Bitcoin has plunged again underneath the $100,000 degree throughout the previous day as on-chain information exhibits the OG whales have been waking up.

Bitcoin OGs Have Transferred Large Quantities Lately

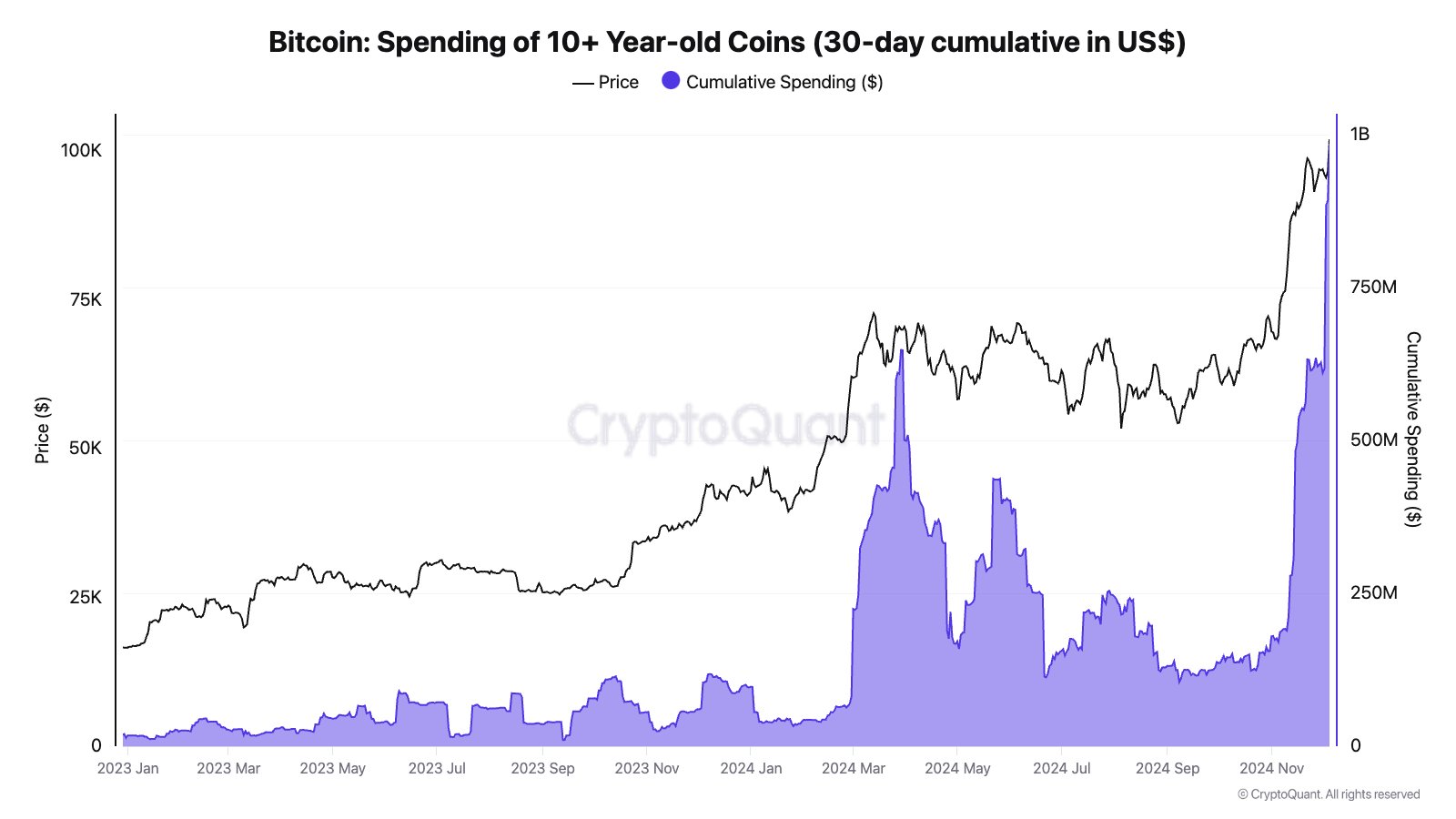

In a brand new publish on X, CryptoQuant Head of Analysis Julio Moreno has mentioned the development within the 30-day cumulative spending of the ten+-year-old Bitcoin tokens.

This metric principally retains monitor of the full variety of cash that the buyers who’ve been holding for 10 years or extra have been shifting on the BTC blockchain throughout the previous month. Under is the chart for the indicator shared by the analyst.

The worth of the metric seems to have been fairly excessive in latest days | Supply: @jjcmoreno on X

As is seen within the graph, the ten+ year-old buyers have moved an enormous variety of cash because the rally within the cryptocurrency’s worth has occurred over the previous month.

Statistically, the longer buyers maintain onto their cash, the much less probably they turn into to promote stated cash at any level. This chance of not promoting turns into important previous the 155-day mark, so the buyers who handle to carry for longer than this era are termed as “long-term holders” (LTHs).

Naturally, even among the many LTHs the resolve of any investor solely grows stronger the upper the age of their cash will get. Within the context of the present matter, the LTHs of relevance are these with tokens older than ten years, entities historic even by the group’s requirements.

Whereas these buyers are actually very outdated, it’s laborious to say whether or not they’re truly resolute. This may increasingly sound contradictory given the sooner truth, nevertheless it’s additionally a statistical fact that cash that become old than 7 years turn into extra prone to have gotten there by being misplaced than through HODLing.

A token is claimed to be ‘misplaced’ when its pockets turns into inaccessible both by being forgotten or by having its keys misplaced. Many of those cash won’t ever enter again into the circulating provide, however some may finally get rediscovered.

A bit of the buyers who’ve been spending the traditional cash within the newest rally may need merely discovered an outdated stash of both their cash or another person’s, so they could have by no means willingly participated in any HODLing in any respect.

The remaining sellers, nonetheless, may very well be essentially the most resolute diamond palms, which they’ve been holding since 2014 or earlier than. It will seem that these HODLers have turn into glad sufficient with the $100,000 goal that they’re keen to lastly half with their cash.

In whole, the 30-day cumulative spending of 10+-year-old cash nearly reached the $1 billion mark simply earlier than the newest pullback within the asset. Given the timing, it’s doable that this promoting might have had some half to play on this crash.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $97,700, down greater than 5% during the last 24 hours.

Appears to be like like the value of the coin has retraced from its newest excessive | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com

Bitcoin has plunged again underneath the $100,000 degree throughout the previous day as on-chain information exhibits the OG whales have been waking up.

Bitcoin OGs Have Transferred Large Quantities Lately

In a brand new publish on X, CryptoQuant Head of Analysis Julio Moreno has mentioned the development within the 30-day cumulative spending of the ten+-year-old Bitcoin tokens.

This metric principally retains monitor of the full variety of cash that the buyers who’ve been holding for 10 years or extra have been shifting on the BTC blockchain throughout the previous month. Under is the chart for the indicator shared by the analyst.

The worth of the metric seems to have been fairly excessive in latest days | Supply: @jjcmoreno on X

As is seen within the graph, the ten+ year-old buyers have moved an enormous variety of cash because the rally within the cryptocurrency’s worth has occurred over the previous month.

Statistically, the longer buyers maintain onto their cash, the much less probably they turn into to promote stated cash at any level. This chance of not promoting turns into important previous the 155-day mark, so the buyers who handle to carry for longer than this era are termed as “long-term holders” (LTHs).

Naturally, even among the many LTHs the resolve of any investor solely grows stronger the upper the age of their cash will get. Within the context of the present matter, the LTHs of relevance are these with tokens older than ten years, entities historic even by the group’s requirements.

Whereas these buyers are actually very outdated, it’s laborious to say whether or not they’re truly resolute. This may increasingly sound contradictory given the sooner truth, nevertheless it’s additionally a statistical fact that cash that become old than 7 years turn into extra prone to have gotten there by being misplaced than through HODLing.

A token is claimed to be ‘misplaced’ when its pockets turns into inaccessible both by being forgotten or by having its keys misplaced. Many of those cash won’t ever enter again into the circulating provide, however some may finally get rediscovered.

A bit of the buyers who’ve been spending the traditional cash within the newest rally may need merely discovered an outdated stash of both their cash or another person’s, so they could have by no means willingly participated in any HODLing in any respect.

The remaining sellers, nonetheless, may very well be essentially the most resolute diamond palms, which they’ve been holding since 2014 or earlier than. It will seem that these HODLers have turn into glad sufficient with the $100,000 goal that they’re keen to lastly half with their cash.

In whole, the 30-day cumulative spending of 10+-year-old cash nearly reached the $1 billion mark simply earlier than the newest pullback within the asset. Given the timing, it’s doable that this promoting might have had some half to play on this crash.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $97,700, down greater than 5% during the last 24 hours.

Appears to be like like the value of the coin has retraced from its newest excessive | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com