stays cautious, ONDO’s proximity to key technical ranges has caught the eye of merchants looking forward to a breakout.

To verify a sustainable restoration, ONDO should break and maintain above $0.90 and push towards the 200-day shifting common (MA) and exponential shifting common (EMA), each sitting close to the $1.08 mark. Reclaiming these indicators would sign a shift in momentum and supply sturdy affirmation of an uptrend forming. A profitable transfer above $1.08 might open the door for a bigger rally as confidence within the RWA narrative strengthens.

Associated Studying

Nonetheless, if bulls fail to interrupt above $0.90 within the coming classes, ONDO dangers falling again into decrease assist zones. Continued rejection at this stage could set off a retest of earlier demand round $0.80 or decrease, doubtlessly extending the consolidation part. For now, ONDO stays on the sting of a breakout or deeper retrace, with the subsequent transfer seemingly defining short-term path.

Featured picture from Dall-E, chart from TradingView