Ethereum (ETH) has jumped virtually 20% over the previous two days because the broader decentralized finance (DeFi) sector rallied following Donald Trump’s presidential victory.

Ethereum Begins To Regain Momentum

The second-largest cryptocurrency by reported market cap has lagged behind Bitcoin (BTC) and different good contract platform tokens like Solana (SOL) for a lot of the 12 months.

Associated Studying

Nonetheless, following Trump’s win as Republican US presidential candidate, ETH has witnessed an increase of over 10% since yesterday. The token’s rise has introduced consideration to one in all Ethereum’s most progressive use instances up to now – DeFi.

In a long-form submit on X, Arthur Arthur Cheong & Eugene Yap from crypto funding agency DeFiance Capital famous that whole worth locked (TVL) in Ethereum-based DeFi protocols is rebounding.

Whereas the analysts credit score a few of this progress to greater crypto asset costs, additionally they spotlight that buying and selling volumes on some DeFi platforms have “almost recovered to 2022 ranges, proving the resurgence is actual.”

Cheong and Yap define a number of components that point out the DeFi ecosystem is heading towards the period of “DeFi renaissance.”

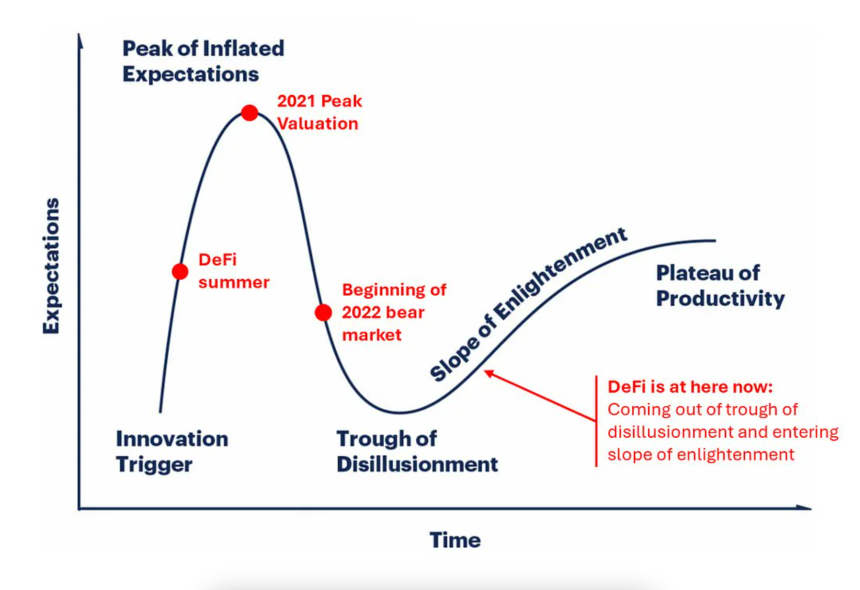

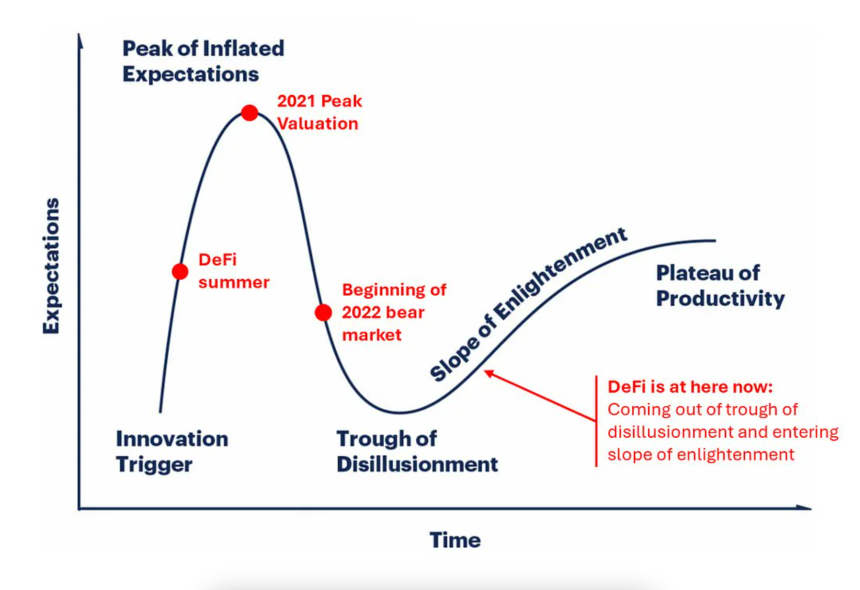

First, the analysts observe that DeFi seems to be rising from the “trough of disillusionment.” For the uninitiated, disillusionment is a section within the Gartner Hype Cycle when curiosity in a expertise wanes as preliminary expectations are unmet.

As proven within the chart under, DeFi is transferring by the “slope of enlightenment” section, possible headed for the “plateau of productiveness” because the expertise matures.

Moreover, macroeconomic components, together with a low interest-rate atmosphere, are anticipated to spice up DeFi adoption in two crucial methods: decreasing alternative prices and making loans extra inexpensive.

With treasury payments and conventional financial savings accounts providing minimal returns, buyers more and more flip to income-generating DeFi methods like yield farming, staking, and liquidity mining.

Decrease rates of interest are additionally more likely to enhance the provision of stablecoins by making loans cheaper, thereby offering further liquidity to drive DeFi progress.

How Is Trump Presidency Bullish For ETH?

The evaluation emphasizes that the 2024 US presidential elections can provide DeFi a lot required regulatory readability. Trump’s presidency is anticipated to convey extra favorable crypto rules, which may enhance investor confidence.

Associated Studying

Consequently, ETH is anticipated to learn from any enhance in investor curiosity in DeFi. Evaluation by crypto consultants suggests that ETH may rise to $3,400 if it clears sure key resistance ranges.

There has additionally been a big enhance in Ethereum whale exercise, indicating that refined and seasoned ETH holders are accumulating the token in anticipation of a possible rally.

ETH faces stiff competitors from rival good contract platforms comparable to Solana. In keeping with a current report, the SOL DeFi ecosystem noticed its TVL enhance to $5.7 billion in Q3 2024.

At press time, ETH trades at $2,806, up 7.1% prior to now 24 hours, with a complete market cap of $338.6 billion.

Featured picture from Unsplash, Charts from X.com and Tradingview.com

Ethereum (ETH) has jumped virtually 20% over the previous two days because the broader decentralized finance (DeFi) sector rallied following Donald Trump’s presidential victory.

Ethereum Begins To Regain Momentum

The second-largest cryptocurrency by reported market cap has lagged behind Bitcoin (BTC) and different good contract platform tokens like Solana (SOL) for a lot of the 12 months.

Associated Studying

Nonetheless, following Trump’s win as Republican US presidential candidate, ETH has witnessed an increase of over 10% since yesterday. The token’s rise has introduced consideration to one in all Ethereum’s most progressive use instances up to now – DeFi.

In a long-form submit on X, Arthur Arthur Cheong & Eugene Yap from crypto funding agency DeFiance Capital famous that whole worth locked (TVL) in Ethereum-based DeFi protocols is rebounding.

Whereas the analysts credit score a few of this progress to greater crypto asset costs, additionally they spotlight that buying and selling volumes on some DeFi platforms have “almost recovered to 2022 ranges, proving the resurgence is actual.”

Cheong and Yap define a number of components that point out the DeFi ecosystem is heading towards the period of “DeFi renaissance.”

First, the analysts observe that DeFi seems to be rising from the “trough of disillusionment.” For the uninitiated, disillusionment is a section within the Gartner Hype Cycle when curiosity in a expertise wanes as preliminary expectations are unmet.

As proven within the chart under, DeFi is transferring by the “slope of enlightenment” section, possible headed for the “plateau of productiveness” because the expertise matures.

Moreover, macroeconomic components, together with a low interest-rate atmosphere, are anticipated to spice up DeFi adoption in two crucial methods: decreasing alternative prices and making loans extra inexpensive.

With treasury payments and conventional financial savings accounts providing minimal returns, buyers more and more flip to income-generating DeFi methods like yield farming, staking, and liquidity mining.

Decrease rates of interest are additionally more likely to enhance the provision of stablecoins by making loans cheaper, thereby offering further liquidity to drive DeFi progress.

How Is Trump Presidency Bullish For ETH?

The evaluation emphasizes that the 2024 US presidential elections can provide DeFi a lot required regulatory readability. Trump’s presidency is anticipated to convey extra favorable crypto rules, which may enhance investor confidence.

Associated Studying

Consequently, ETH is anticipated to learn from any enhance in investor curiosity in DeFi. Evaluation by crypto consultants suggests that ETH may rise to $3,400 if it clears sure key resistance ranges.

There has additionally been a big enhance in Ethereum whale exercise, indicating that refined and seasoned ETH holders are accumulating the token in anticipation of a possible rally.

ETH faces stiff competitors from rival good contract platforms comparable to Solana. In keeping with a current report, the SOL DeFi ecosystem noticed its TVL enhance to $5.7 billion in Q3 2024.

At press time, ETH trades at $2,806, up 7.1% prior to now 24 hours, with a complete market cap of $338.6 billion.

Featured picture from Unsplash, Charts from X.com and Tradingview.com