After Ethereum (ETH) surged previous the psychologically vital $2,000 value stage yesterday, its subsequent main value hurdle stands at $2,400. Seasoned crypto analyst Ali Martinez emphasised that ETH should clear this stage to regain bullish momentum.

Ethereum Wants To Clear $2,400 To Flip Bullish

Ethereum has climbed practically 4.5% over the previous week, rising from roughly $1,800 on March 13 to $1,992 on the time of writing. Nevertheless, Martinez factors out that regardless of the current upward motion, ETH should conquer the $2,400 stage to substantiate a bullish shift.

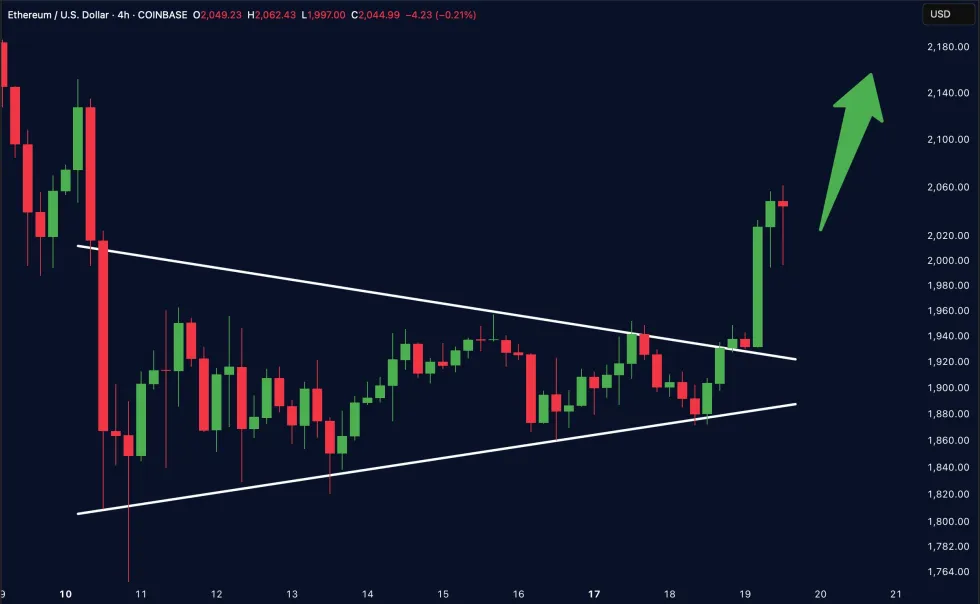

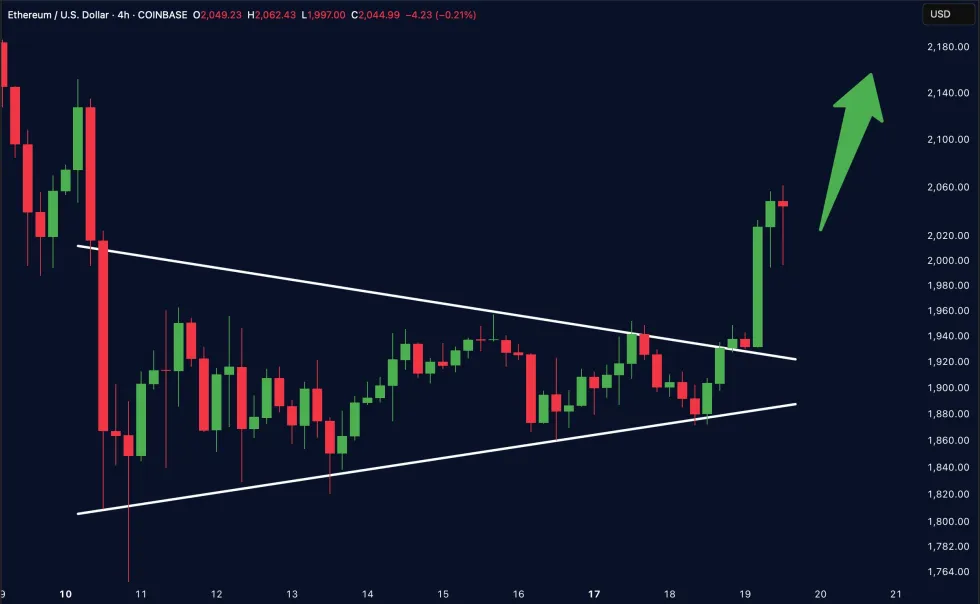

Whereas $2,400 stays about 20% away from present value ranges, a number of crypto analysts imagine ETH might be on the verge of a bullish development reversal. Crypto analyst Merlijn The Dealer highlighted that ETH has damaged out of a symmetrical triangle sample on the 4-hour chart.

The analyst added that ETH’s “most hated rally is about to ignite.” Merlijn’s evaluation aligns with fellow analyst Ted, who famous {that a} quick squeeze may quickly propel ETH to $3,000.

Equally, in an X publish, crypto analyst Crypto Caesar prompt that ETH could also be close to this market cycle’s backside and will quickly expertise a powerful upward development reversal. The analyst shared a chart exhibiting ETH bouncing off a long-standing trendline a number of occasions since mid-2022.

Additional supporting the bullish case, analyst Amr Taha defined in a CryptoQuant Quicktake publish that over 150,000 ETH have exited derivatives exchanges previously two days. Taha famous that such massive outflows usually sign accumulation by institutional traders – a historically bullish indicator.

ETH Threatens Slumping To $1,060

Regardless of the optimistic alerts, some analysts warn that ETH might face extra draw back earlier than any vital upside transfer. In an X publish, crypto dealer Mags prompt ETH may crash to a spread low of $1,060 if no significant help stage holds.

Moreover, different analysts warning that ETH may fall as little as $800 if it breaks down from an ascending triangle sample. Knowledge from crypto exchange-traded funds (ETF) tracker SoSoValue additionally signifies waning institutional confidence in ETH.

Notably, US-based spot ETH ETFs have seen steady web outflows since March 5. As of now, complete web property held in spot ETH ETFs stand barely above $7 billion, representing roughly 2.8% of ETH’s complete provide.

That mentioned, Ethereum’s MVRV Ratio dropping to 0.9 may sign a bullish setup for the digital asset, although such results usually take time to play out. At press time, ETH trades at $1,992, down 1.7% previously 24 hours.

Featured Picture from Unsplash.com, Charts from X, CryptoQuant and TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

After Ethereum (ETH) surged previous the psychologically vital $2,000 value stage yesterday, its subsequent main value hurdle stands at $2,400. Seasoned crypto analyst Ali Martinez emphasised that ETH should clear this stage to regain bullish momentum.

Ethereum Wants To Clear $2,400 To Flip Bullish

Ethereum has climbed practically 4.5% over the previous week, rising from roughly $1,800 on March 13 to $1,992 on the time of writing. Nevertheless, Martinez factors out that regardless of the current upward motion, ETH should conquer the $2,400 stage to substantiate a bullish shift.

Whereas $2,400 stays about 20% away from present value ranges, a number of crypto analysts imagine ETH might be on the verge of a bullish development reversal. Crypto analyst Merlijn The Dealer highlighted that ETH has damaged out of a symmetrical triangle sample on the 4-hour chart.

The analyst added that ETH’s “most hated rally is about to ignite.” Merlijn’s evaluation aligns with fellow analyst Ted, who famous {that a} quick squeeze may quickly propel ETH to $3,000.

Equally, in an X publish, crypto analyst Crypto Caesar prompt that ETH could also be close to this market cycle’s backside and will quickly expertise a powerful upward development reversal. The analyst shared a chart exhibiting ETH bouncing off a long-standing trendline a number of occasions since mid-2022.

Additional supporting the bullish case, analyst Amr Taha defined in a CryptoQuant Quicktake publish that over 150,000 ETH have exited derivatives exchanges previously two days. Taha famous that such massive outflows usually sign accumulation by institutional traders – a historically bullish indicator.

ETH Threatens Slumping To $1,060

Regardless of the optimistic alerts, some analysts warn that ETH might face extra draw back earlier than any vital upside transfer. In an X publish, crypto dealer Mags prompt ETH may crash to a spread low of $1,060 if no significant help stage holds.

Moreover, different analysts warning that ETH may fall as little as $800 if it breaks down from an ascending triangle sample. Knowledge from crypto exchange-traded funds (ETF) tracker SoSoValue additionally signifies waning institutional confidence in ETH.

Notably, US-based spot ETH ETFs have seen steady web outflows since March 5. As of now, complete web property held in spot ETH ETFs stand barely above $7 billion, representing roughly 2.8% of ETH’s complete provide.

That mentioned, Ethereum’s MVRV Ratio dropping to 0.9 may sign a bullish setup for the digital asset, although such results usually take time to play out. At press time, ETH trades at $1,992, down 1.7% previously 24 hours.

Featured Picture from Unsplash.com, Charts from X, CryptoQuant and TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.