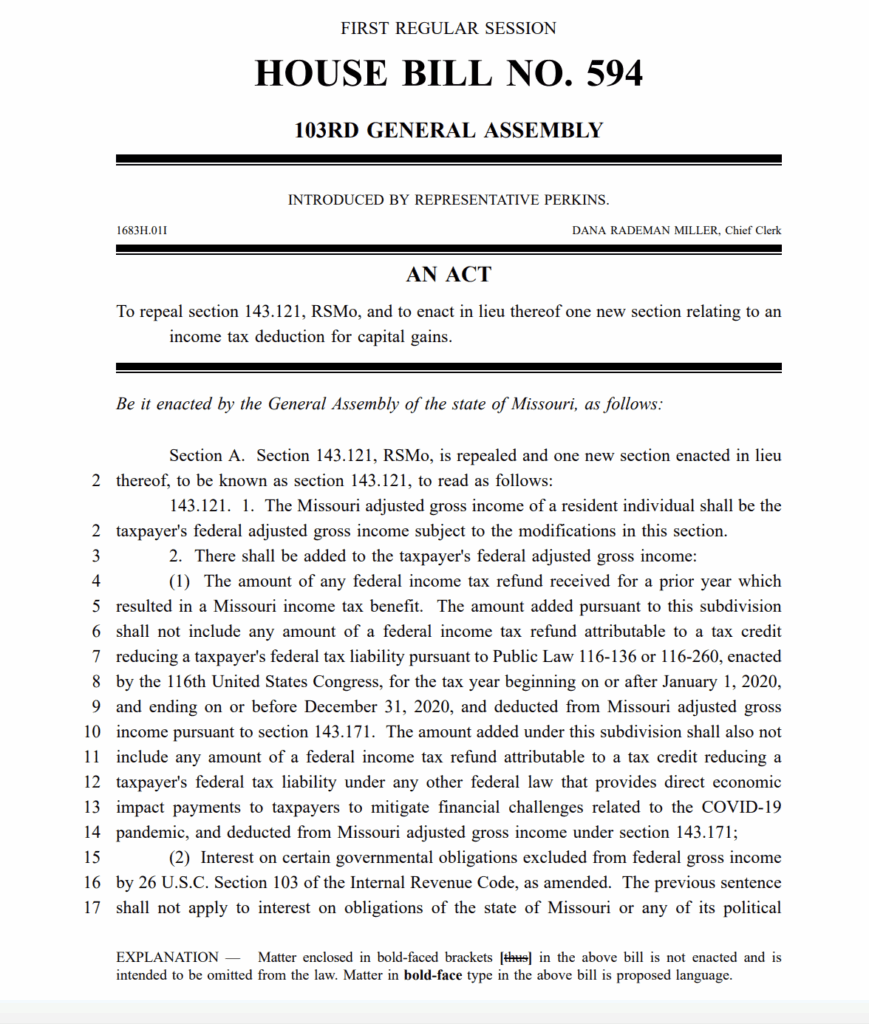

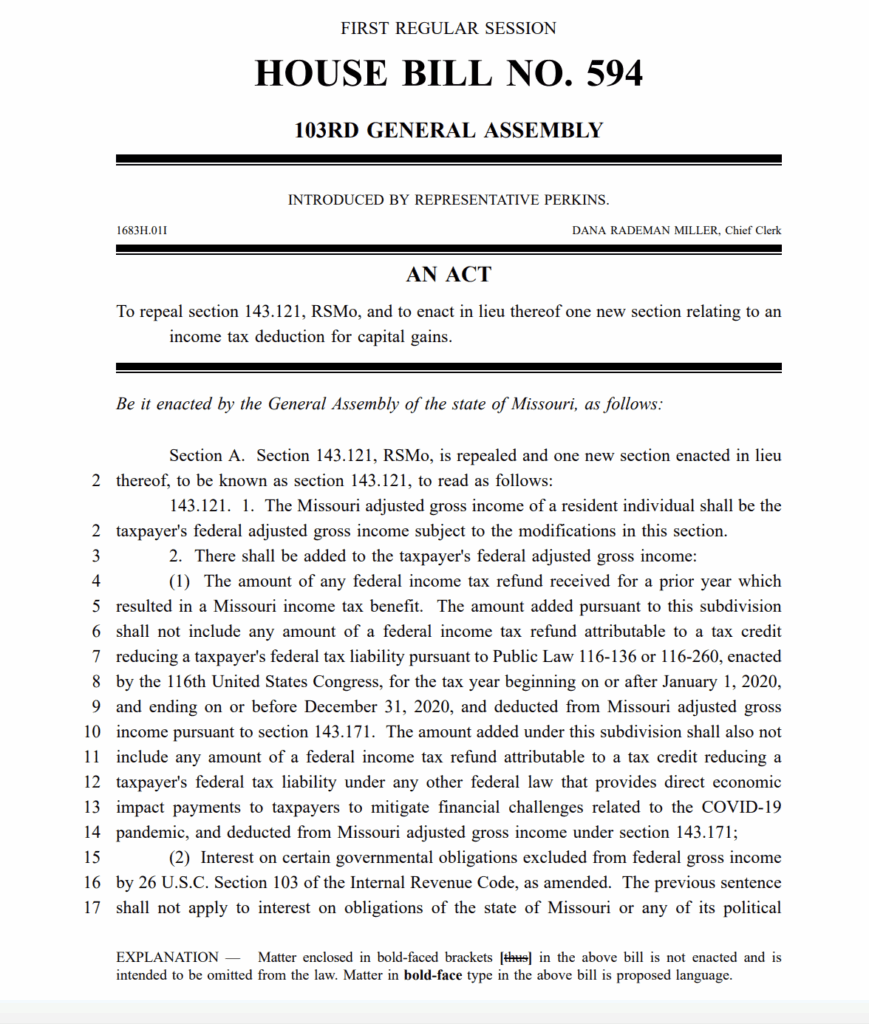

Missouri’s Home Invoice 594 (HB594), which might eradicate capital good points taxes for residents within the state, not too long ago handed a vote within the state’s Home of Representatives and now awaits a signature from Missouri’s governor, Mike Kehoe (R).

If the invoice passes, Missourians can write off “a hundred percent of all revenue reported as a capital achieve for federal revenue tax functions,” based on the language within the invoice. Because of this residents of Missouri wouldn’t should pay a capital good points tax once they spend (or promote) their bitcoin.

This invoice differs from a invoice not too long ago launched in Rhode Island that may allow the state’s residents to spend as much as $10,000 monthly in bitcoin with out incurring a capital good points tax on the state degree whereas nonetheless paying it on the federal degree in that it stipulates that the adjusted gross revenue for Missourians beneath this invoice would alter their federal gross revenue.

The language within the invoice reads as follows: “The Missouri adjusted gross revenue of a resident particular person shall be the taxpayer’s federal adjusted gross revenue topic to the modifications within the [bill].”

It’s unclear as as to if Governor Kehoe will signal the invoice or not, as, if it have been to be enacted, it will cut back the state’s income by nearly $300 million per 12 months at a time when public colleges in Missouri are underfunded and Governor Kehoe has acknowledged that public colleges are underperforming.

With that mentioned, different Republicans (Gov. Kehoe is a Republican) within the state have made the argument that enacting HB594 into regulation would gas financial progress within the state and supply tax aid for the typical Missourian.

HB594’s passing within the Missouri Home of Representatives comes within the wake of a broader push again on taxation inside america, as President Trump not too long ago shared on Fact Social that he’s contemplating eliminating revenue taxes on these making lower than $200,000 per 12 months as he implements tariffs to make up for the distinction in income.

If Governor Kehoe indicators the invoice into regulation, Missouri will turn out to be the primary state with revenue taxes to depart out earnings from capital good points in addition to a pleasant jurisdiction for Bitcoiners trying to spend their bitcoin with out having to pay taxes on the fiat good points they’ve made on it.

Missouri’s Home Invoice 594 (HB594), which might eradicate capital good points taxes for residents within the state, not too long ago handed a vote within the state’s Home of Representatives and now awaits a signature from Missouri’s governor, Mike Kehoe (R).

If the invoice passes, Missourians can write off “a hundred percent of all revenue reported as a capital achieve for federal revenue tax functions,” based on the language within the invoice. Because of this residents of Missouri wouldn’t should pay a capital good points tax once they spend (or promote) their bitcoin.

This invoice differs from a invoice not too long ago launched in Rhode Island that may allow the state’s residents to spend as much as $10,000 monthly in bitcoin with out incurring a capital good points tax on the state degree whereas nonetheless paying it on the federal degree in that it stipulates that the adjusted gross revenue for Missourians beneath this invoice would alter their federal gross revenue.

The language within the invoice reads as follows: “The Missouri adjusted gross revenue of a resident particular person shall be the taxpayer’s federal adjusted gross revenue topic to the modifications within the [bill].”

It’s unclear as as to if Governor Kehoe will signal the invoice or not, as, if it have been to be enacted, it will cut back the state’s income by nearly $300 million per 12 months at a time when public colleges in Missouri are underfunded and Governor Kehoe has acknowledged that public colleges are underperforming.

With that mentioned, different Republicans (Gov. Kehoe is a Republican) within the state have made the argument that enacting HB594 into regulation would gas financial progress within the state and supply tax aid for the typical Missourian.

HB594’s passing within the Missouri Home of Representatives comes within the wake of a broader push again on taxation inside america, as President Trump not too long ago shared on Fact Social that he’s contemplating eliminating revenue taxes on these making lower than $200,000 per 12 months as he implements tariffs to make up for the distinction in income.

If Governor Kehoe indicators the invoice into regulation, Missouri will turn out to be the primary state with revenue taxes to depart out earnings from capital good points in addition to a pleasant jurisdiction for Bitcoiners trying to spend their bitcoin with out having to pay taxes on the fiat good points they’ve made on it.