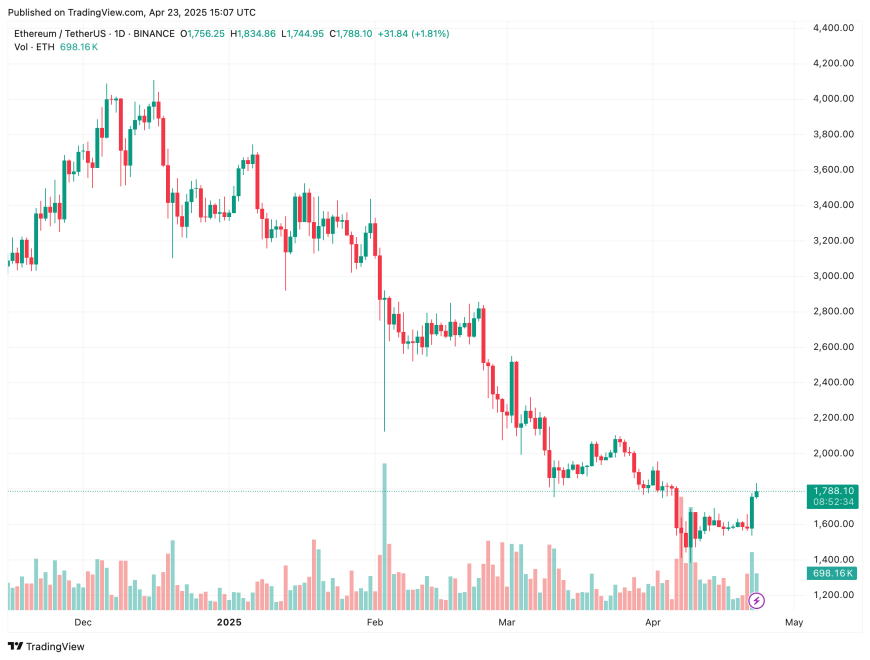

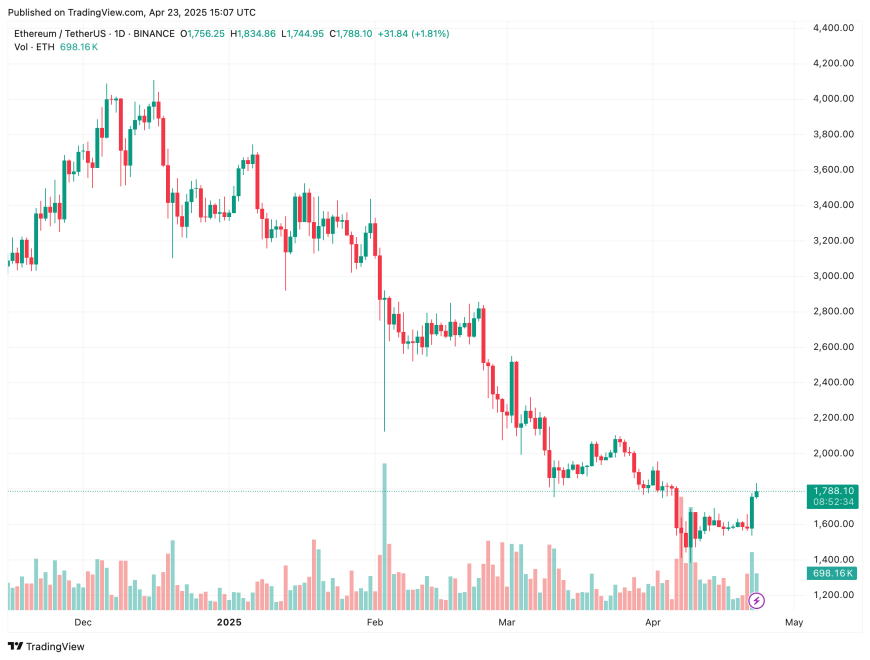

Ethereum (ETH) is starting to point out indicators of a possible bullish reversal, with the second-largest cryptocurrency by market cap climbing 9.1% prior to now 24 hours. Alongside the value surge, Ethereum’s community exercise has seen a notable uptick.

Ethereum Community Exercise Explodes Amid Value Rally

In accordance with a current CryptoQuant Quicktake publish by analyst Carmelo_Aleman, Ethereum’s lively addresses have surged considerably over the previous few days. Between April 20 and April 22, ETH lively addresses jumped from 306,211 to 336,366 – a rise of 9.85% in simply 48 hours.

The analyst notes that such a pointy rise in lively addresses factors to elevated on-chain exercise. Nevertheless, they warning in opposition to analyzing this metric in isolation, emphasizing the necessity to additionally monitor different metrics corresponding to change quantity, transaction depend, and gasoline charges for a fuller image.

Newest information from Ycharts signifies that Ethereum transactions per day have witnessed a major spike over the previous few days. Particularly, the variety of transactions has climbed from 1.042 million on April 19, to 1.293 million on April 22.

Moreover, DefiLlama studies a major rise in Whole Worth Locked (TVL) throughout the Ethereum decentralized finance (DeFi) ecosystem. Notably, TVL climbed from $46.28 billion on April 19, to $49.99 billion on the time of writing.

Regardless of the current progress, TVL stays properly under the December 2024 excessive of roughly $76 billion. Buying and selling quantity on ETH-based decentralized exchanges (DEX) has additionally surged, leaping from $932 million on April 20, to $2.44 billion at this time.

Past bullish on-chain metrics, technical indicators are additionally pointing to a possible reversal. In a current publish on X, crypto analyst Titan of Crypto highlighted that ETH has damaged out of a falling wedge sample on the each day chart – a classically bullish sign.

Moreover, Ethereum’s Relative Energy Index (RSI) has damaged out of a long-term downtrend. The RSI is at present hovering round 50, suggesting there’s important room for upward momentum if the value follows go well with.

Some Warning Indicators For ETH

Regardless of enhancing sentiment, the Ethereum Concern & Greed Index is flashing a studying of 64 – indicating that ETH is perhaps getting into overbought territory at its present worth stage.

Moreover, ETH might face sturdy resistance across the $2,300 mark if the present bullish momentum continues. At press time, ETH is buying and selling at $1,788, up 9.1% over the previous 24 hours.

Featured Picture from Unsplash.com, charts from CryptoQuant, X, and TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

Ethereum (ETH) is starting to point out indicators of a possible bullish reversal, with the second-largest cryptocurrency by market cap climbing 9.1% prior to now 24 hours. Alongside the value surge, Ethereum’s community exercise has seen a notable uptick.

Ethereum Community Exercise Explodes Amid Value Rally

In accordance with a current CryptoQuant Quicktake publish by analyst Carmelo_Aleman, Ethereum’s lively addresses have surged considerably over the previous few days. Between April 20 and April 22, ETH lively addresses jumped from 306,211 to 336,366 – a rise of 9.85% in simply 48 hours.

The analyst notes that such a pointy rise in lively addresses factors to elevated on-chain exercise. Nevertheless, they warning in opposition to analyzing this metric in isolation, emphasizing the necessity to additionally monitor different metrics corresponding to change quantity, transaction depend, and gasoline charges for a fuller image.

Newest information from Ycharts signifies that Ethereum transactions per day have witnessed a major spike over the previous few days. Particularly, the variety of transactions has climbed from 1.042 million on April 19, to 1.293 million on April 22.

Moreover, DefiLlama studies a major rise in Whole Worth Locked (TVL) throughout the Ethereum decentralized finance (DeFi) ecosystem. Notably, TVL climbed from $46.28 billion on April 19, to $49.99 billion on the time of writing.

Regardless of the current progress, TVL stays properly under the December 2024 excessive of roughly $76 billion. Buying and selling quantity on ETH-based decentralized exchanges (DEX) has additionally surged, leaping from $932 million on April 20, to $2.44 billion at this time.

Past bullish on-chain metrics, technical indicators are additionally pointing to a possible reversal. In a current publish on X, crypto analyst Titan of Crypto highlighted that ETH has damaged out of a falling wedge sample on the each day chart – a classically bullish sign.

Moreover, Ethereum’s Relative Energy Index (RSI) has damaged out of a long-term downtrend. The RSI is at present hovering round 50, suggesting there’s important room for upward momentum if the value follows go well with.

Some Warning Indicators For ETH

Regardless of enhancing sentiment, the Ethereum Concern & Greed Index is flashing a studying of 64 – indicating that ETH is perhaps getting into overbought territory at its present worth stage.

Moreover, ETH might face sturdy resistance across the $2,300 mark if the present bullish momentum continues. At press time, ETH is buying and selling at $1,788, up 9.1% over the previous 24 hours.

Featured Picture from Unsplash.com, charts from CryptoQuant, X, and TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.