Final month, we checked out the biggest (fiat-backed) gamers within the stablecoin market and the hazy regulatory scrutiny they’re making an attempt to navigate. It’s turning into more and more clear that these issuers are on the relative mercy of US regulators. Certainly, simply shortly after our submit, the third-largest stablecoin (BUSD) acquired a attainable loss of life sentence from the SEC and NYDFS due to unbacked BUSD on the BNB Chain. This month, we discover a special class of stablecoins; ones which might be a lot smaller and considerably much less steady. But crucially, as a result of they’re making an attempt to function on-chain and out of doors of the TradFi infrastructure and regulatory constraints that fiat-backed stablecoins face, they’ve essentially the most potential to unlock new credit score improvements and efficiencies.

It’s no shock that cash creation was one of many first monetary experiments on blockchains. Tokens on a blockchain that characterize a US greenback are in idea helpful for funds, however the marketplace for this by no means actually took off. As a substitute, the primary actual use case for such tokens was the identical factor that underpins most crypto headlines: hypothesis.

Merchants trying to improve their crypto publicity by leverage powered the primary artificial dollar-pegged stablecoin (Dai), with over-collateralized on-chain loans backing it by a fancy system of sensible contracts and oracles. Since then, there have been many makes an attempt to create extra environment friendly designs, with much less and fewer collateral backing.

This was taken to its logical excessive with algorithmic stablecoins like Terra, or (who remembers?) Empty Set Greenback and the related sequence of zero-collateral loss of life spirals in January 2021. These failures turned many bitter on modern stablecoin designs, however the potential to print cash is so attractive that new ventures are at all times going to emerge. And with most of the newest improvements coming from DeFi veterans, there needs to be stronger conviction concerning their future success. But will any of them be capable to problem the massive fiat-backed stablecoins? To try a solution to this hypothetical query, let’s check out essentially the most outstanding gamers on this aspect of the market.

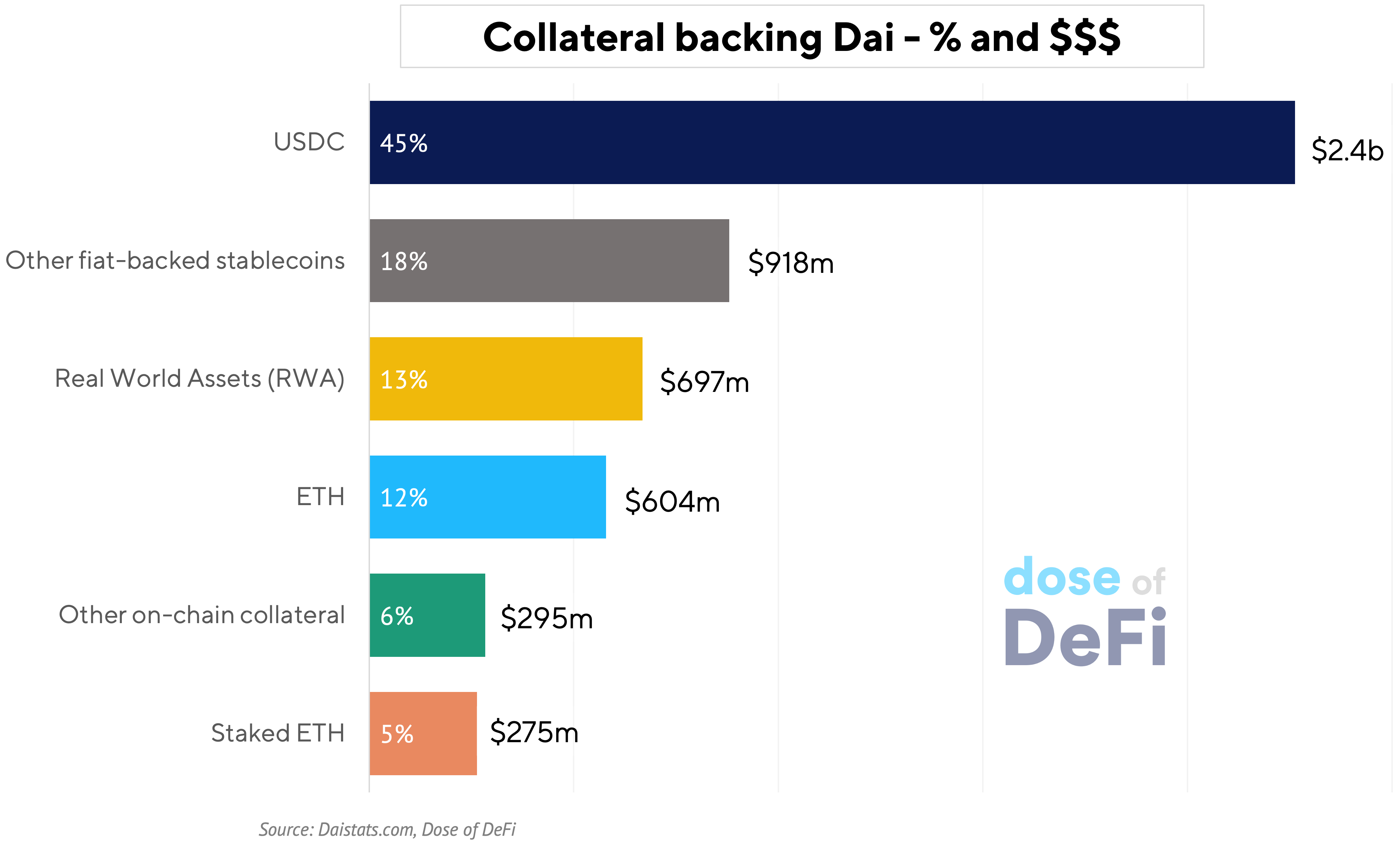

The OG decentralized stablecoin spent from 2020 by most of 2022 centralizing its reliance on USDC, some now dubbing it “wrapped USDC”. It spent that point soul looking with its founder Rune Christenson penning its Endgame Plan, which goals to maneuver MakerDAO away from its reliance on the US greenback and into an actually unbiased and steady retailer of worth.

The Endgame Plan was poorly acquired. The underlying conundrum MakerDAO finds itself in is one that each creator of a brand new, modern stablecoin will ultimately run into: the right way to scale and develop provide relying completely on on-chain belongings and enforcement mechanisms. MakerDAO grew and grew in 2021 and 2022, however that progress got here at a price: it’s now practically 60% backed by fiat stablecoins.

This highlights an inconvenient fact: there may be extra demand for stablecoins on-chain than there may be on-chain collateral to again it. For now, no less than. However since Rune talks about Maker on a century-long timeline, it could be smart to sluggish Dai’s ascent to match with the present asset base of blockchains.

Trying forward, whereas MakerDAO is pushing ahead with strategic initiatives like elevating the Dai Financial savings Charge (DSR) to 1% and forking Aave v3’s front-end (Spark Protocol) to strengthen its place, it appears to have change into a sufferer of its personal success. It’s concurrently in each decentralization and progress mode: the most recent instance being permitting Dai to be minted with MKR collateral. It’s going all-in on regulatory arbitrage, but additionally betting massive on actual world belongings (RWAs) which might be very straightforward to control.

MakerDAO has lengthy been centered on getting Dai into the higher echelons of liquid stablecoins, nevertheless it more and more seems to be prefer it should defend turf in opposition to fellow DeFi OGs Aave and Curve, which have imminent plans to launch stablecoins of their very own.

The rumors surrounding secondary lending platforms like Aave and their plans to launch stablecoins have been round for a while. These lending protocols have already got the important thing piece of infrastructure wanted to launch a stablecoin: the power to shortly liquidate an underwater place. Lending protocols need their very own stablecoins for a similar purpose that centralized exchanges have their very own most popular stablecoin: to create lock-ins to their ecosystem.

Aave’s GHO stablecoin is shortly approaching launch, deploying on take a look at web two weeks in the past. It doesn’t supply something new when it comes to design; its success will hinge on the power to capitalize on Aave’s community results. Aave has already out-competed Compound on this sense, by deploying to extra networks and itemizing extra belongings. Attracting extra on-chain borrowing demand is a tall activity, however Aave has been main the best way in DeFi on this entrance for a number of years. Very similar to a financial institution with broad distribution, Aave will try to leverage its present lending footprint to upsell to GHO. The way it offers with peg enforcement and manages its reliance on fiat-backed stablecoins is one other subject altogether.

In growing its stablecoin-launch plans, Curve’s steady swap swimming pools have been important in unlocking liquidity by pairing them with different stablecoins. Like Aave, Curve will quickly launch a stablecoin (crvUSD) to reinforce its ecosystem. However not like Aave, crvUSD might be primarily based on a brand new, modern design the place liquidations are changed with a particular objective AMM. One approach to make collateral extra environment friendly is by incomes charges off of it by liquidity provisioning, and certainly crvUSD might be backed by collateral that can also be market making on ETH and USD.

crvUSD’s whitepaper is heavy on the maths and on the hand-waving, nevertheless it does showcase a brand new stablecoin design that might show a breakthrough in effectivity and in attracting new on-chain borrowing demand. The query of whether or not this design works out for Curve needs to be answered imminently; crvUSD cleared an vital governance milestone final week, and might be dwell within the subsequent few weeks.

Gyroscope is one other new stablecoin quickly to launch on Ethereum with an modern design. It goals to restrict reliance on single oracle feeds for costs by meta-aggregating and indexing them. It additionally introduces an up to date model of Maker’s Peg Stability Module that may try to stop the Gyroscope stablecoin (GYD) from getting co-opted by a centralized stablecoin in its seek for peg stability (what occurred to Maker). Gyroscope is dwell on Polygon and getting ready for a mainnet launch.

Maybe no DeFi challenge has had a greater previous 12 months than Frax. After efficiently bootstrapping itself in 2021 by some ponzi-nomics, it constructed on key partnerships to combine Frax round DeFi.

Frax is growing greater than only a stablecoin, however quite an ecosystem of various monetary services and products. Most lately, it launched one of the profitable ETH liquid staking derivatives ever (LSD). Frax has the identical subject as MakerDAO when it comes to dependence on the centralized USDC for backing, however its smaller measurement means it will likely be simpler to wean itself off. We’re optimistic about Frax as a result of the success of any stablecoin will in the end come all the way down to having an enormous swath of customers trying to tackle debt in that stablecoin, and Frax has demonstrated its potential to develop market share in multiple product vertical.

Frax began as a partially-backed algorithmic stablecoin, however is now shifting to be fully-backed, with a sign vote passing this week. This can encourage extra confidence in Frax but additionally means it will likely be tougher to scale because it runs into the same set of issues as Maker and Dai.

Many DeFi die-hards and ETH maximalists lengthy for single-collateral Dai, which was beforehand backed solely by ETH – the purest asset identified to humanity. Liquity’s LUSD and Reflexer’s Rai are the one ETH-only stablecoins nonetheless standing. We coated Rai’s try to change into a non-USD stablecoin in the summertime of 2021. Finally, it did not generate sufficient demand for its stablecoin and its “un-governance” design prevented any adjustments to the core protocol. Ameen Soleimani, one among Rai’s co-founders has finished a mea culpa, explaining that ETH isn’t nice collateral in a world of liquid staking derivatives (LSD), which have the identical fungibility however include built-in yield. Staked ETH could quickly change into the preferred collateral on Ethereum.

Which may be an issue for Liquity’s LUSD, which is backed solely by ETH and boasts a low collateralization ratio (110%) in addition to a no-interest-rate construction and an avenue for LUSD holders to earn yield by liquidations. It has stayed stubbornly above $1.00 for the final six months, however is lastly inching its approach down, partially as a result of hen bonds. Whereas some now tout the ETH-only collateral, will Liquity keep aggressive if debtors desire ETH with a yield a la LSDs?

It’s vital to recollect the distinction in measurement. Liquity’s is presently $600m, Rai maxed out at $100m. Frax is at $1bn and Dai at $5bn. All of those mixed nonetheless solely characterize 15% of the dimensions of USDC, and even much less of a proportion of USDT. Whereas printing your individual cash on-chain will endlessly be attractive and worthwhile for an ecosystem constructing lending merchandise, fiat-backed stablecoins stay the one approach to meet the insatiable demand for {dollars} on the blockchain.

-

MakerDAO raises debt limits on ETH LSDs Hyperlink

-

Coinbase launches Base, a rollup fork of Optimism Hyperlink

-

zeromev.org reveals MEV extraction block-by-block Hyperlink

-

Flashbots announce MEV share to return some MEV to customers Hyperlink

That’s it! Suggestions appreciated. Simply hit reply. Written in Nashville, however headed to Denver on Wednesday. Attain out in case you’re round.

Dose of DeFi is written by Chris Powers, with assist from Denis Suslov and Monetary Content material Lab. Caney Fork, which owns Dose of DeFi, is a contributor to DXdao and advantages financially from it and its merchandise’ success. All content material is for informational functions and isn’t supposed as funding recommendation.