The introduction of BitVM good contracts has marked a big milestone within the path for scalability and programmability of Bitcoin. Rooted within the authentic BitVM protocol, Bitlayer’s Finality Bridge introduces the primary model of the protocol dwell on testnet, which is an effective start line for realizing the guarantees of the Bitcoin Renaissance or “Season 2”.

In contrast to earlier BTC bridges that usually required reliance on centralized entities or questionable belief assumptions, the Finality Bridge leverages a mix of BitVM good contracts, fraud proofs, and zero-knowledge proofs. This mixture not solely enhances safety but in addition considerably reduces the necessity for belief in third events. We’re not on the trustless degree that Lightning supplies, however this can be a million instances higher than present sidechains designs claiming to be Bitcoin Layers 2s (along with considerably rising the design area for Bitcoin purposes).

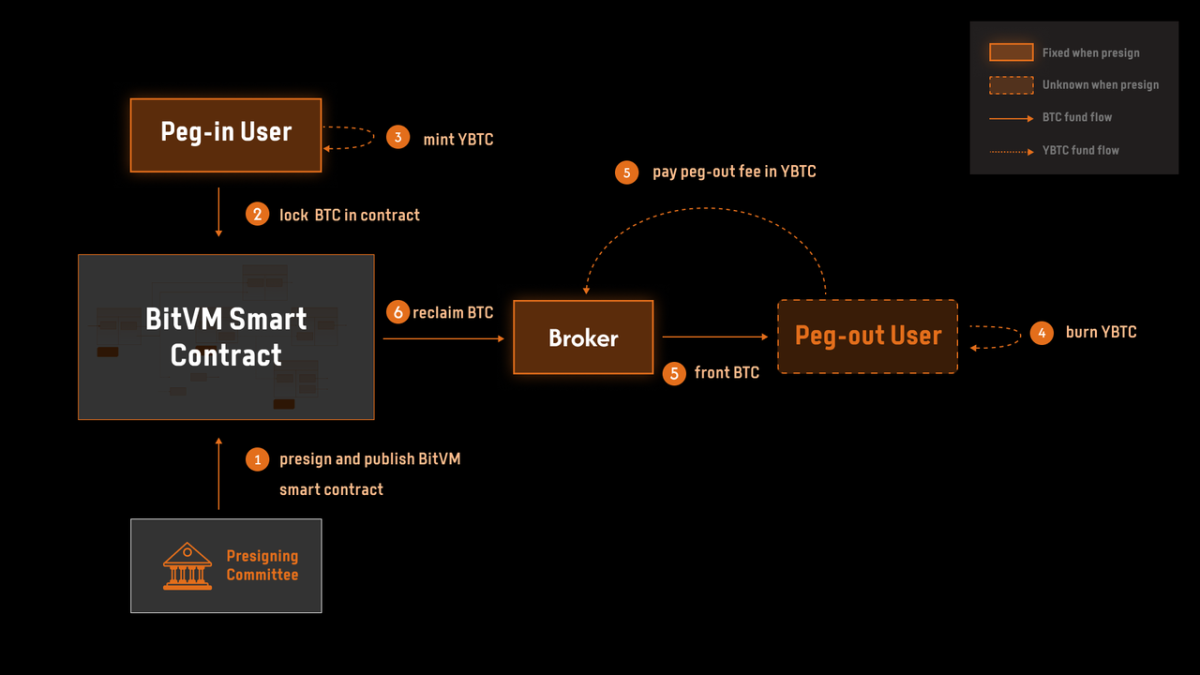

The system operates on a precept the place funds are securely locked in addresses ruled by a BitVM good contract, functioning beneath the premise that no less than one participant within the system will act truthfully. This setup inherently reduces the belief necessities however has to introduce further complexities that Bitlayer goals to handle with this model of the bridge.

The Mechanics of Belief

In sensible phrases, when Bitcoin is locked into the BitVM good contract by means of the Finality Bridge, customers are issued YBTC – a token that maintains a strict 1:1 peg with Bitcoin. This peg is not only a promise however is enforced by the underlying good contract logic, guaranteeing that every YBTC represents an actual, locked Bitcoin on the primary chain (no faux “restacked” BTC metrics). This mechanism permits customers to take part in DeFi actions like lending, borrowing, and yield farming throughout the Bitlayer ecosystem with out compromising on the safety and settlement assurances that Bitcoin supplies.

Whereas some locally may discover these actions objectionable, the sort of structure permits customers to get some ensures that they beforehand couldn’t hope to get with conventional sidechain designs, with the added bonus that we don’t have to “change” Bitcoin to make it occur (though covenants would make this bridge design utterly “trust-minimized, which might successfully make it a “True” Bitcoin Layer 2). For extra particulars in regards to the completely different ranges of dangers related to sidechains designs, check out Bitcoin Layers evaluation of Bitlayer right here.

Nevertheless, till such developments come to fruition, the Bitlayer Finality Bridge serves as the very best realization of the BitVM 2 paradigm. It is a testomony to what’s potential after the dev “mind drain” from centralized chains again to Bitcoin. Regardless of all of the challenges that BitVM chains will face, I stay exceptionally excited on the prospect of Bitcoin fulfilling its future because the Final Settlement Chain for all financial exercise.

This text is a Take. Opinions expressed are totally the writer’s and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

Guillaume’s articles specifically could talk about matters or firms which are a part of his agency’s funding portfolio (UTXO Administration). The views expressed are solely his personal and don’t characterize the opinions of his employer or its associates. He’s receiving no monetary compensation for these Takes. Readers shouldn’t contemplate this content material as monetary recommendation or an endorsement of any specific firm or funding. At all times do your individual analysis earlier than making monetary choices.