Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

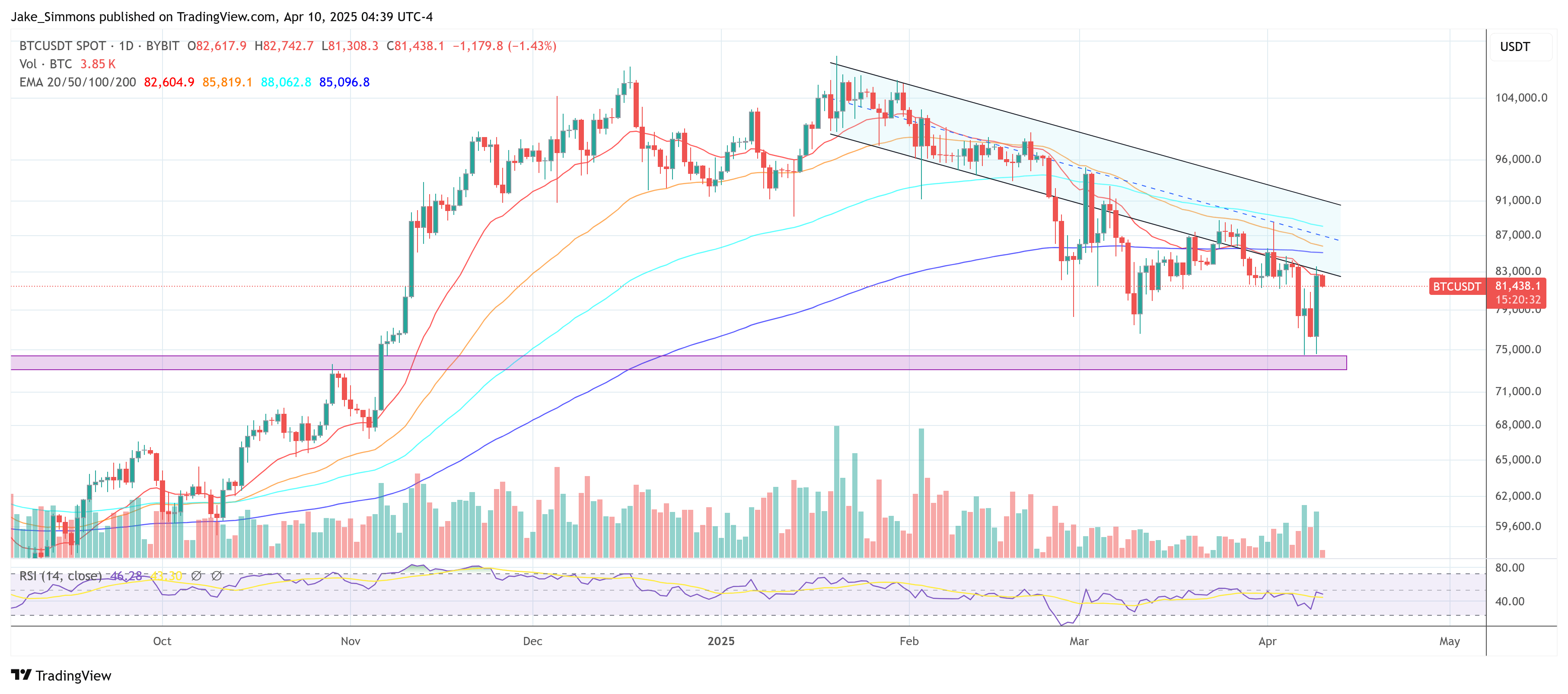

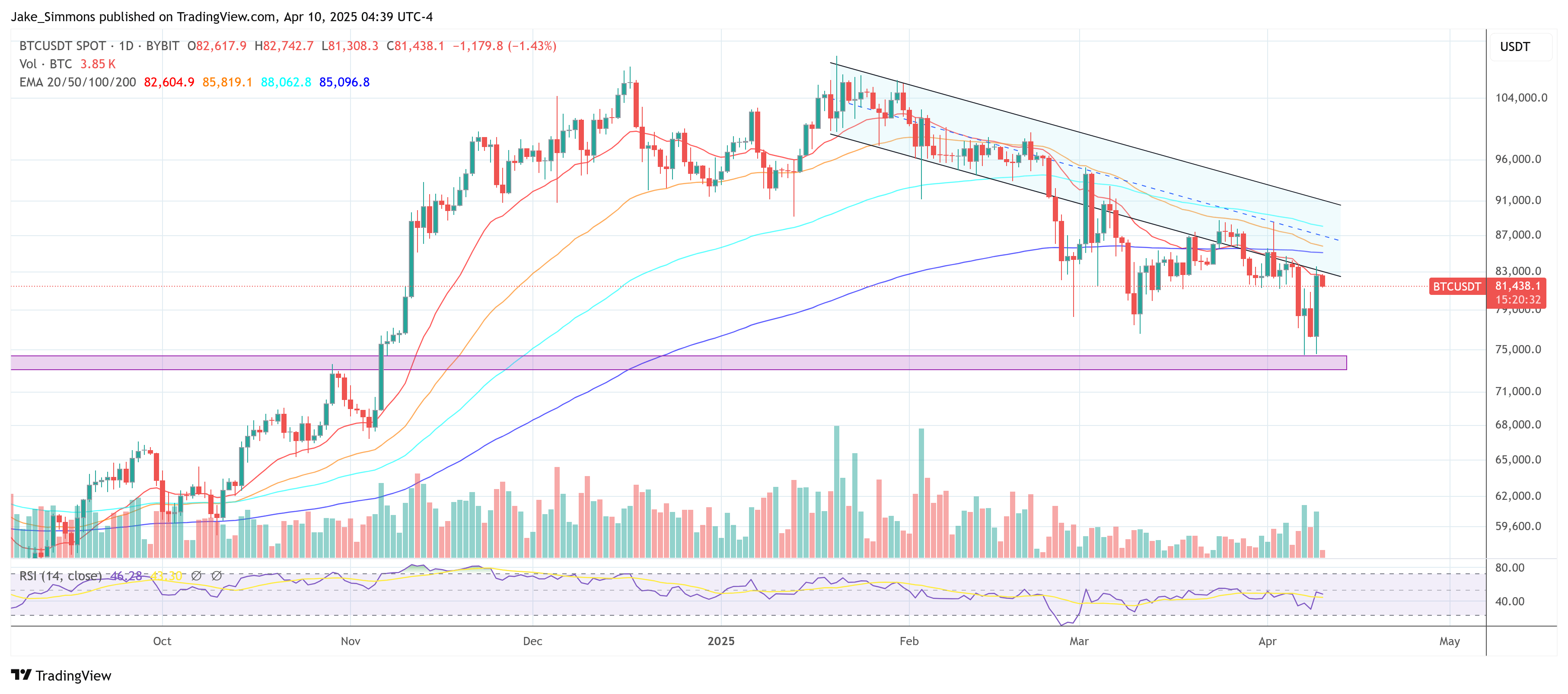

On Wednesday, Bitcoin surged greater than 8% to achieve a excessive of $83,588 following President Donald Trump’s announcement of a 90-day pause on new reciprocal tariffs for over 75 nations, excluding China. Buyers and market analysts considered the transfer as a sign of reduction, reflecting hopes that the fast escalation of tariffs would abate, not less than briefly. But President Trump concurrently hiked the tariff fee on China to 125%, indicating that the commerce battle between the world’s two largest economies stays removed from settled.

Trump’s determination to pause most of his newly introduced tariffs was tied to concern over disruptive shifts within the bond market. Yields on 10-year Treasury notes, which had soared to a seven-week excessive, remained elevated after the tariff pause was revealed. Regardless of the short-term reduction for a lot of nations, the instant tariff hike on China highlighted the continuing stalemate, suggesting persistent uncertainty for international markets. Some analysts see the surge of danger belongings, together with Bitcoin, as partly pushed by altering expectations round future negotiations.

Potential China Deal Not Priced In For Bitcoin

Amid this backdrop, Joe McCann, founder, CEO, CIO, and solo managing GP of the crypto fund Uneven, voiced his perspective on X, observing that the market was initially pricing in tariffs for China, EU and your complete world, however is now solely pricing China.

Associated Studying

He indicated {that a} take care of Beijing stays unpriced, so if a breakthrough emerges, the market “explodes” greater. “Market was priced for China, EU and everybody else getting tariffed. Market now pricing solely China. Market not pricing a China deal,” McCann remarks.

He additionally notes that “the explosion on the lengthy finish is danger parity pods blowing up,” referencing abrupt market actions in long-duration bonds. McCann sees the present setting as harking back to the market backside in the course of the COVID interval, with funds beginning to re-gross positions and short-sellers protecting. He highlights the likelihood that if the yuan strengthens in opposition to the greenback, it will doubtless imply China is ready to barter, implying that fairness and crypto markets could also be buying and selling too low.

“However as we speak, lengthy solely funds re-grossed and shorts lined.Trump has signaled max ache for China and is keen to barter. Market can solely re-price greater. If the Yuan rallies in opposition to the Greenback tonight, that’s doubtless an indication China desires to barter, which implies the market is mispriced (too low). UST 30Y public sale tomorrow ought to see additional oblique bids – identical story as as we speak,” McCann writes.

“Not Out Of The Woods But”

Jeff Park, Head of Alpha Methods at Bitwise, cautioned that the setting stays fragile, noting on X that weakened yuan dynamics, a still-robust 10-year yield above 4%, and ongoing credit score issues at spreads past 400 foundation factors persist as potential headwinds. In line with him, “[this] will probably be an unpopular opinion […] we’re out the woods but […] the web consequence continues to be damaging for danger belongings,” particularly if the Federal Reserve doesn’t lower charges as beforehand anticipated.

Associated Studying

He cited this lack of financial help as an element that amplifies volatility. “If something its really extra regarding how little liquidity is available in the market to expertise on line casino swings like this,” he writes through X.

X person Adam Yoder agrees that “bonds nonetheless went up as we speak, gold went up,” suggesting there are nonetheless sufficient safe-haven flows to maintain conventional buyers cautious of riskier belongings. Park concurred, suggesting “that is really form of a horrible transfer” and expressing confusion over what the White Home hopes to realize with a partial pause that leaves China alone to bear the brunt.

In the meantime, in a swift reversal of its earlier name, Goldman Sachs withdrew a lately introduced recession baseline after the 90-day pause was confirmed. Its revised outlook, printed by Jan Hatzius, maintains that complete tariffs—each the prevailing 10% and anticipated sector-specific charges of 25%—will nonetheless be carried out, however that the market has been spared a direct international escalation.

Goldman now returns to its earlier non-recession baseline forecast of 0.5% This autumn/This autumn GDP progress in 2025, a forty five% recession chance, and three successive 25-basis-point “insurance coverage” cuts by the Federal Reserve in June, July, and September. In line with the assertion, “we proceed to anticipate extra sector-specific tariffs” and an general fee that would method the 15 percentage-point enhance Goldman had initially anticipated.

All Eyes On At the moment’s CPI Launch

Notably, as we speak, the US Shopper Worth Index (CPI) information for March 2025 is scheduled to be launched by the US Bureau of Labor Statistics (BLS) at 8:30 ET – an enormous report for the market which might be essential for BTC’s subsequent transfer.

The CPI for February 2025 confirmed a year-over-year (YoY) enhance of two.8% (not seasonally adjusted), with a month-over-month (MoM) rise of 0.2% (seasonally adjusted). Core CPI, excluding meals and power, was up 3.1% YoY. This marked a slight cooling from January’s 3.0% YoY headline fee, suggesting a gradual disinflation pattern.

Expectations for the March CPI are to doubtlessly drop to round 2.5% YoY, with some analysts suggesting it might even fall to 2.6% or decrease if tendencies in housing prices, rents, and power costs proceed to ease. Core CPI is anticipated to hover round 3.0% to three.1% YoY, reflecting persistent strain from companies and shelter prices.

At press time, BTC traded at $81,438.

Featured picture created with DALL.E, chart from TradingView.com

Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

On Wednesday, Bitcoin surged greater than 8% to achieve a excessive of $83,588 following President Donald Trump’s announcement of a 90-day pause on new reciprocal tariffs for over 75 nations, excluding China. Buyers and market analysts considered the transfer as a sign of reduction, reflecting hopes that the fast escalation of tariffs would abate, not less than briefly. But President Trump concurrently hiked the tariff fee on China to 125%, indicating that the commerce battle between the world’s two largest economies stays removed from settled.

Trump’s determination to pause most of his newly introduced tariffs was tied to concern over disruptive shifts within the bond market. Yields on 10-year Treasury notes, which had soared to a seven-week excessive, remained elevated after the tariff pause was revealed. Regardless of the short-term reduction for a lot of nations, the instant tariff hike on China highlighted the continuing stalemate, suggesting persistent uncertainty for international markets. Some analysts see the surge of danger belongings, together with Bitcoin, as partly pushed by altering expectations round future negotiations.

Potential China Deal Not Priced In For Bitcoin

Amid this backdrop, Joe McCann, founder, CEO, CIO, and solo managing GP of the crypto fund Uneven, voiced his perspective on X, observing that the market was initially pricing in tariffs for China, EU and your complete world, however is now solely pricing China.

Associated Studying

He indicated {that a} take care of Beijing stays unpriced, so if a breakthrough emerges, the market “explodes” greater. “Market was priced for China, EU and everybody else getting tariffed. Market now pricing solely China. Market not pricing a China deal,” McCann remarks.

He additionally notes that “the explosion on the lengthy finish is danger parity pods blowing up,” referencing abrupt market actions in long-duration bonds. McCann sees the present setting as harking back to the market backside in the course of the COVID interval, with funds beginning to re-gross positions and short-sellers protecting. He highlights the likelihood that if the yuan strengthens in opposition to the greenback, it will doubtless imply China is ready to barter, implying that fairness and crypto markets could also be buying and selling too low.

“However as we speak, lengthy solely funds re-grossed and shorts lined.Trump has signaled max ache for China and is keen to barter. Market can solely re-price greater. If the Yuan rallies in opposition to the Greenback tonight, that’s doubtless an indication China desires to barter, which implies the market is mispriced (too low). UST 30Y public sale tomorrow ought to see additional oblique bids – identical story as as we speak,” McCann writes.

“Not Out Of The Woods But”

Jeff Park, Head of Alpha Methods at Bitwise, cautioned that the setting stays fragile, noting on X that weakened yuan dynamics, a still-robust 10-year yield above 4%, and ongoing credit score issues at spreads past 400 foundation factors persist as potential headwinds. In line with him, “[this] will probably be an unpopular opinion […] we’re out the woods but […] the web consequence continues to be damaging for danger belongings,” particularly if the Federal Reserve doesn’t lower charges as beforehand anticipated.

Associated Studying

He cited this lack of financial help as an element that amplifies volatility. “If something its really extra regarding how little liquidity is available in the market to expertise on line casino swings like this,” he writes through X.

X person Adam Yoder agrees that “bonds nonetheless went up as we speak, gold went up,” suggesting there are nonetheless sufficient safe-haven flows to maintain conventional buyers cautious of riskier belongings. Park concurred, suggesting “that is really form of a horrible transfer” and expressing confusion over what the White Home hopes to realize with a partial pause that leaves China alone to bear the brunt.

In the meantime, in a swift reversal of its earlier name, Goldman Sachs withdrew a lately introduced recession baseline after the 90-day pause was confirmed. Its revised outlook, printed by Jan Hatzius, maintains that complete tariffs—each the prevailing 10% and anticipated sector-specific charges of 25%—will nonetheless be carried out, however that the market has been spared a direct international escalation.

Goldman now returns to its earlier non-recession baseline forecast of 0.5% This autumn/This autumn GDP progress in 2025, a forty five% recession chance, and three successive 25-basis-point “insurance coverage” cuts by the Federal Reserve in June, July, and September. In line with the assertion, “we proceed to anticipate extra sector-specific tariffs” and an general fee that would method the 15 percentage-point enhance Goldman had initially anticipated.

All Eyes On At the moment’s CPI Launch

Notably, as we speak, the US Shopper Worth Index (CPI) information for March 2025 is scheduled to be launched by the US Bureau of Labor Statistics (BLS) at 8:30 ET – an enormous report for the market which might be essential for BTC’s subsequent transfer.

The CPI for February 2025 confirmed a year-over-year (YoY) enhance of two.8% (not seasonally adjusted), with a month-over-month (MoM) rise of 0.2% (seasonally adjusted). Core CPI, excluding meals and power, was up 3.1% YoY. This marked a slight cooling from January’s 3.0% YoY headline fee, suggesting a gradual disinflation pattern.

Expectations for the March CPI are to doubtlessly drop to round 2.5% YoY, with some analysts suggesting it might even fall to 2.6% or decrease if tendencies in housing prices, rents, and power costs proceed to ease. Core CPI is anticipated to hover round 3.0% to three.1% YoY, reflecting persistent strain from companies and shelter prices.

At press time, BTC traded at $81,438.

Featured picture created with DALL.E, chart from TradingView.com