Wallets have lengthy been the punching bag of crypto. Their poor UX carries the blame for crypto’s incapability to interrupt additional into the mainstream. No person has a favourite pockets – solely the one which annoys them the least. The issue lies with the complexity of blockchains and managing non-public keys. After years of improvement, that is slowly altering with the upcoming enormous improve within the Pectra Arduous Fork. Under, Denis & I have a look at what’s to come back, and the implications for market and energy buildings inside a thriving pockets trade.

– Chris

The crypto consumer expertise (UX) has traditionally been poor, with people shedding funds, choosing centralized options, or leaving the house altogether.

There have been two key efforts to boost DeFi UX. First, through centralized options that provide a white-glove model of DeFi. The DeFi Mullet is a world the place onchain protocols are used, however most customers depend on centralized companies like Coinbase to carry their keys and management their funds (finest exemplified by the Coinbase integration of DeFi lending protocol Morpho). The second is through a world that fulfills the unique crypto imaginative and prescient, the place self-custody is utilized by the plenty and crypto wallets are ubiquitous.

DeFi energy customers – responsible as charged – are prepared to place up with the clunkiness as a result of they need the liberty to discover each inch of the blockchain. However an everyday consumer doesn’t need something to do with non-public keys.

Crypto wallets have lengthy disillusioned; each cycle guarantees a greater pockets design to lastly unlock mainstream adoption. This time, the hype is perhaps warranted. Or at the least, it is a final shot earlier than the centralized companies begin driving onchain product improvement.

With the upcoming Pectra Arduous Fork on Ethereum (introducing EIP-7702) and recent income fashions (from in-app swaps to MEV circulation offers), wallets are evolving from clunky key-management instruments into refined ‘orchestration layers’.

On this piece, we’ll discover how EIP-7702 builds on current upgrades (i.e. EIP-4337), which wallets are finest positioned to capitalize on user-friendly options, and why these modifications may lastly lead wallet-UX to meet its promise of self-custody.

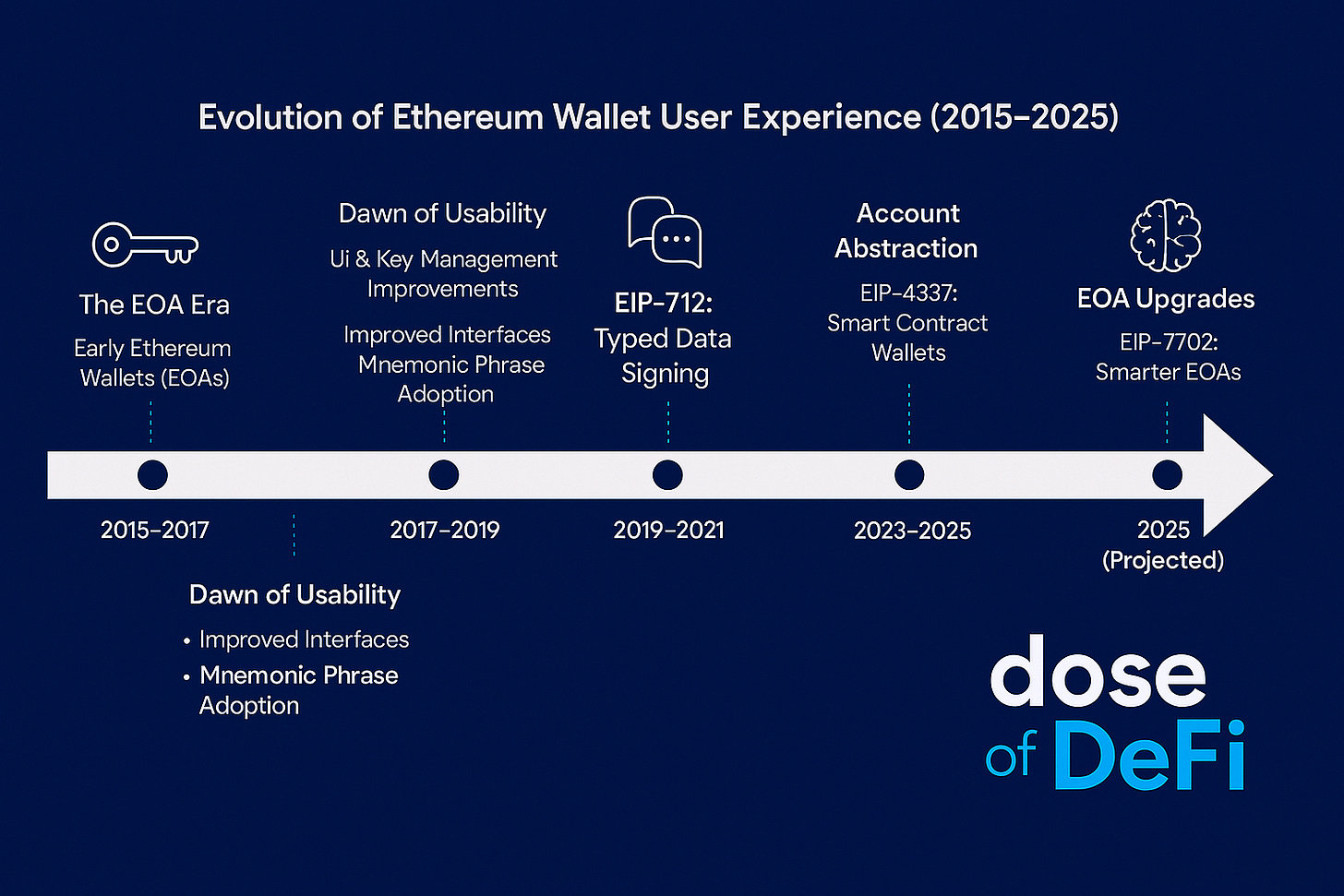

Efforts to boost UX in crypto have been progressing just lately. As mentioned in our article titled Summary away! The race in the direction of interoperability, the newest important improve to Ethereum (EIP-4337) went reside in 2024. Now, market consideration has shifted to EIP-7702, which is ready to launch with the upcoming Pectra Arduous Fork. In different phrases, an opportune second to debate its implications. The important thing one being that, with this new infrastructure in place, we’re lastly outfitted to construct consumer experiences that may method Web2 usability – whereas preserving the core ideas of Web3.

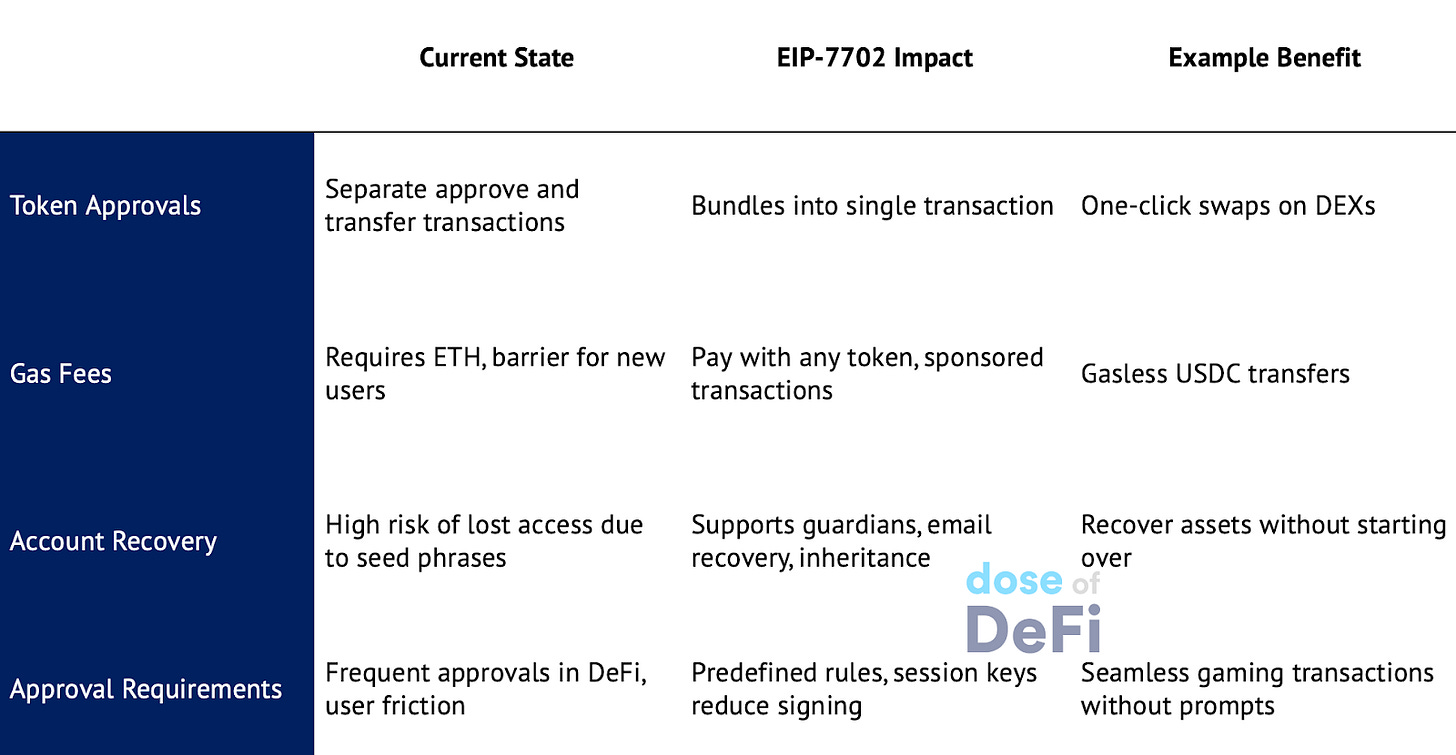

EIP-7702 will considerably alter how Ethereum accounts operate. Listed here are some notable enhancements that shall be made to current externally owned accounts (EOAs), the default account sort:

-

No extra token approvals: Approvals and swaps shall be bundled right into a one-click expertise, as an alternative of the clunky present one. Going ahead, an EOA can delegate to a sensible contract that executes each the approve and transferFrom steps in a single transaction. Bundling additionally permits extra environment friendly execution of complicated DeFi methods with out requiring particular person transaction signatures.

-

Gasoline abstraction: Customers will be capable to pay fuel charges with any token, profit from sponsored transactions (the place an utility or pockets covers fuel prices), and make the most of cross-chain fuel funds. Presently, customers should purchase ETH or SOL to ship USDC – think about having to purchase Federal Reserve inventory simply to wire {dollars}.

-

Account restoration: Relying on the pockets supplier, restoration choices reminiscent of guardians, email-based restoration, and legacy/inheritance options shall be launched. Many crypto customers have misplaced tokens by misplacing their seed phrases.

-

Much less signing: Customers will be capable to set predefined guidelines for interacting with decentralized purposes, offering restricted entry with out requiring fixed approvals. With EIP-7702, customers can create session keys to assist mitigate the related friction by permitting customers to pre-authorize interactions, lowering the necessity for extreme signing.

Regardless of the advantages, the velocity at which EIP-7702-based wallets shall be adopted is unsure. One factor about wallets is that customers are sticky – and merchandise are gradual to implement new options. For Dapps, this creates twice the complexity: two consumer journeys, two separate interfaces – virtually like constructing two distinct merchandise. Because of this, there’s little quick motivation for Dapps to spend money on devoted account abstraction experiences, and customers have little purpose to undertake good accounts in the event that they don’t noticeably enhance their Web3 expertise.

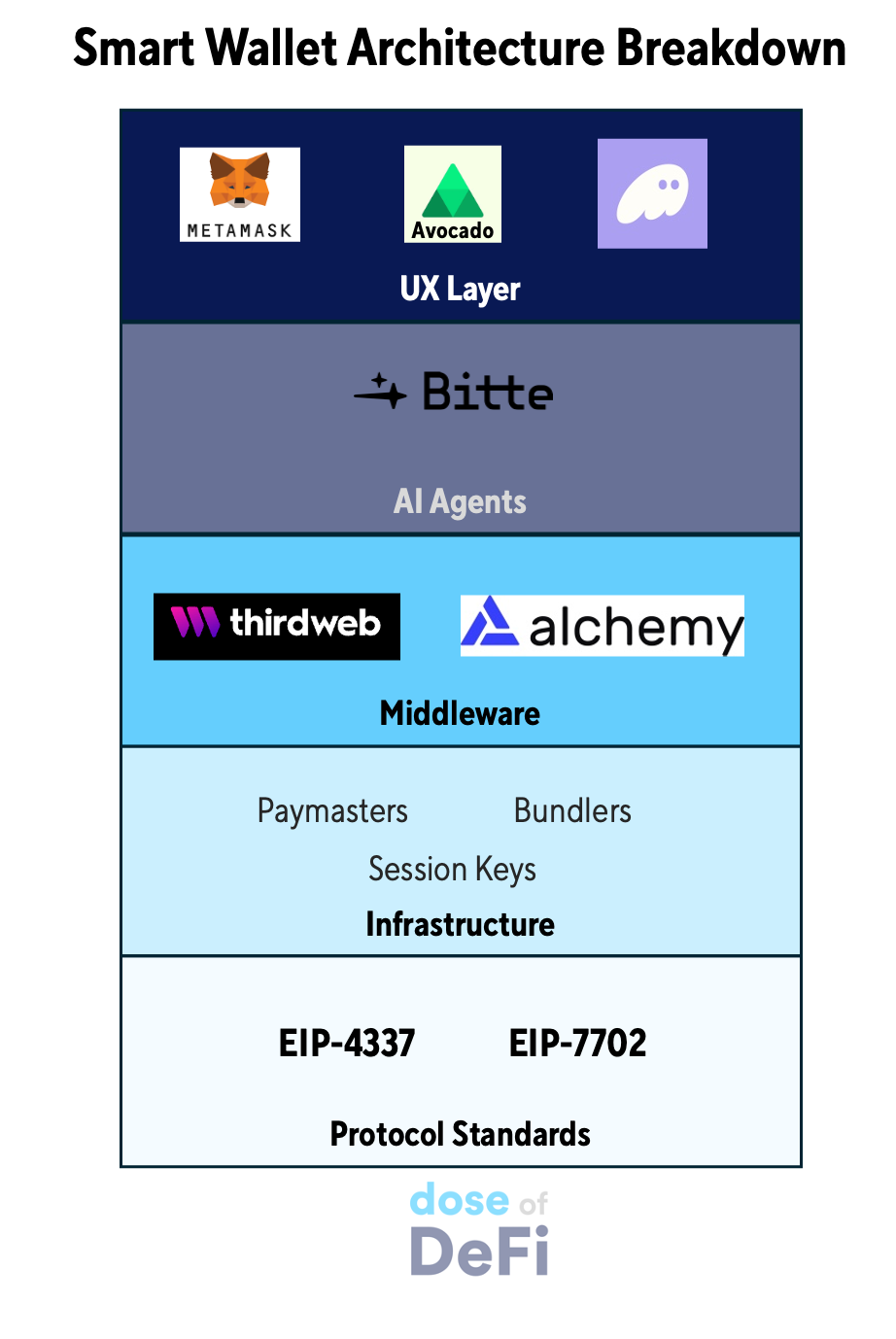

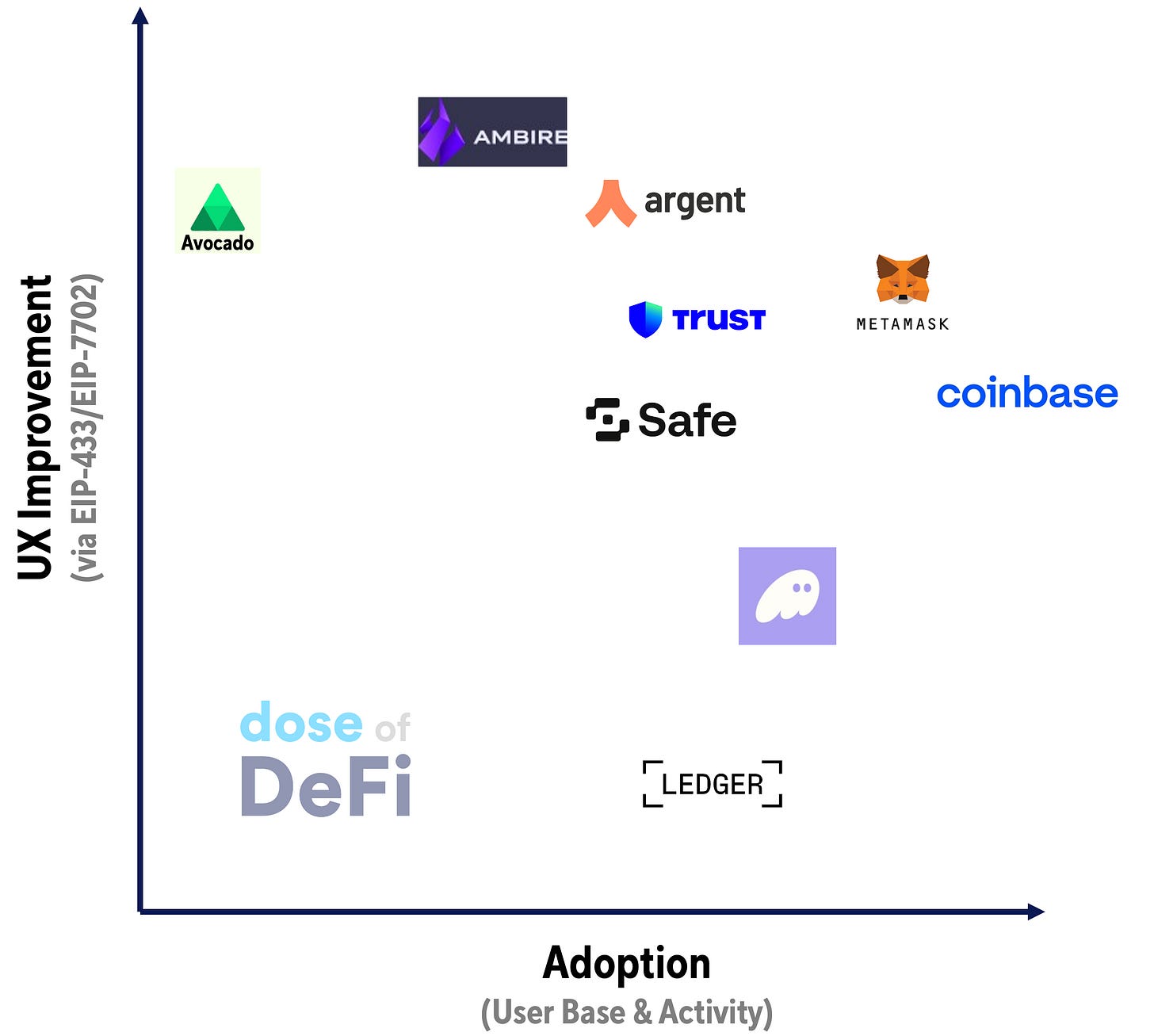

Ambire, Argent and Avocado are among the many first wallets so as to add EIP-4337-based good contracts. Within the developer instruments house, Thirdweb and Alchemy provide SDKs and APIs that make it simple for builders to embed EIP-4337-compliant good wallets into dApps, accelerating adoption.

In 2024, EIP-4337 good accounts noticed huge development, with over 103 million Person Operations – a greater than tenfold improve from 2023. (Facet be aware: UserOps are a brand new consumer transaction sort after the EIP-4337 replace). Nevertheless, most accounts had been single-use, pushed by apps providing sign-up rewards, whereas only some apps, like Blocklords and OpenSocial, succeeded in driving repeat engagement. Notably, 87% of UserOps charges had been coated by Paymasters, making transactions cheaper for customers. Total, EIP-4337 adoption expanded throughout a number of chains and use circumstances, particularly gaming and social apps (although retaining energetic customers stays a problem). Nonetheless, ERC-4337 bundle transactions represented solely about 1.5% of complete ETH + L2 ecosystem transactions in 2024.

One vital side lacking from the wallet-UX-upgrade motion is privateness. Vitalik Buterin just lately emphasised that privateness stays an unresolved subject in crypto. Privateness-focused cryptocurrency Monero, regardless of its proficient developer workforce and important monetary sources, has by no means achieved mainstream adoption. Whereas the removing of Twister Money from the OFAC sanctions checklist is a constructive improvement, the blockchain group – together with the Ethereum Basis – has but to prioritize privateness enhancements on the Layer 1 degree. In his December article, Vitalik poses some short-term privateness options primarily based on wallets, a few of that are being carried out in Zupass. Nevertheless, to have a correct long-term resolution, these enhancements should be carried out on the base chain or utility layer, like the current launch of PrivacyPools.com.

Exterior of the infrastructure enhancements, wallets might also see enhancements with the rise of AI. Bitte.ai is pioneering AI-driven automation by embedding AI brokers immediately into DeFi purposes. As an alternative of conventional point-and-click interfaces, Bitte’s system employs chat-based interactions, the place AI assistants information customers, execute transactions, and handle DeFi actions.

Initiatives reminiscent of Bitte permit customers to enter pure language instructions (e.g., “Swap X ETH for X USDC on chain X,” “Deposit to Spark,” “Ship 0.5 ETH to Mother”). AI then determines the optimum route, constructs the transaction, and presents it for affirmation. This text-based method improves usability by consolidating a number of DeFi protocols inside a single interface. To reinforce safety, AI analyzes consumer habits and introduces further affirmation steps for suspicious exercise.

One of many best advantages of the shift to AI-driven or chat-based UX is the rise of intent protocols. As we beforehand mentioned, intents signify a consumer expressing their desired final result in a transaction request. This method removes pointless constraints on how the request is executed, focusing as an alternative on the supposed consequence. Specialised actors often known as ‘solvers’ then compete to determine essentially the most cost-efficient strategy to fulfill a consumer’s intent.

So to recap, wallets will profit from main infrastructure upgrades on Ethereum with 7702. And with this, be capable to wield AI of their endless battle to summary away the complexity of blockchain transactions.

For many of crypto’s historical past, wallets had been vital infrastructure with no enterprise mannequin. They sat closest to the consumer however struggled to seize worth, serving as UI layers that had been costly to construct and keep, but troublesome to monetize. That is now modified. Immediately, wallets are quietly turning into worthwhile. MetaMask generates $50 million+ via in-app swaps. Phantom simply raised at a $3 billion valuation with a reported $90 million in annualized income. Many wallets now monetize order circulation or seize MEV — just like how Robinhood monetizes retail circulation in conventional finance.

Wallets have at all times been alluring to buyers, however by no means sustained the funding required to make them client merchandise. With a extra predictable income stream, buyers and corporations will certainly be extra prepared to dump sources into advertising and marketing and consumer acquisition for wallets.

These modifications carry main enterprise implications. Immediately, customers should manually choose a blockchain, including pointless complexity. Sooner or later, intermediaries will automate this course of primarily based on safety preferences (e.g., institutional buyers favoring extremely safe chains) or particular consumer objectives (e.g., selecting a series that helps a selected DeFi protocol).

Entities that implement this choice – reminiscent of wallets and intent protocols – may turn into the dominant distribution channels, successfully controlling the consumer relationship. This shift would profit threat managers like Gauntlet and Block Analitica, in addition to threat evaluation frameworks like L2Beat. This could then affect which chains and protocols AI defaults to as ‘most well-liked’ choices. By default, property could also be allotted to safer networks reminiscent of Ethereum or Stage 1 L2s like Arbitrum and OP (as categorized by L2Beat), whereas superior customers may go for riskier alternate options, together with Stage 0 L2s.

Nevertheless, this development may face pushback from L1 and L2 chains, because it dangers commoditizing them. L1s and L2s are among the many most well-funded and deeply entrenched gamers within the trade, making the aggressive dynamics unpredictable. Uniswap has already launched its personal blockchain and later launched a pockets, so is more likely to keep management over its consumer relationship. In the meantime, we see ‘Ethereum-aligned’ wallets like MetaMask directing visitors towards Ethereum and its L2s. But as MetaMask adapts to market demand by integrating Solana, one should ask: will the Ethereum Basis must launch its personal ‘Ethereum Pockets’ to defend its moat?

Wallets now have the upgrades, enterprise fashions, and AI-driven UX to push DeFi in the direction of the mainstream. Nonetheless, there’s no assure of a purely self-custodial future.

On one hand, the DeFi Mullet isn’t more likely to go wherever: centralized platforms already dominate onboarding and might merely fold in onchain back-ends for these wanting ‘crypto below the hood’ with out key-management hassles. On the opposite, EIP-7702 and ‘wallet-as-orchestrator’ fashions give self-custody its finest shot but. If pockets suppliers pair account abstraction, AI-driven interfaces, and new income streams (like MEV circulation offers) to fund innovation, they might lastly overcome the clunky UX that has deterred on a regular basis customers.

We have now good purpose to need self-custodial wallets to succeed. They uphold crypto’s founding precept of decentralization and forestall lock-in. If broadly adopted, user-controlled wallets would imply no single platform can maintain funds hostage or dictate the principles.

Whether or not these paths merge, coexist, or collide continues to be to be seen – and the deciding components go effectively past consumer interfaces. As we explored in DeFi splits in two within the fall, laws, liquidity fragmentation, and protocol governance additionally push DeFi in divergent instructions. Within the close to time period, we may even see the DeFi Mullet thrive with newcomers looking for simplicity, whereas extra superior or privacy-conscious customers embrace the brand new wave of highly effective, user-friendly self-custody.

If that latter group can ship a ‘simply works’ expertise to rival centralized apps, they could fulfill crypto’s authentic imaginative and prescient. But when key-management complexities stay unsolved, custodial giants will stay the face of DeFi. A technique or one other, wallets at the moment are finest positioned to resolve which model of ‘monetary freedom’ wins out – and the way decentralized the way forward for DeFi shall be.

-

Aave integrates Chainlink SVR on Ethereum for liquidation MEV recapture Hyperlink

-

CowAMM suffers small exploit exploit Hyperlink

-

Rath Finance launches new DeFi rails for yield packaging Hyperlink

-

Hydro workforce develops new method to impermanent loss Hyperlink

-

Compound Labs reemerges, toys with launching Compound Basis Hyperlink

-

DeFi revenues decline in March as onchain exercise slows Hyperlink

-

AtlasEVM introduces common public sale system for transaction execution Hyperlink

-

Matcha expands to Solana with SVM and EVM chain help Hyperlink

That’s it! Suggestions appreciated. Simply hit reply. Nonetheless into this meme: open-source capitalism.

Dose of DeFi is written by Chris Powers, with assist from Denis Suslov, Zhev and Monetary Content material Lab. All content material is for informational functions and isn’t supposed as funding recommendation.