Over $5 billion will probably be distributed to FTX collectors from the bankrupt crypto change’s property within the coming weeks, as the following wave of reimbursements is ready to happen on Could 30, based on the FTX Restoration Belief’s assertion launched yesterday (Could 15).

The upcoming Could 30 distributions are the second part of the FTX chapter property’s restoration plan. With this subsequent wave, 4 teams of collectors are set to be reimbursed, with distributions ranging between 54% and 102% of the worth of their FTX holdings on the level the change collapsed in November 2022.

FTX Creditor claims

FTX Prospects:

Class 5: Claims > $50k

5A: FTX Worldwide

5B: USClass 7: Claims <=$50k

7A: FTX Intl

7B: USClass 6: Non Prospects

Can discover your class in your FTX voting type pic.twitter.com/pTZ10Q7q7u

— Sunil (FTX Creditor Champion) (@sunil_trades) Could 16, 2025

FTX Restoration Belief Administrator Remarks On The Magnitude Of The FTX Repayments, Says “This Is An Unprecedented Distribution Course of”

“These first non-convenience class distributions are an vital milestone for FTX,” FTX Restoration Belief plan administrator John J. Ray III mentioned yesterday within the assertion. “The scope and magnitude of the FTX creditor base make this an unprecedented distribution course of.”

Below the restoration plan, members of collectors Class 5—a bunch that features lenders and buying and selling companions of Alameda Analysis and different merchants and distributors—will obtain distributions between 54% and 72% of their claims.

One other group of FTX victims with small, unsecured claims can count on disbursements of 61%, whereas claims involving inter-company pursuits will probably be paid out at 120%.

DISCOVER: 12 Greatest AI Crypto Cash to Put money into 2025

BitGo and Kraken are working with the Restoration Belief and can ship the funds on to eligible collectors’ change accounts inside one to a few enterprise days from Could 30.

In complete, over $5 billion is ready to be distributed on Could 30. Worldwide claims over $50k are set to obtain 72% of their misplaced portfolio worth whereas $50k+ claims from inside the US will obtain 54%.

Surprisingly, claims on portfolios price beneath $50k are scheduled to obtain 120%, with no info supplied on why any creditor would obtain greater than the unique worth of their misplaced portfolio.

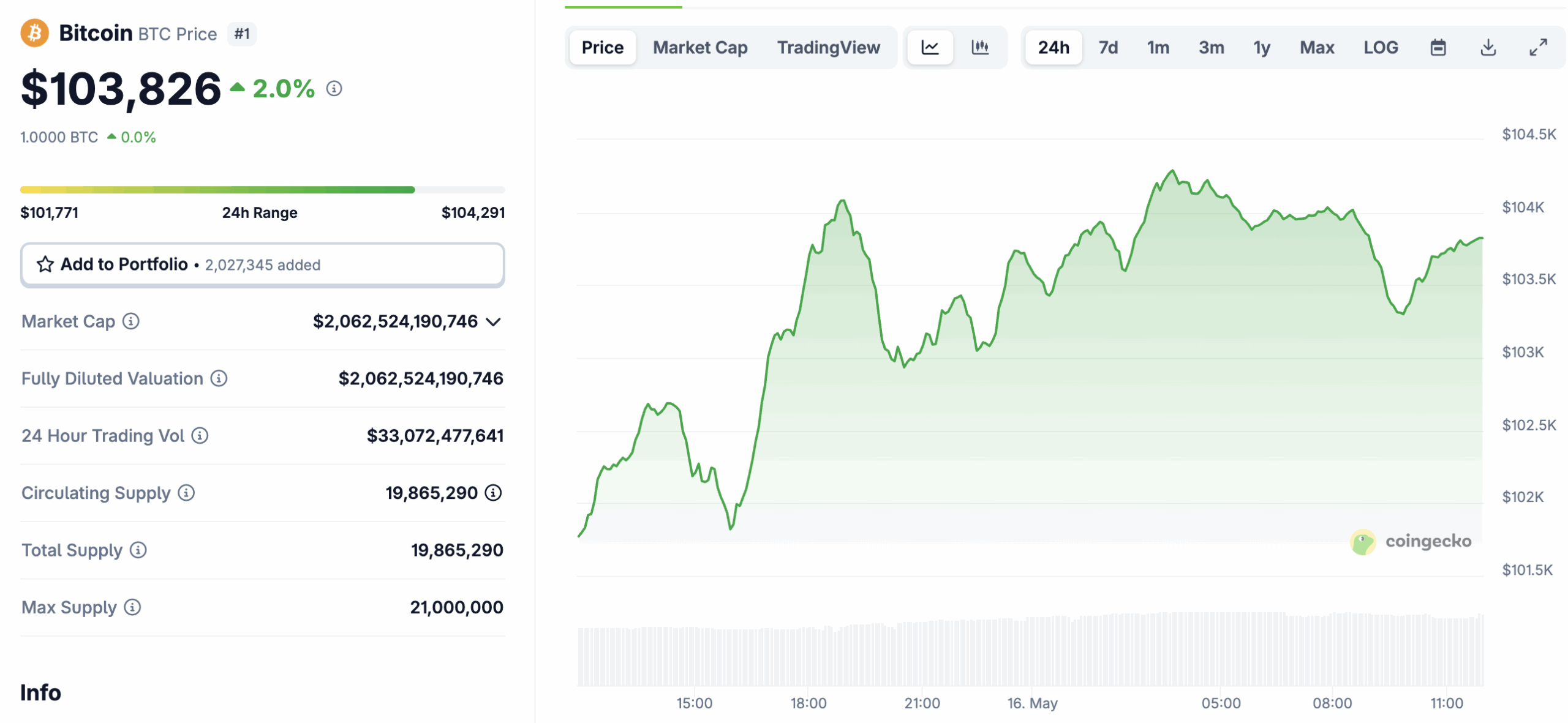

Bitcoin is presently buying and selling at round $103,800 and is up 2% on the day following the information of FTX’s upcoming repayments on the finish of the month.

Why Is $5 Billion In Reimbursements Bullish For Bitcoin: New All-Time Excessive Quickly?

Put merely, these repayments from the FTX belief will result in an enormous liquidity injection into the crypto markets. The repayments on Could 30 will see a distribution of serious capital to collectors.

These collectors are a mix of retail {and professional} crypto traders, and consequently, they’re more likely to reinvest these funds again into the markets. After already struggling as soon as with the collapse of FTX and the tumultuous journey to get their funds again, the collectors could act extra risk-averse with the recovered funds, making Bitcoin essentially the most logical funding alternative.

This inflow of capital might enhance shopping for stress and drive Bitcoin’s value greater, main into June’s FOMC Fed conferences, which many are anticipating fee cuts. If Powell does certainly slash the rates of interest in June, it could give market members the inexperienced gentle to pour into risk-on belongings as soon as extra.

Lastly, the present market sentiment heading into these repayments is extremely excessive, particularly in comparison with November 2022 when FTX initially crashed and BTC was at all-time low, buying and selling for $16,000.

We’re presently in the midst of the 12-16 month interval following a Bitcoin halving that has traditionally been one of the best interval for BTC value motion. This, coupled with the upcoming FOMC conferences and $5 billion of recent capital flowing into crypto, might kickstart Bitcoin’s run to $150,000 and above within the coming months.

Each $5b FTX creditor payout and Bitcoin Vegas occurring on the finish of the month

all time highs inside 2 weeks time

fuck you

greater

— RookieXBT

(@RookieXBT) Could 15, 2025

EXPLORE: 20+ Subsequent Crypto to Explode in 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

The FTX restoration belief will probably be distributing $5bn to collectors on Could 30

- The repayments will start with accounts valued beneath $50,000

- BTC is up 2% on the day following information of the repayments

- $5bn of recent liquidity being injected into the markets may lead BTC to recent highs and actually kick-off the bull market within the course of

The publish $5Bn FTX Stimulus Drop Is About To Gas New Bitcoin ATH: Right here’s Why appeared first on 99Bitcoins.