Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin is wrapping up the week with power, buying and selling above the $105,000 mark after a pointy rally that pushed costs to a brand new all-time excessive close to $112,000. The transfer reignited bullish momentum throughout the market, with merchants and analysts now turning their focus to what may very well be the subsequent part of this cycle.

Associated Studying

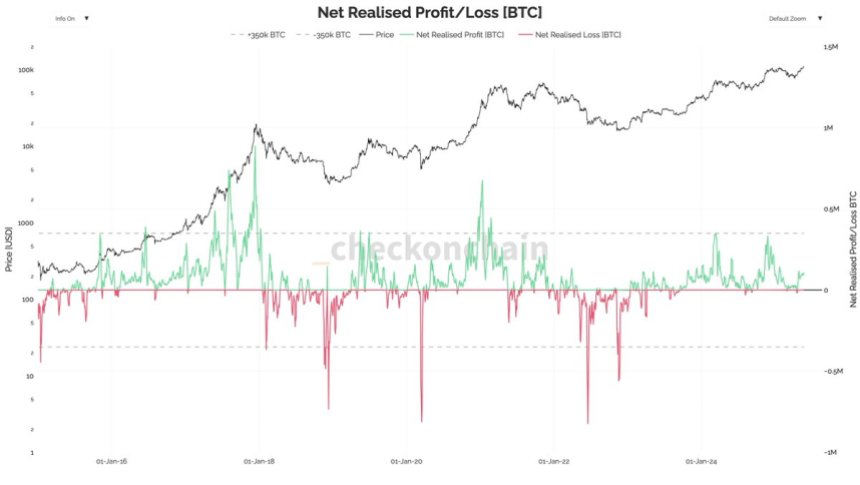

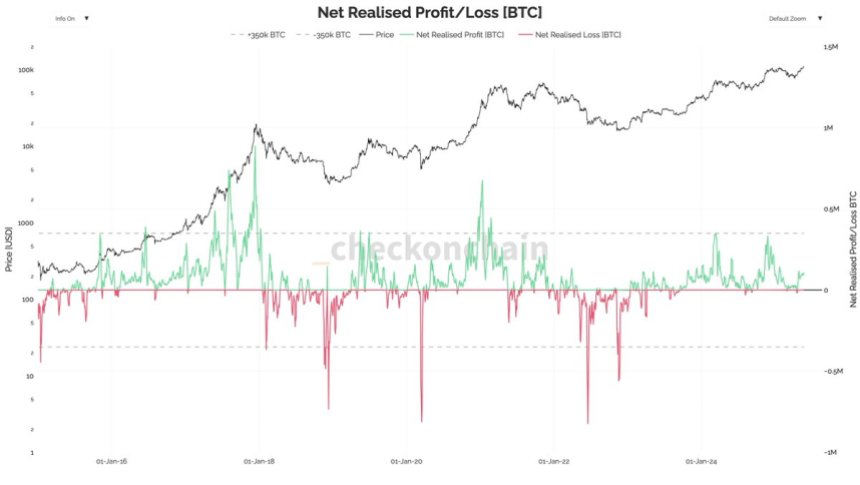

Regardless of the aggressive push greater, on-chain information suggests the market stays wholesome. High analyst Darkfost highlighted that internet realized income are nonetheless inside regular ranges for a bull run. In line with his evaluation, profit-taking shouldn’t be an indication of weak spot—it’s a crucial a part of market construction throughout uptrends. “That is what retains traders engaged and prevents parabolic exhaustion,” he famous.

The latest value motion factors to a possible shift in market dynamics, as Bitcoin breaks out of its post-halving consolidation part. With weekly help forming above $105K and realized revenue metrics staying in test, bulls are eyeing greater ranges. If this momentum holds, the $112K rejection might solely be a short-term hurdle. As at all times, volatility stays in play—however this week’s shut sends a robust sign: the bull market construction continues to be intact.

Bitcoin Has Room To Develop As It Prepares For Historic Weekly Shut

Bitcoin is on monitor to report its highest weekly shut in historical past, signaling rising power because it prepares for what many imagine may very well be the subsequent main bullish part. After surging to a brand new all-time excessive close to $112,000 earlier this week, BTC is now stabilizing above the $105,000 degree—positioning itself above key short-term help going into subsequent week.

Nonetheless, whereas value motion paints a bullish image, macroeconomic circumstances proceed to pose dangers. Excessive rates of interest, tightening monetary circumstances, and broader market uncertainty stay main elements. Traders are cautiously optimistic, however volatility may shortly return if international threat sentiment deteriorates.

On-chain information affords a extra grounded view of the present cycle. In line with Darkfost, CryptoQuant information exhibits that realized income at the moment stand at 104,000 BTC, or round $11 billion. Whereas that quantity could appear giant, it’s nonetheless effectively under the historic hazard zone of 350,000 BTC—a degree that usually alerts euphoric circumstances or overheating.

This implies the market stays in a wholesome profit-taking zone. “Revenue-taking shouldn’t be a purple flag throughout a bull market,” Darkfost famous. “It’s crucial. It helps keep momentum and retains contributors engaged.”

The approaching week will probably be essential. A confirmed weekly shut above $105K may solidify this degree as new help and set the stage for additional upside. But when bulls fail to carry floor, the rally dangers dropping steam. For now, Bitcoin seems sturdy, however the market is coming into a zone the place conviction will probably be examined.

Associated Studying

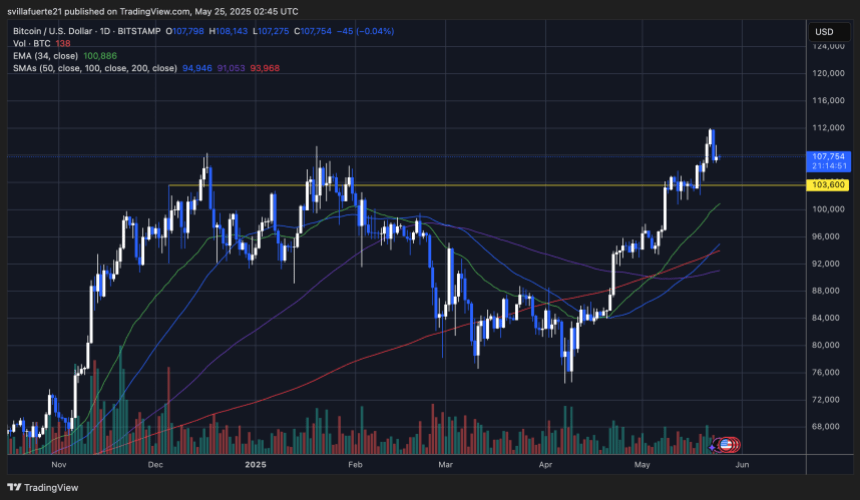

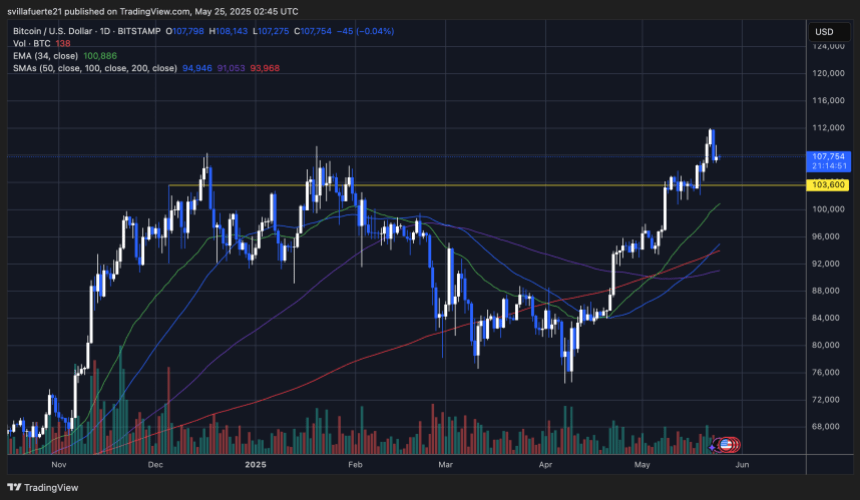

BTC Holds Key Assist After Rejection From New ATH

Bitcoin is at the moment buying and selling round $107,750 after a risky week that noticed costs hit a brand new all-time excessive close to $112,000. The every day chart exhibits BTC pulling again from overbought circumstances however holding firmly above the 34-day EMA at $100,886—a degree that has persistently acted as dynamic help throughout this uptrend.

Worth stays effectively above the 50, 100, and 200-day SMAs, confirming a robust bullish construction. The important thing horizontal help at $103,600—now reclaimed—is one other essential zone. This degree beforehand acted as a resistance ceiling in the course of the March-April vary and now serves as a possible launchpad if BTC consolidates above it.

Quantity seems to be declining barely on the pullback, which can counsel this can be a wholesome retrace quite than a reversal. So long as Bitcoin maintains above the $103,600–$105,000 zone, bulls stay in management. A deeper correction would discover preliminary help across the 34 EMA after which the 100 SMA close to $91,000.

Associated Studying

For now, the bullish pattern stays intact. Nonetheless, rejection at $112K and slowing momentum name for warning. A weekly shut above $105K would verify power, whereas a break under $103K may set off short-term weak spot.

Featured picture from Dall-E, chart from TradingView

Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin is wrapping up the week with power, buying and selling above the $105,000 mark after a pointy rally that pushed costs to a brand new all-time excessive close to $112,000. The transfer reignited bullish momentum throughout the market, with merchants and analysts now turning their focus to what may very well be the subsequent part of this cycle.

Associated Studying

Regardless of the aggressive push greater, on-chain information suggests the market stays wholesome. High analyst Darkfost highlighted that internet realized income are nonetheless inside regular ranges for a bull run. In line with his evaluation, profit-taking shouldn’t be an indication of weak spot—it’s a crucial a part of market construction throughout uptrends. “That is what retains traders engaged and prevents parabolic exhaustion,” he famous.

The latest value motion factors to a possible shift in market dynamics, as Bitcoin breaks out of its post-halving consolidation part. With weekly help forming above $105K and realized revenue metrics staying in test, bulls are eyeing greater ranges. If this momentum holds, the $112K rejection might solely be a short-term hurdle. As at all times, volatility stays in play—however this week’s shut sends a robust sign: the bull market construction continues to be intact.

Bitcoin Has Room To Develop As It Prepares For Historic Weekly Shut

Bitcoin is on monitor to report its highest weekly shut in historical past, signaling rising power because it prepares for what many imagine may very well be the subsequent main bullish part. After surging to a brand new all-time excessive close to $112,000 earlier this week, BTC is now stabilizing above the $105,000 degree—positioning itself above key short-term help going into subsequent week.

Nonetheless, whereas value motion paints a bullish image, macroeconomic circumstances proceed to pose dangers. Excessive rates of interest, tightening monetary circumstances, and broader market uncertainty stay main elements. Traders are cautiously optimistic, however volatility may shortly return if international threat sentiment deteriorates.

On-chain information affords a extra grounded view of the present cycle. In line with Darkfost, CryptoQuant information exhibits that realized income at the moment stand at 104,000 BTC, or round $11 billion. Whereas that quantity could appear giant, it’s nonetheless effectively under the historic hazard zone of 350,000 BTC—a degree that usually alerts euphoric circumstances or overheating.

This implies the market stays in a wholesome profit-taking zone. “Revenue-taking shouldn’t be a purple flag throughout a bull market,” Darkfost famous. “It’s crucial. It helps keep momentum and retains contributors engaged.”

The approaching week will probably be essential. A confirmed weekly shut above $105K may solidify this degree as new help and set the stage for additional upside. But when bulls fail to carry floor, the rally dangers dropping steam. For now, Bitcoin seems sturdy, however the market is coming into a zone the place conviction will probably be examined.

Associated Studying

BTC Holds Key Assist After Rejection From New ATH

Bitcoin is at the moment buying and selling round $107,750 after a risky week that noticed costs hit a brand new all-time excessive close to $112,000. The every day chart exhibits BTC pulling again from overbought circumstances however holding firmly above the 34-day EMA at $100,886—a degree that has persistently acted as dynamic help throughout this uptrend.

Worth stays effectively above the 50, 100, and 200-day SMAs, confirming a robust bullish construction. The important thing horizontal help at $103,600—now reclaimed—is one other essential zone. This degree beforehand acted as a resistance ceiling in the course of the March-April vary and now serves as a possible launchpad if BTC consolidates above it.

Quantity seems to be declining barely on the pullback, which can counsel this can be a wholesome retrace quite than a reversal. So long as Bitcoin maintains above the $103,600–$105,000 zone, bulls stay in management. A deeper correction would discover preliminary help across the 34 EMA after which the 100 SMA close to $91,000.

Associated Studying

For now, the bullish pattern stays intact. Nonetheless, rejection at $112K and slowing momentum name for warning. A weekly shut above $105K would verify power, whereas a break under $103K may set off short-term weak spot.

Featured picture from Dall-E, chart from TradingView