Bitcoin’s worth trajectory is as soon as once more capturing headlines, and this time the catalyst seems to be world liquidity traits reshaping investor sentiment. In a latest complete breakdown, Matt Crosby, Lead Analyst at Bitcoin Journal Professional, presents compelling proof tying the digital asset’s renewed bullish momentum to the increasing world M2 cash provide. His insights not solely illuminate the way forward for Bitcoin worth but additionally anchor its macroeconomic relevance in a broader monetary context.

Bitcoin Value and World Liquidity: A Excessive-Impression Correlation

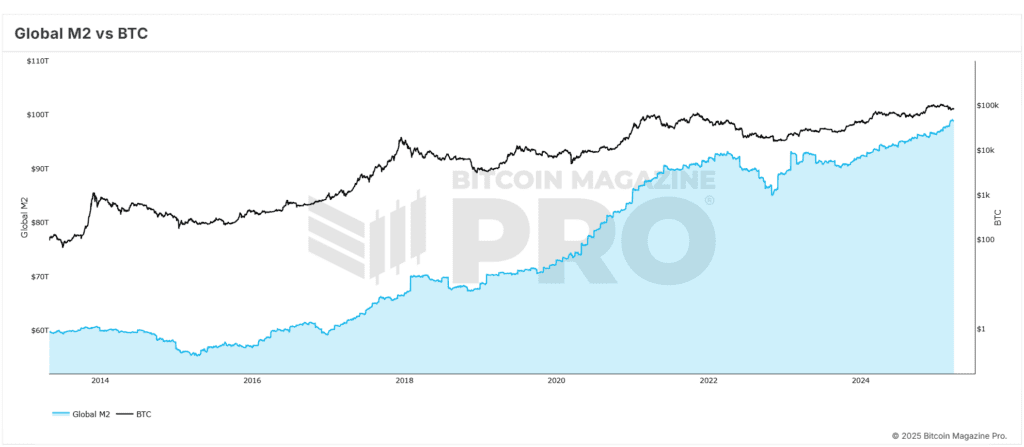

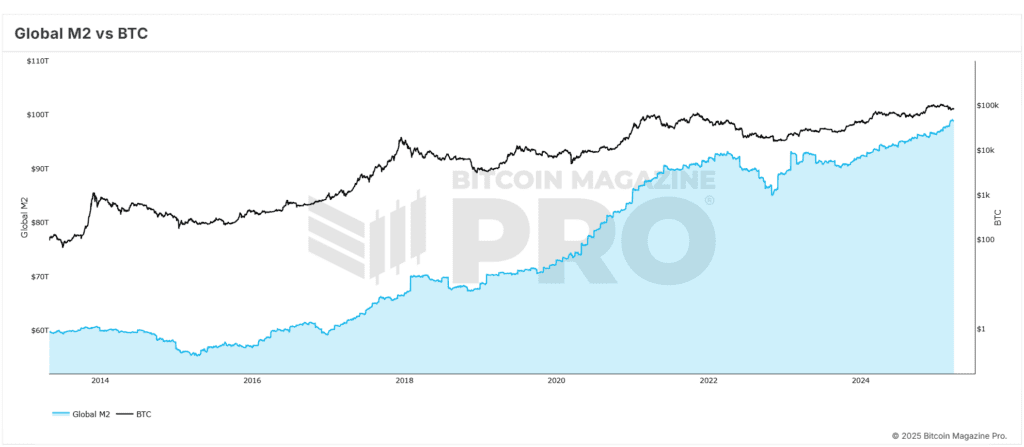

Crosby highlights a exceptional and constant correlation—usually exceeding 84%—between Bitcoin worth and world M2 liquidity ranges. As liquidity will increase throughout the worldwide economic system, Bitcoin worth sometimes responds with upward motion, though with a noticeable delay. Historic information helps the commentary of a 56–60 day lag between financial growth and Bitcoin worth will increase.

This perception has lately confirmed correct, as Bitcoin worth rebounded from lows of $75,000 to above $85,000. This pattern carefully aligns with the forecasted restoration that Crosby and his staff had outlined primarily based on macro indicators, validating the energy and reliability of the correlation driving Bitcoin worth upward.

Why the 2-Month Delay Impacts Bitcoin Value

The 2-month delay in market response is a important commentary for understanding Bitcoin worth actions. Crosby emphasizes that financial coverage and liquidity injections don’t instantly have an effect on speculative property like BTC. As a substitute, there’s an incubation interval, sometimes round two months, throughout which liquidity filters by means of monetary methods and begins to affect Bitcoin worth.

Crosby has optimized this correlation by means of varied backtests, adjusting timeframes and offsets. Their findings point out {that a} 60-day delay yields essentially the most predictive accuracy throughout each short-term (1-year) and prolonged (4-year) historic Bitcoin worth motion. This lag supplies a strategic benefit to buyers who monitor macro traits to anticipate Bitcoin worth surges.

S&P 500 and Its Affect on Bitcoin Value Developments

Including additional credibility to the thesis, Crosby extends his evaluation to conventional fairness markets. The S&P 500 displays an excellent stronger all-time correlation of roughly 92% with world liquidity. This correlation strengthens the argument that financial growth is a big driver not only for Bitcoin worth, but additionally for broader risk-on asset courses.

By evaluating liquidity traits with a number of indices, Crosby demonstrates that Bitcoin worth is just not an anomaly however a part of a broader systemic sample. When liquidity rises, equities and digital property alike have a tendency to profit, making M2 provide a necessary indicator for timing Bitcoin worth actions.

Forecasting Bitcoin Value to $108,000 by June 2025

To construct a forward-looking perspective, Crosby employs historic fractals from earlier bull markets to challenge future Bitcoin worth actions. When these patterns are overlaid with present macro information, the mannequin factors to a situation the place Bitcoin worth might retest and probably surpass its all-time highs, focusing on $108,000 by June 2025.

This optimistic projection for Bitcoin worth hinges on the belief that world liquidity continues its upward trajectory. The Federal Reserve’s latest statements recommend that additional financial stimulus may very well be deployed if market stability falters—one other tailwind for Bitcoin worth progress.

The Price of Enlargement Impacts Bitcoin Value

Whereas rising liquidity ranges are important, Crosby stresses the significance of monitoring the speed of liquidity growth to foretell Bitcoin worth traits. The year-on-year M2 progress charge gives a extra nuanced view of macroeconomic momentum. Though liquidity has typically elevated, the tempo of growth had slowed quickly earlier than resuming an upward pattern in latest months.

This pattern is strikingly much like situations noticed in early 2017, simply earlier than Bitcoin worth entered an exponential progress section. The parallels reinforce Crosby’s bullish outlook on Bitcoin worth and emphasize the significance of dynamic, quite than static, macro evaluation.

Last Ideas: Getting ready for the Subsequent Bitcoin Value Section

Whereas potential dangers resembling a world recession or a big fairness market correction persist, present macro indicators level towards a positive atmosphere for Bitcoin worth. Crosby’s data-driven strategy gives buyers a strategic lens to interpret and navigate the market.

For these seeking to make knowledgeable selections in a unstable atmosphere, these insights present actionable intelligence grounded in financial fundamentals to capitalize on Bitcoin worth alternatives.

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to a rising neighborhood of analysts, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. At all times do your individual analysis earlier than making any funding selections.

Bitcoin’s worth trajectory is as soon as once more capturing headlines, and this time the catalyst seems to be world liquidity traits reshaping investor sentiment. In a latest complete breakdown, Matt Crosby, Lead Analyst at Bitcoin Journal Professional, presents compelling proof tying the digital asset’s renewed bullish momentum to the increasing world M2 cash provide. His insights not solely illuminate the way forward for Bitcoin worth but additionally anchor its macroeconomic relevance in a broader monetary context.

Bitcoin Value and World Liquidity: A Excessive-Impression Correlation

Crosby highlights a exceptional and constant correlation—usually exceeding 84%—between Bitcoin worth and world M2 liquidity ranges. As liquidity will increase throughout the worldwide economic system, Bitcoin worth sometimes responds with upward motion, though with a noticeable delay. Historic information helps the commentary of a 56–60 day lag between financial growth and Bitcoin worth will increase.

This perception has lately confirmed correct, as Bitcoin worth rebounded from lows of $75,000 to above $85,000. This pattern carefully aligns with the forecasted restoration that Crosby and his staff had outlined primarily based on macro indicators, validating the energy and reliability of the correlation driving Bitcoin worth upward.

Why the 2-Month Delay Impacts Bitcoin Value

The 2-month delay in market response is a important commentary for understanding Bitcoin worth actions. Crosby emphasizes that financial coverage and liquidity injections don’t instantly have an effect on speculative property like BTC. As a substitute, there’s an incubation interval, sometimes round two months, throughout which liquidity filters by means of monetary methods and begins to affect Bitcoin worth.

Crosby has optimized this correlation by means of varied backtests, adjusting timeframes and offsets. Their findings point out {that a} 60-day delay yields essentially the most predictive accuracy throughout each short-term (1-year) and prolonged (4-year) historic Bitcoin worth motion. This lag supplies a strategic benefit to buyers who monitor macro traits to anticipate Bitcoin worth surges.

S&P 500 and Its Affect on Bitcoin Value Developments

Including additional credibility to the thesis, Crosby extends his evaluation to conventional fairness markets. The S&P 500 displays an excellent stronger all-time correlation of roughly 92% with world liquidity. This correlation strengthens the argument that financial growth is a big driver not only for Bitcoin worth, but additionally for broader risk-on asset courses.

By evaluating liquidity traits with a number of indices, Crosby demonstrates that Bitcoin worth is just not an anomaly however a part of a broader systemic sample. When liquidity rises, equities and digital property alike have a tendency to profit, making M2 provide a necessary indicator for timing Bitcoin worth actions.

Forecasting Bitcoin Value to $108,000 by June 2025

To construct a forward-looking perspective, Crosby employs historic fractals from earlier bull markets to challenge future Bitcoin worth actions. When these patterns are overlaid with present macro information, the mannequin factors to a situation the place Bitcoin worth might retest and probably surpass its all-time highs, focusing on $108,000 by June 2025.

This optimistic projection for Bitcoin worth hinges on the belief that world liquidity continues its upward trajectory. The Federal Reserve’s latest statements recommend that additional financial stimulus may very well be deployed if market stability falters—one other tailwind for Bitcoin worth progress.

The Price of Enlargement Impacts Bitcoin Value

Whereas rising liquidity ranges are important, Crosby stresses the significance of monitoring the speed of liquidity growth to foretell Bitcoin worth traits. The year-on-year M2 progress charge gives a extra nuanced view of macroeconomic momentum. Though liquidity has typically elevated, the tempo of growth had slowed quickly earlier than resuming an upward pattern in latest months.

This pattern is strikingly much like situations noticed in early 2017, simply earlier than Bitcoin worth entered an exponential progress section. The parallels reinforce Crosby’s bullish outlook on Bitcoin worth and emphasize the significance of dynamic, quite than static, macro evaluation.

Last Ideas: Getting ready for the Subsequent Bitcoin Value Section

Whereas potential dangers resembling a world recession or a big fairness market correction persist, present macro indicators level towards a positive atmosphere for Bitcoin worth. Crosby’s data-driven strategy gives buyers a strategic lens to interpret and navigate the market.

For these seeking to make knowledgeable selections in a unstable atmosphere, these insights present actionable intelligence grounded in financial fundamentals to capitalize on Bitcoin worth alternatives.

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to a rising neighborhood of analysts, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. At all times do your individual analysis earlier than making any funding selections.